USD/JPY

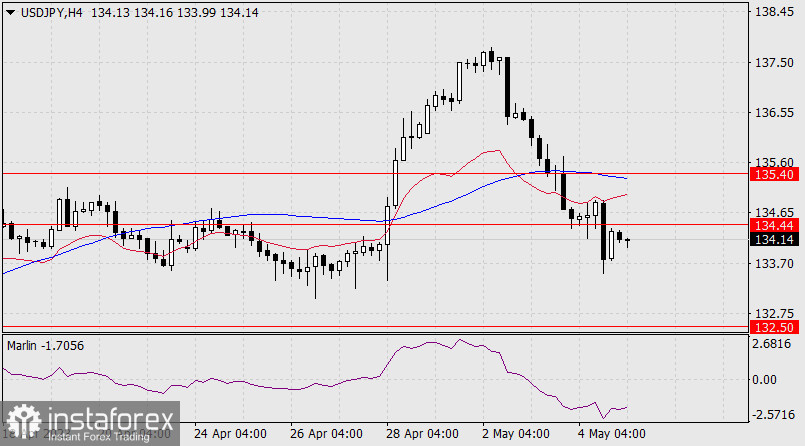

The yen managed to go below the support of the embedded price channel line on the monthly chart (134.44). The Marlin oscillator is not averse to moving below the zero line to develop success in negative territory. By success, I mean that the price will reach the nearest support of 132.50 - the MACD indicator line on the daily chart.

The price can reach the underlying price channel line in the area of the 130.55 level in case the stock market sharply falls - in such a situation, the yen will act as a protective asset.

If the price climbs above 134.44, consolidates above the level, then the 135.40 level will become the first target on the way to medium-term growth.

On the four-hour chart, the situation is neutral. Obviously, the price is waiting for an external impulse, which could be the release of the US employment report. Formally, the technical picture is downward, but the Marlin oscillator showed a technical low, the price is trying to climb above 134.44, and consolidation above it will strengthen the bulls' position.