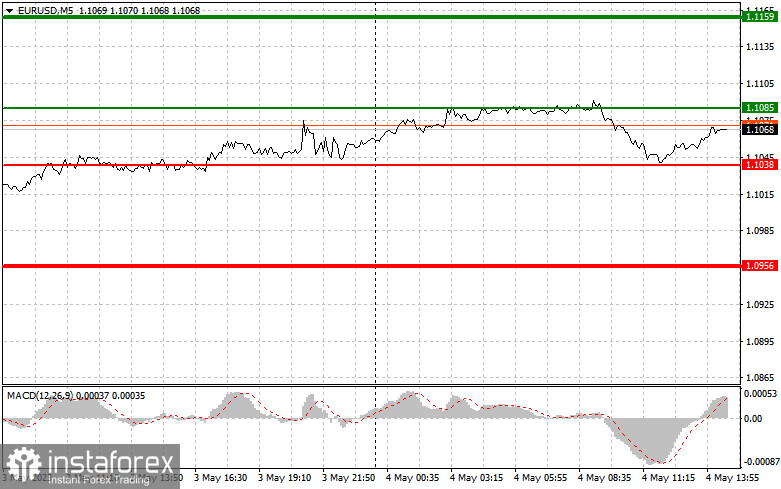

Euro did not rise even though Service PMI in the eurozone turned out a bit better than expected. As a result, there was a massive downward correction in EUR/USD, but buyers quickly took advantage of this moment, picking up all the movement. As for the signals, the test of 1.1053 occurred when the MACD line was already far from zero, so the downward potential was limited.

If the ECB announces a much larger rate hike than expected, euro will soar regardless of the position of the MACDline. But if it is the same as expected, pressure on the pair will return. Also ahead is data on US jobless claims and foreign trade balance, but they are unlikely to lead to a sharp spike in volatility.

For long positions:

Buy euro when the price hits 1.1085 (green line on the chart) and then take-profit when the quote reaches the level of 1.1159. Growth will continue if the ECB raises the interest rate by 0.5%. However, before buying, make sure that the MACD line is above zero and is starting to rise from it.

Euro can also be bought after the level of 1.1038 is tested twice, but the MACD line should be in the oversold area as only by that will the market reverse to 1.1085 and 1.1159.

For short positions:

Sell euro when the price reaches 1.1038 (red line on the chart) and take-profit at the level of 1.0956. Pressure will return if the ECB takes a dovish stance on monetary policy. However, before selling, make sure that the MACD line is below zero and is starting to drop down from it.

Euro can also be sold after the level of 1.1085 is tested twice, but the MACD line should be in the overbought area as only by that will the market reverse to 1.1038 and 1.0956.

What's on the chart:

Thin green line - entry price at which you can buy EUR/USD

Thick green line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further growth above this level is unlikely.

Thin red line - entry price at which you can sell EUR/USD

Thick red line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further decline below this level is unlikely.

MACD line- it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.