On Wednesday, the Fed raised the benchmark rate by 0.25% to 5.25%, as expected. That is why the market showed no reaction to the announcement.

So what were investors waiting for? What will they focus on in the near future?

From the outcome of the FOMC meeting, they wanted to see whether the Federal Reserve would hike rates further or announce the end of the tightening cycle. However, neither happened. Powell spoke very vaguely at the press conference, not dwelling on specific issues. Were his words important? First and foremost, he said that the bank's focus would still be on fighting inflation, and he hinted that there might be a pause in rate hikes in June.

In fact, his remarks confirmed that the end of the tightening cycle is nearing, which is a positive factor for the stock market and a negative one for the US dollar. However, things will get clear only after the publication of fresh consumer inflation data, which should reveal whether or not prices will continue to decline. If figures come in line with market expectations, the rate hike cycle may end already this summer.

In fact, there is speculation in the market that the regulator may start cutting rates as early as this fall. Whether this will happen or not remains to be seen. However, more market participants now support these expectations.

But let's get back to the key events of the day. According to the consensus forecast, the ECB is likely to raise the benchmark rate by 0.25% to 3.75%, and the deposit rate to 3.25% from 3.00%. Markets expect this decision as they want to know whether rate hikes will continue, so all the attention will be drawn to President Lagarde's speech.

If she speaks about the need to combat high inflation, the euro may strengthen against the dollar, as there is a high probability that the Federal Reserve will consider the need to end the tightening cycle, while the ECB, on the contrary, will have to continue hiking rates because the inflation rate in the eurozone still remains high at 7%.

Finally, the Federal Reserve will likely be the first bank to end the tightening cycle, which will have a negative impact on the dollar exchange rate in the forex market amid the stabilization of treasury yields but will support demand for US stocks.

Daily forecast:

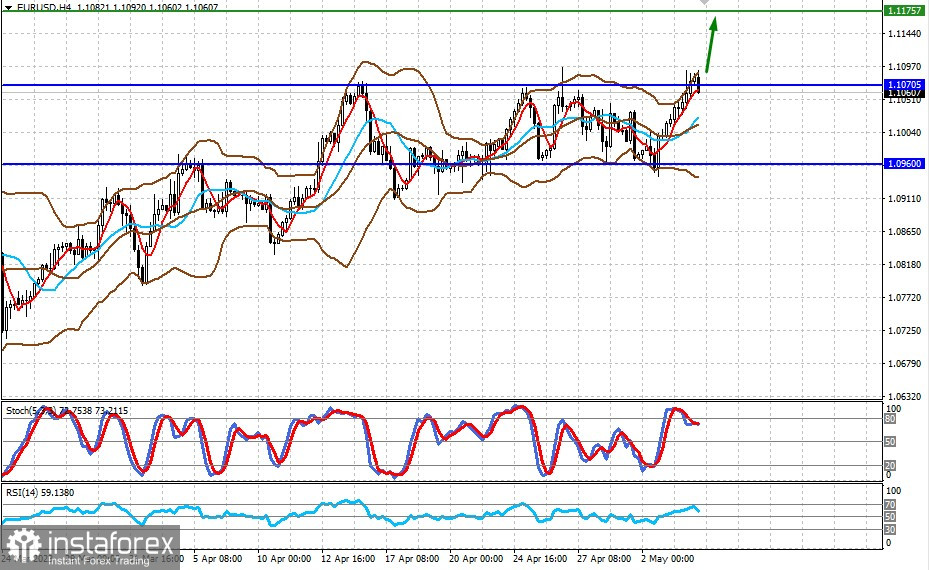

EUR/USD

The pair is trading near 1.1070, decreasing reasonably ahead of the ECB meeting. Support for quotes is seen at 1.1175.

USD/JPY

The pair is trading above the support line of the short-term uptrend and the level of 134.35. The price may go below the mark and drop to 133.00 on expectations of a pause in the tightening cycle from the Federal Reserve.