The Federal Reserve is an institution that acts as a central bank and is not under the control of the US government. In other words, the Fed has complete independence from all officials, even the president. And the dollar remains the world's reserve currency. That's why the markets approached the Fed meeting with the utmost responsibility.

I believe that the outcome of the meeting did not disappoint the market, as the market did not expect more. There were no chances of raising the rate by 50 points. Exactly what was supposed to happen happened. It is what the markets have been preparing for over the past few weeks. The interest rate increased by another 25 basis points, which fully met market expectations. Fed Chairman Jerome Powell, at the press conference, removed the phrase about the need to continue tightening monetary policy from his rhetoric but also noted that the central bank would be willing to take a new rate hike if the situation warranted it. All his other statements were mere "filler."

For example, it was mentioned that future meetings would consider various factors and data. In particular, the state of the US economy, the labor market, and unemployment. The "lagging effect" of the impact of monetary tightening will be taken into account. The ongoing US banking crisis will be of great importance. Based on these statements, we can confidently conclude that the "basic" scenario does not imply new rate hikes. But no one knows what the situation will be in a month, two, or three, and the Fed cannot make any promises at this time.

In my opinion, this is an absolutely correct approach by the central bank, but it did not give the markets any reason for a strong increase or decrease in demand for the dollar. Powell also noted that the Fed would be discussing a rate hike at the June meeting as well. If the dynamics of the decline in the consumer price index remain high, then a new rate hike will not be necessary. One thing the market understood from all that was: this is the time when monetary tightening will finally come to an end. I think a similar moment will soon come in the European Union and the United Kingdom. Therefore, I do not believe that the euro and the pound should continue to rise. The wave marking of both instruments and the news background work against this. Although the construction of new downward waves is significantly delayed, I still believe they will begin their construction shortly.

This week, we should pay close attention to data on the labor market and unemployment in the United States. The reaction to these reports could be much stronger than the reaction to the Fed meeting. We might see surprises with Friday's reports, while there were none yesterday. The US currency, as before, requires strong payroll and unemployment figures. It doesn't always grow even with strong news; if the data is weak, a new decline is possible.

