Details of the economic calendar on May 4

The European Central Bank (ECB) decided to raise the interest rate to 3.75%, increasing it by 25 basis points and thus following the Federal Reserve System (Fed), which also slowed the pace of rate hikes. Despite this being the highest rate level since autumn 2008, the market reacted to the news by weakening the euro, as it expected stricter measures from the regulator. However, ECB comments indicate a high likelihood of a rate hike at the next meeting. At the same time, the regulator's zeal seems to be cooling, even though core inflation is at 5.6%, and overall inflation is at 7%.

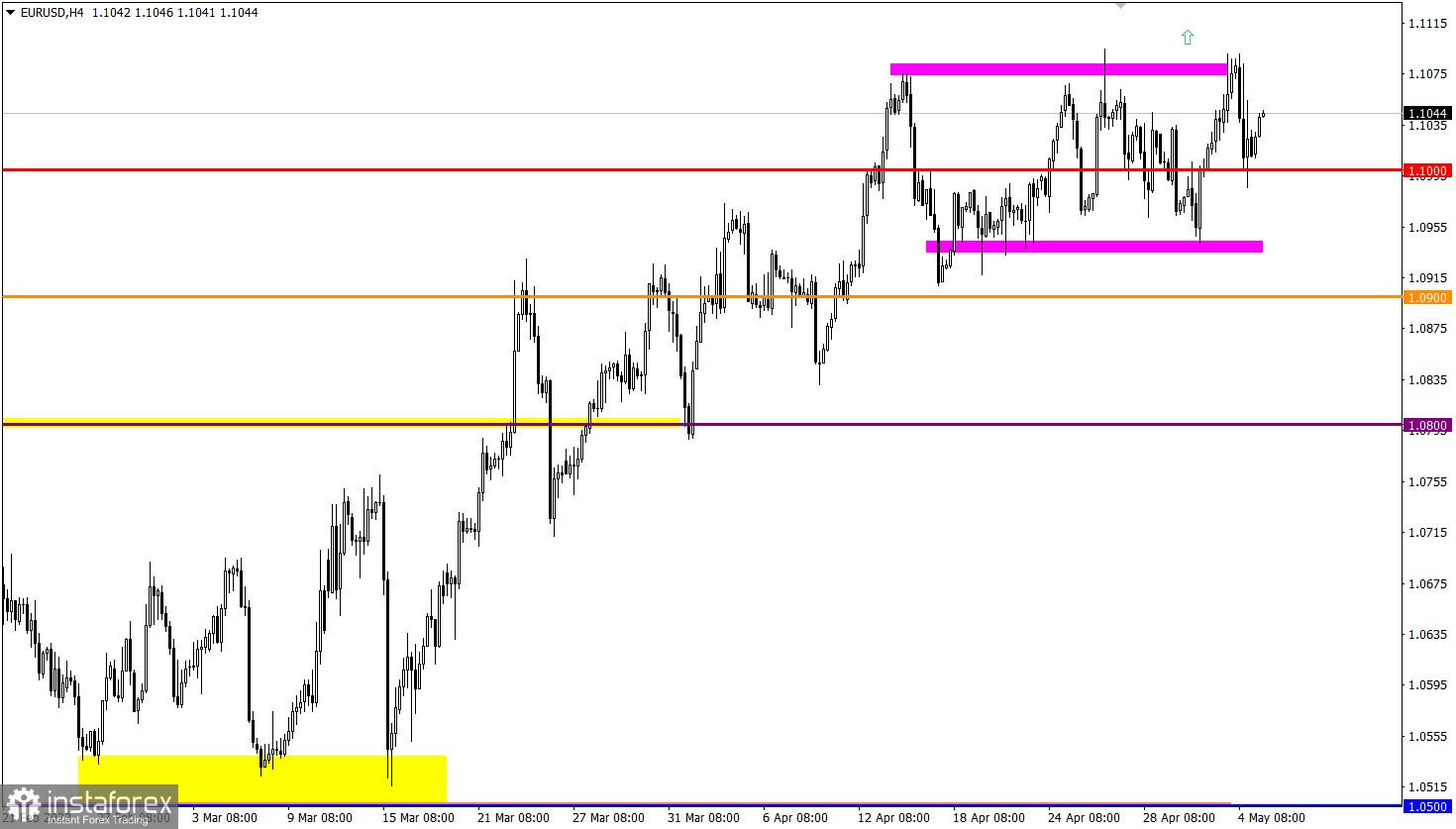

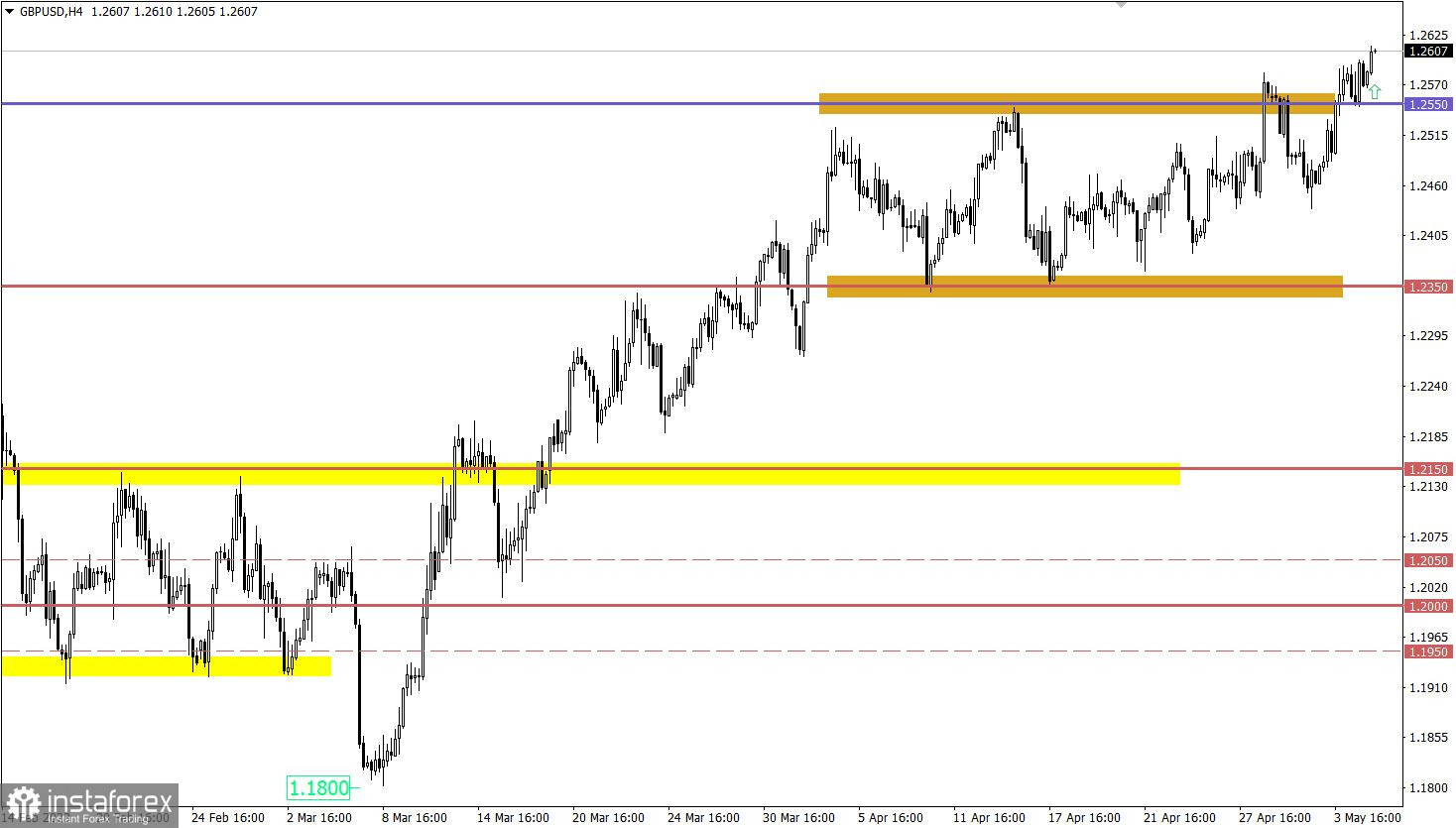

Analysis of trading charts from May 4

The EUR/USD exchange rate showed speculative activity following the ECB meeting results. During this activity, the rate fell below the 1.1000 level, but sellers' joy was short-lived as the rate quickly recovered, almost to the level before the decline. On the other hand, the GBP/USD strengthened its long positions after bouncing off the previously passed level of 1.2550. This led to a continuation of the medium-term upward trend, which updated the local high.

Economic calendar for May 5

A dynamic week will end with the significant economic event of the United States Department of Labor report, which is likely to impact the market and speculators.

Unemployment is expected to rise from 3.5% to 3.6%, and the number of new jobs created outside the agricultural sector may be only 180,000 compared to 236,000 in the previous month. Such a result may lead to a weakening of the dollar's position in the market. This is an important point for investors and traders who can consider this information in their trading decisions.

Timing targeting:

U.S. Department of Labor report – 12:30 UTC

EUR/USD trading plan for May 5

It is assumed that a stable holding of the price above the 1.1050 mark could lead to an increase in long positions on the euro and a possible attempt to update the local high within the medium-term trend. At the same time, an alternative scenario is possible, where the price will fluctuate within a sideways range between 1.0950 and 1.1100. Traders take both scenarios into account when making decisions about positions in the market.

GBP/USD trading plan for May 5

In this situation, there is a likelihood that the upward trend of the British pound will become inertial, and speculators will ignore the possible technical signal of overbuying in the short-term period. If this happens, the quote may continue its movement towards the next resistance level at the 1.2700 mark.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.