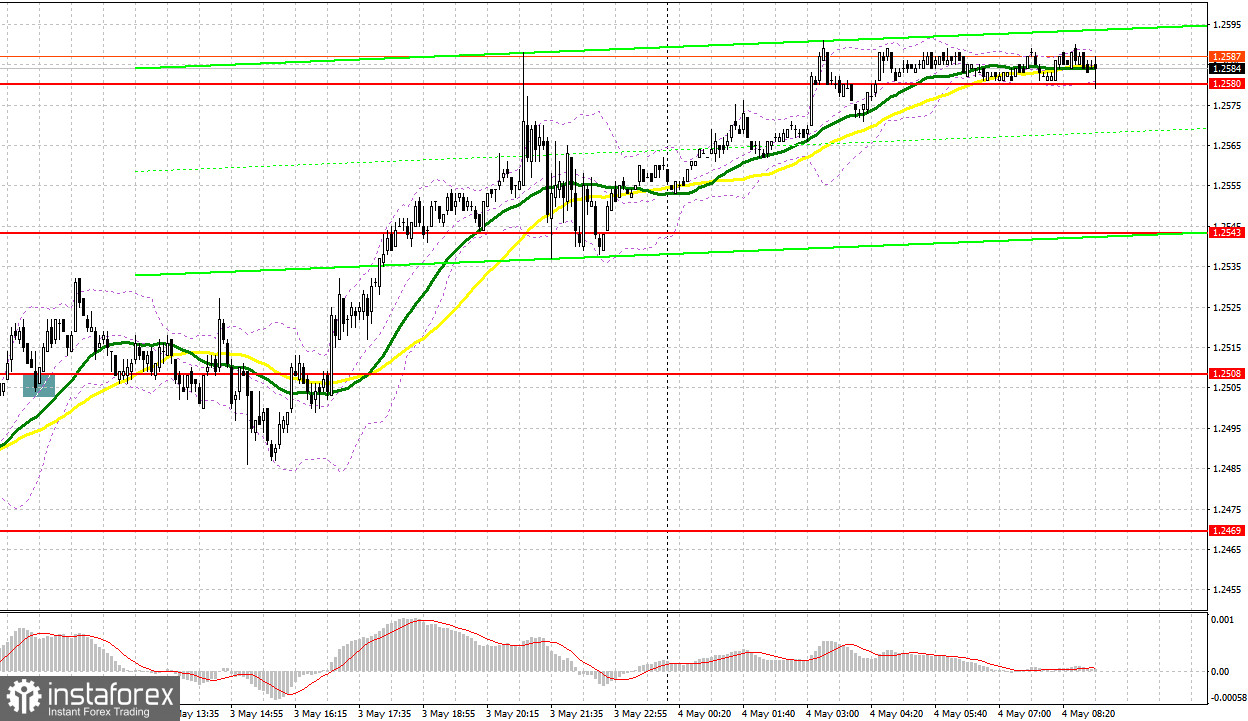

Yesterday, a single entry signal was made. Let's look at the 5-minute chart to see what happened there. In my morning forecast, I considered entering the market from the level of 1.2508. A breakout and retest of 1.2508 amid an empty macroeconomic calendar in the United Kingdom produced a signal to buy the pound, which resulted in a price increase of more than 30 pips. I also closed several positions before the release of important data in the United States. In the second half of the day, not a single entry point was made.

To open long positions on GBP/USD, it is required:

Yesterday, the Fed raised interest rates as expected. GBP/USD returned to the monthly high once again. However, a breakout through the mark is likely to take place today because data on the services PMI in the UK for April is projected to exceed economists' forecasts. This means that inflationary pressures, with which the Bank of England has not been able to cope for a year, will increase. Weak data on mortgage approvals in the UK will hardly affect the price.