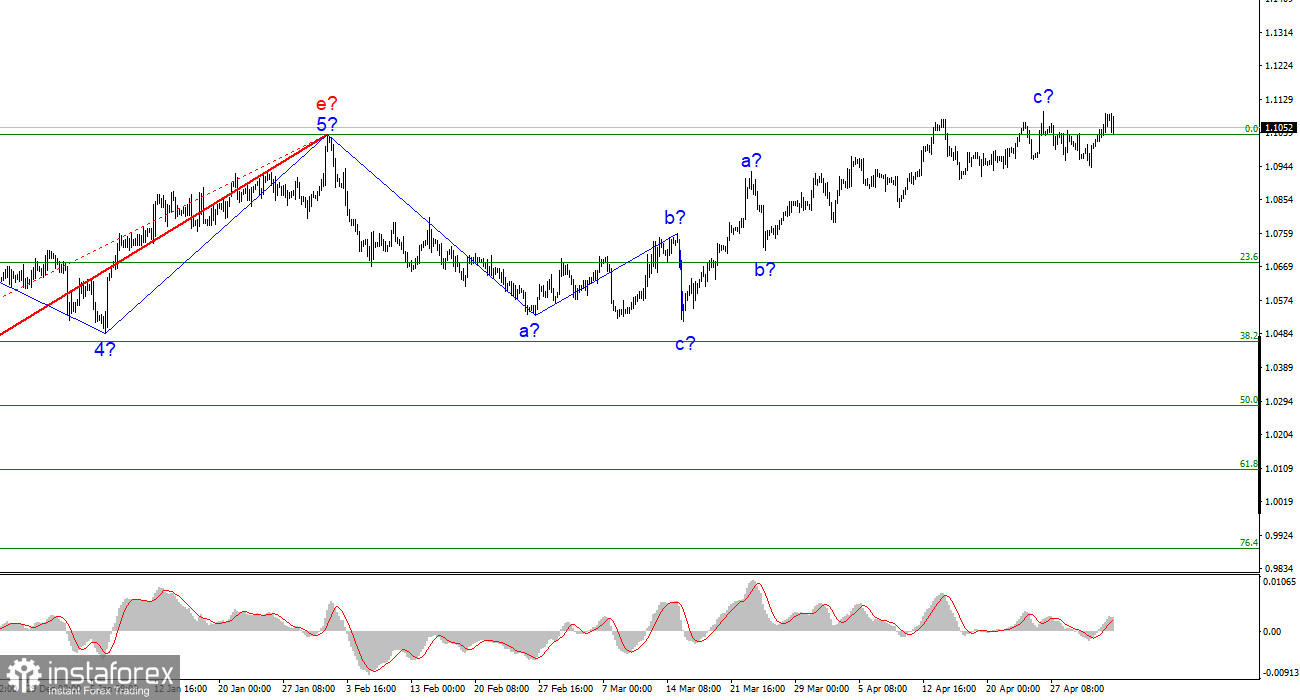

Based on the analysis, I conclude that the construction of the uptrend segment is nearing completion. Therefore, you can sell now, and the instrument has quite a large space for decline. I think that targets in the area of 1.0500-1.0600 can be considered quite realistic. With these targets, I recommend selling the instrument on the reversal of the MACD indicator to the downside as long as the instrument is below the 1.1030 mark, which corresponds to 0.0% Fibonacci.

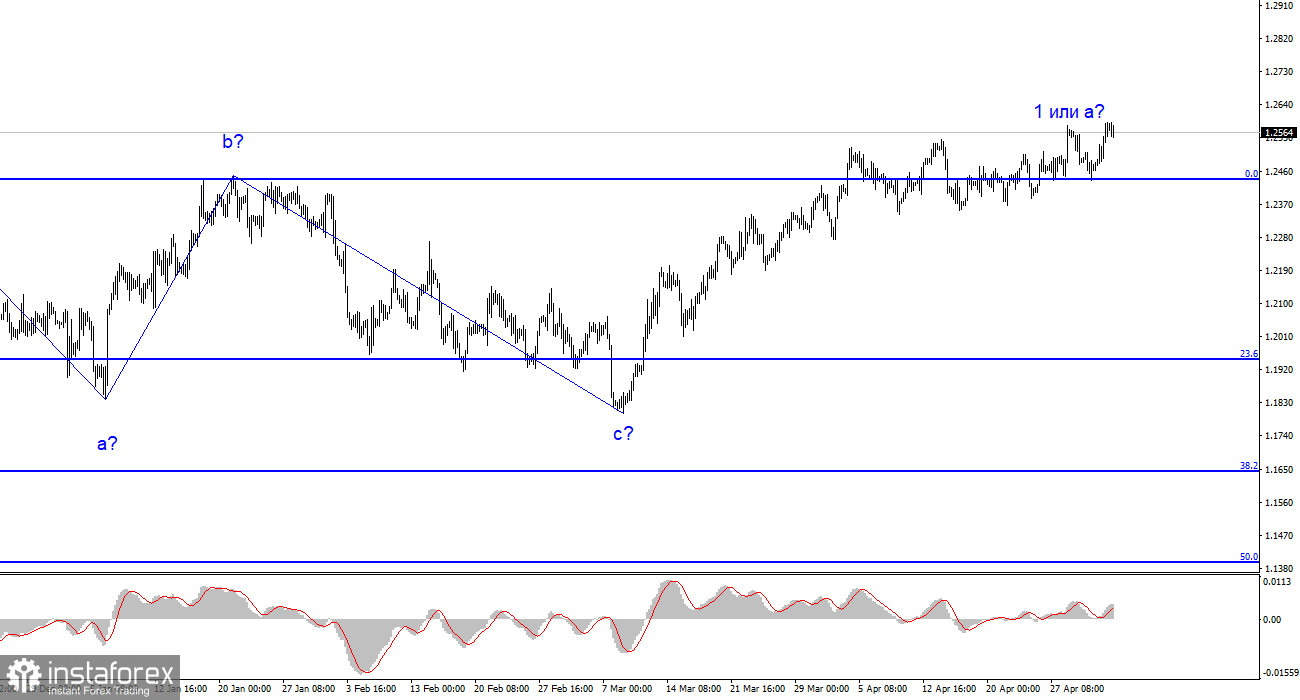

The wave picture of the GBP/USD pair has long implied the construction of a new downward wave. The wave pattern is not quite unambiguous now, as well as the news background. I don't see any factors that would support the British currency in the long term, and wave b could turn out to be very deep, but it hasn't even started yet. I believe that the instrument's decline is more likely now, but the first wave of the ascending section continues to become more complicated, the quotes have moved away from the 0.0% Fibonacci mark. Now it will be more difficult to determine the beginning of the construction of wave b.