Despite the fact that the single European currency initially fell on Thursday and then it rose a bit, the pound still managed to confidently strengthen. The reason for this is that after the European Central Bank raised the refinancing rate, the focus is now on the upcoming Bank of England meeting. There is no doubt that the British central bank will also raise its interest rates. Moreover, considering the fact that inflation in the UK has accelerated again, it seems that the BoE will now be leading the pace of monetary tightening. This is the main driving force for the British currency.

At the same time, today, the pound's growth is likely to be supported by the content of the US Department of Labor report. According to forecasts, the unemployment rate should rise from 3.5% to 3.6%. In addition, outside of agriculture, only 190,000 new jobs may be created. Considering the population of the United States, the level of economic activity, and the population growth rates, just over 200,000 new jobs should be created monthly to maintain stability in the labor market. In other words, there are signs of a worsening situation in the labor market, and at the same time, in the entire economy as a whole. Naturally, this does not contribute to the strengthening of the US currency.

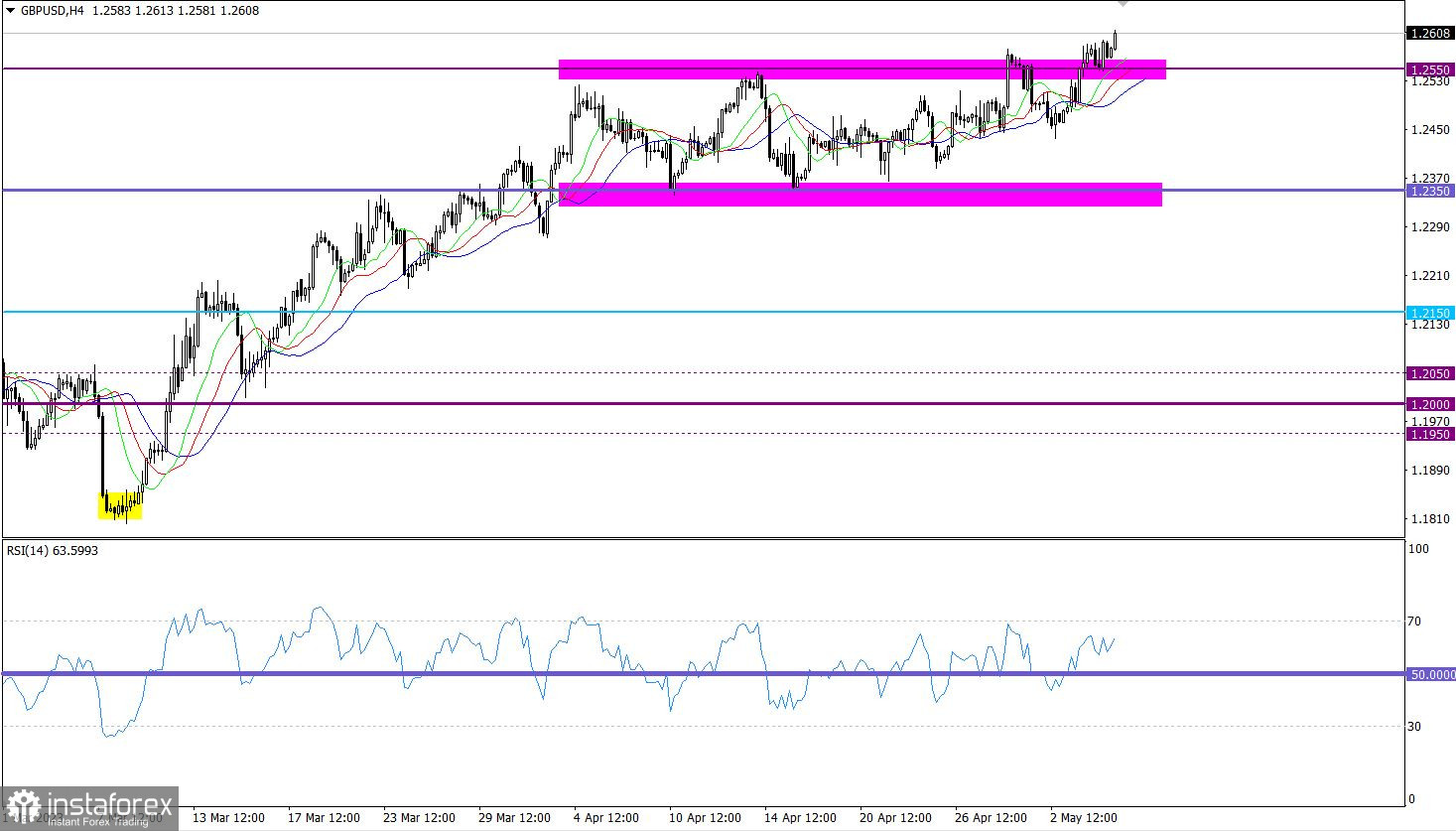

The British pound has strengthened its long positions against the US dollar after bouncing off the previously passed level of 1.2550. As a result, an uptrend continued to form in the medium-term, updating the local high.

On the four-hour chart, the RSI indicator is moving in the upper area of 50/70 which points to the growth in the volume of long positions. There is no signal of the British pound being overbought.

On the four-hour and daily charts, the Alligator's MAs are headed upwards, which reflects the quote's movement.

Outlook

In this situation, the upward movement may turn into a momentum, in which a possible technical signal of the British pound being overbought in short-term periods will be ignored by speculators. In this case, the quote may head towards the subsequent resistance level of 1.2700.

The complex indicator analysis points to an upward cycle in the short-term, medium-term and intraday periods.