The World Bank believes gold prices are outpacing the broader commodity sector as economic growth puts pressure on demand.

According to the latest World Bank report, due to lower economic activity, commodity prices will decline by 21% this year compared to last year's growth of 45%. And presumably, until 2024, prices will remain relatively stable. As central banks continue to combat inflationary threats by tightening monetary policy, risks of lower commodity prices persist. After a financial stress, lending conditions may tighten. If such risks arise, they will weaken demand for industrial goods, leading to lower prices. Amid global uncertainty, precious metals will remain an attractive asset for a long time.

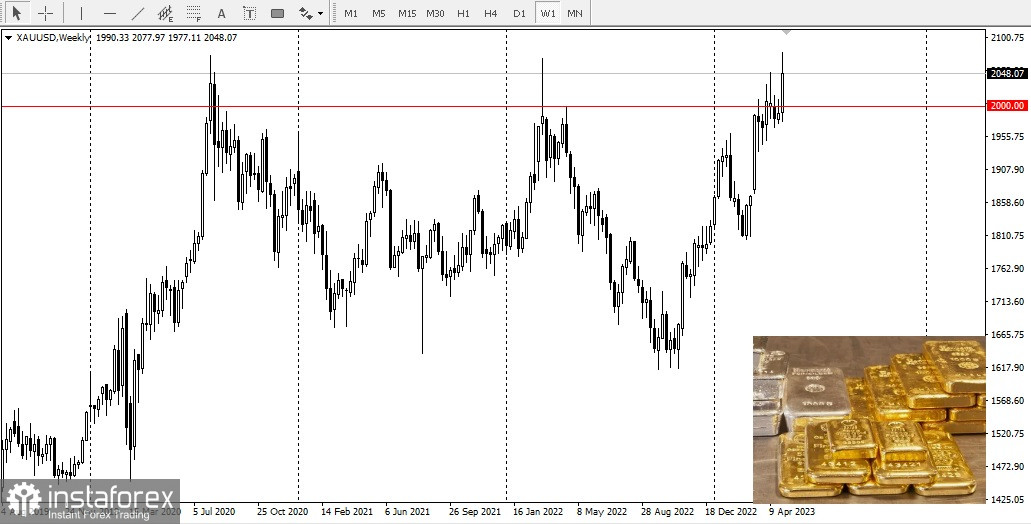

World Bank analysts believe that precious metals will grow by 6% this year, outpacing the broader commodity market. Gold is currently leading the precious metals sector, having appreciated by 10% in the first three months of the year. World Bank analysts predict that the average gold price for the entire year will be $2,000 per ounce.

Even if the Federal Reserve maintains its aggressive monetary policy and other central banks continue to raise interest rates, demand for safe-haven assets will continue to support gold prices until the end of the year. In 2022, central banks' rate hikes restrained gold prices. However, the recent divergence between gold prices and the yield of 10-year Treasury Inflation-Protected Securities (TIPS) suggests that the impact of geopolitical and economic uncertainty on prices was stronger than the alternative cost effect. Central banks' demand for gold may provide an even greater boost this year.

Silver prices in 2023 are expected to grow by 6%. The World Bank maintains a long-term bullish view on the precious metal.

An increase in production for solar photovoltaic products, automobiles, and some electronic components (e.g., for 5G internet) may lead to increased demand and higher prices.

The World Bank is also optimistic about platinum, even though the precious metal was neutral at the beginning of the year.

According to World Bank forecasts, platinum prices in 2023 will remain close to $1,000 per troy ounce. In 2024, they will grow by another 5%. Demand is also expected to increase this year due to the industrial, automotive, and investment sectors. As the world transitions to green energy, the long-term prospects for platinum demand are positive, considering its use in electrolyzers, carbon-free hydrogen production, and fuel cells.