GBP/USD

Yesterday, the British pound overdid its growth with the Federal Reserve's neutral decision (a 0.76% increase against the euro's 0.57% increase), although the trading volume was high. To break the technical divergence, the price needs to go significantly higher than the target level of 1.2666 (the peak of May 27, 2022), which seems unlikely at the moment.

The price may well reach 1.2666 by the time the US employment data is published on Friday, but the current growth, especially growth after Friday's data, is at risk.

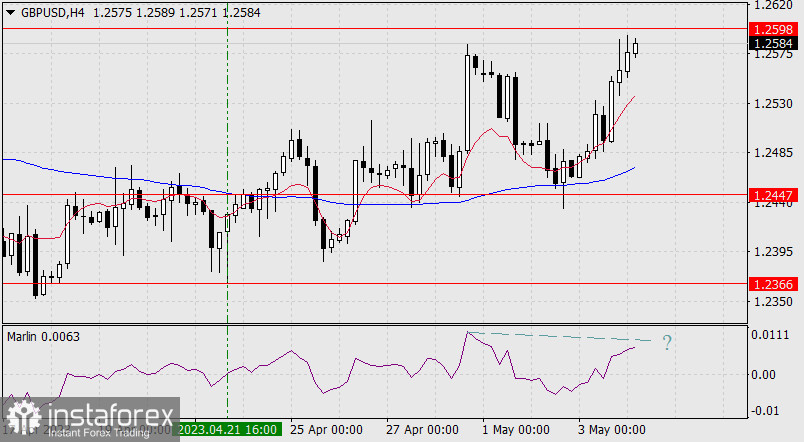

On a four-hour chart, the price demonstrates accelerated growth above the balance and MACD indicator lines, but the Marlin oscillator is tired of growing. A slight price reversal from the current levels will create a divergence, which will be the first sign of a reversal. We are waiting for the European Central Bank's decision on its rate and, with even more excitement, tomorrow's labor report.