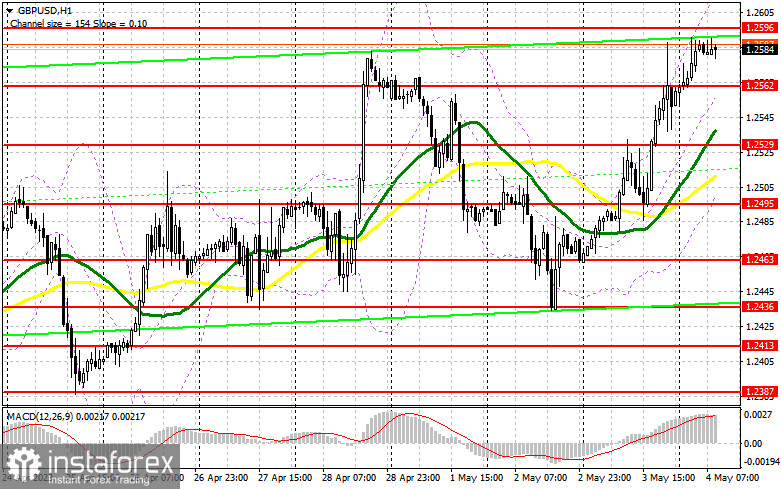

I would like to see a correction before the release of all reports. The main task of buyers in this scenario will be to protect the intermediate support of 1.2562, formed yesterday. A false breakout through it will generate a buy signal with the target at the monthly high of 1.2596. A breakout and consolidation above this range will make an additional signal to buy the instrument, with the target at 1.2627. The most distant target is seen in the area of 1.2663, where I am going to take profit.

If the pair decreases to 1.2562 where there is no bullish activity, I will open long positions only on a false breakout through 1.2529, which is in line with the bullish moving averages. I will also buy GBP/USD from a low of 1.2495, allowing a correction of 30-35 pips intraday.

To open short positions on GBP/USD, it is required:

The focus is on reports from the United Kingdom, which may cause a bearish correction today. However, this is highly unlikely to happen. If the pair shows growth, the bears could try to break through the area of 1.2596. If they fail to do that or a false breakout occurs, the pound is likely to face pressure and decrease to the level of 1.2562. A breakout and an upside retest of this range will exert additional pressure on the pound and generate a sell signal with the target at 1.2529. The most distant target remains at the low of 1.2495, where I am going to take profit.

If GBP/USD goes up with no bearish activity at 1.2596, which may take place by the second half of the day, I will sell after a test of the next resistance at 1.2627. If there is no bearish activity there either, I will sell GBP/USD on from a high of 1.2663, allowing a bearish correction of 30-35 pips intraday.

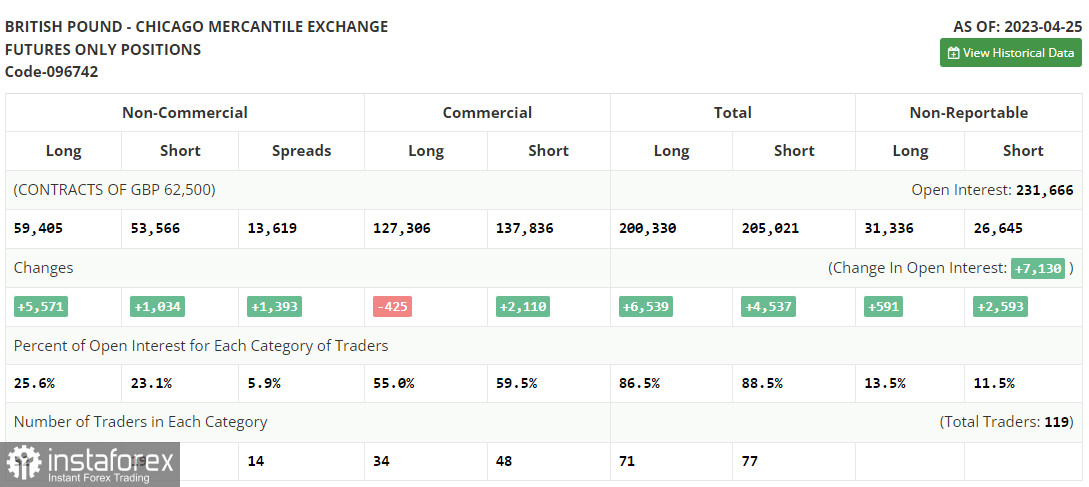

According to the Commitments of Traders (COT) report from April 25, there was an increase in both long and short positions. The Bank of England has nothing left to do but stay aggressive because it has not achieved any progress in fighting inflation lately. High interest rates will, in any case, provide support for the pound, which will remain in demand. Taking into account the current state of the US economy, a stronger pound against the dollar seems likely. The latest COT report showed that non-commercial short positions increased by 1,034 to 53,566, while non-commercial long positions jumped by 5,571 to the level of 59,405. This led to a surge in the non-commercial net position to 5,839 from 1,302 a week earlier. This has been the fifth weekly rise, confirming bullish market sentiment. The weekly closing price fell to 1.2421 from 1.2446.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, which indicates a bullish continuation.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Support stands at 1.2495, in line with the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.