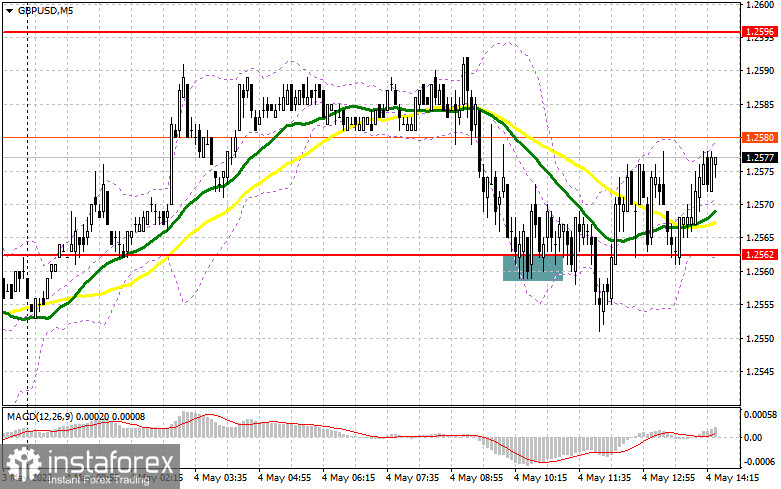

In my morning forecast, I considered entering the market from 1.2562. Let's take a look at the 5-minute chart and see what happened there. A decline and a false breakout through this level provided an excellent entry point for long positions, which came in line with my expectations. At the time of writing, the pair rose by about 20 pips. The trading plan for the second half of the day remains almost the same.

To open long positions on GBP/USD, it is required:

Upbeat data on business activity in the UK services sector has sustained demand for GBP/USD, as it is clear that inflation will remain high, forcing the Bank of England to raise rates further. In the second half of the day, data on initial jobless claims and the trade balance will be released in the US. However, it will unlikely influence the market, so growth may extend.

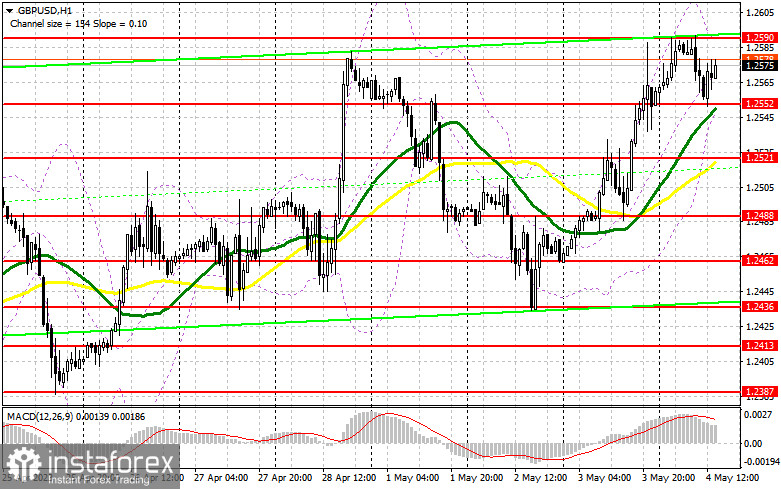

My trading plan remains the same. I will open long positions only when the price declines and a false breakout occurs in the area of 1.2552 – today's support. The main task for the bulls will be to push the pair to the area of 1.2590. A breakout and a downside retest of this new level will make an additional signal to buy the pound with the target at 1.2627. The most distant target stands in the area of 1.2663, where I am going to take profit.

If the pair decreases to 1.2552 where there is no bullish activity, I will open long positions only when a false breakout occurs through the next support at 1.2521, which is in line with the bullish moving averages. I will also buy GBP/USD from a low of 1.2488, allowing a correction of 30-35 pips intraday.

To open short positions on GBP/USD, it is required:

Sellers were active in the first half of the day, but a significant decline in the price did not happen. With a small downward correction, growth of GBP/USD may continue, so I will sell only from a monthly high of 1.2590, and only in case of a false breakout. This will give a signal to open short positions with the target at 1.2552, which is in line with the bullish moving averages. A breakout and an upside retest of this range will exert pressure on GBP/USD, generating a new signal to sell with the target at 1.2521. The most distant target remains at a low of 1.2488, where I am going to take profit.

If GBP/USD goes up in the second half of the day with no bearish activity at 1.2590, which is also quite likely, especially after the ECB raised interest rates, I will sell after a test of the next resistance at 1.2627 and after a false breakout only. If there is no bearish activity there either, I will sell GBP/USD from a high of 1.2663, allowing a bearish correction of 30-35 pips intraday.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, which indicates a bullish trend.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Support stands at 1.2552, in line with the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

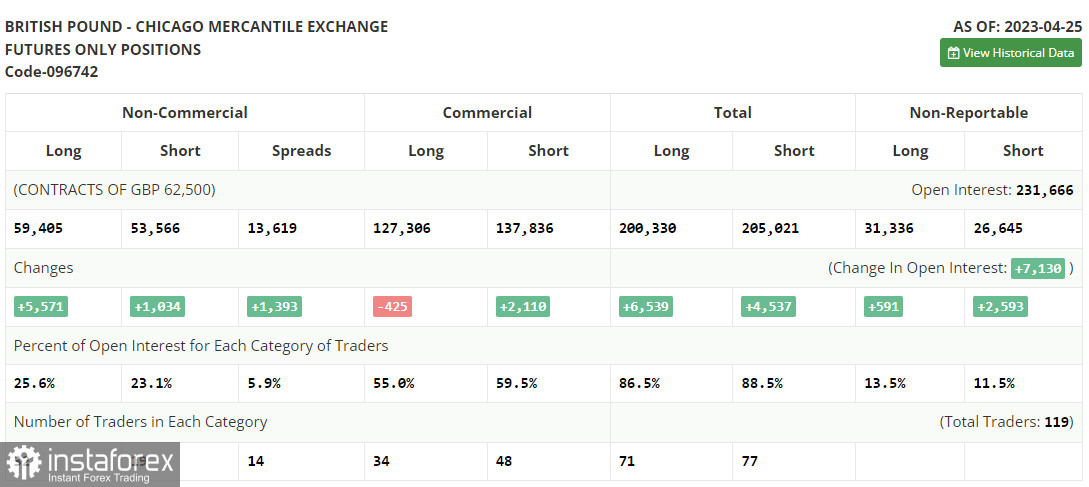

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.