In light of recent events, markets fear that the US will face serious consequences of the second wave of the banking crisis and see more medium and low-capitalization banks filing for bankruptcy.

Following the meltdown of SVB and First Republic Bank, another regional bank, Western Alliance, is now on the edge of collapse. Meanwhile, PacWest is reportedly considering selling all or part of its business. The news sent PacWest's share price down by 50.62%. Despite a 13% rebound in post-market trading, the situation will unlikely change.

In fact, the US banking sector is going through a crisis amid rate hikes by the Federal Reserve. By the way, the regulator raised the benchmark rate by 0.25% to 5.25% this week. The banking sector's capitalization increased noticeably during the period of zero interest rates. So, we are now witnessing its collapse. This is why stock investors' reaction is so restrained. On the other hand, this is also what prevents stock indices in the United States and other developed countries from collapsing.

So why aren't stock indices falling?

This is mainly because investors partially hope that an economic slowdown in the US, a possible decline in NFPs, and serious problems in the banking sector amid slowing inflation will not only urge the Federal Reserve to pause rate hikes but will also mark an end of the tightening cycle. Some even expect that the regulator will announce the first rate cut as early as this fall.

In general, everything that is going on suggests that the Federal Reserve has an important decision to make — to save the economy by allowing inflation to be slightly above the target of 2%.

This speculation is what provides support for stock indices, fueling hopes that the regulator will be forced to give in and return to lower interest rates. Of course, in such a case, the dollar is likely to decline, especially against those major currencies whose central banks will be forced to raise interest rates further to curb inflation. It is about the Bank of England and the ECB. Thus, President Christine Lagarde at a press conference after the meeting on Thursday said that the regulator would keep on hiking rates further.

In this light, we expect the dollar index to fall below 100.00 and demand for safe-haven gold to rise. The weakness of the dollar will be another contributor to its higher value.

Outlook:

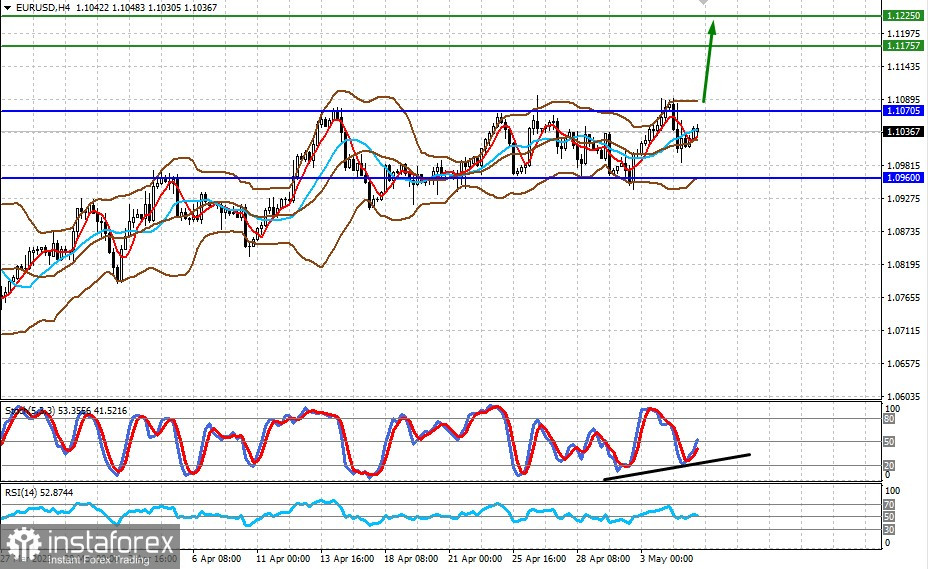

EUR/USD

The pair is trading in the range of 1.0960-1.1070. If NFP data comes in line with the market consensus of 180,000 or even lower and unemployment rises to 3.6% or above, the pair may go higher on expectations that the Federal Reserve will end the tightening cycle. In case of a breakout through 1.1070, the pair may rise to 1.1175, targeting 1.1225.

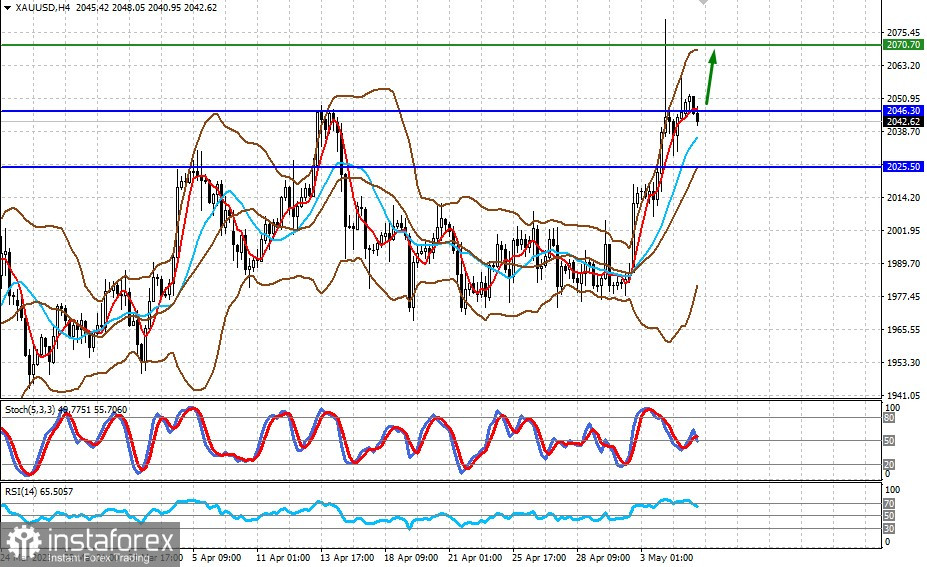

XAU/USD

After reaching an all-time high, unseen since 2000, gold entered a bearish correction and broke below 2,046.30. If macro data in the US comes below the forecast, the price may rally to 2,070.70.