Long-term perspective.

The currency pair GBP/USD showed another round of illogical growth during the current week. While the European currency had an ECB meeting, which can be considered "dovish" (albeit with a stretch), the Bank of England's meeting will only occur next week. Thus, the GBP/USD pair only had American statistics at its disposal, which is difficult to call weak or disastrous. Nevertheless, the pound grew most of the week, even on Friday, when the European currency remained in place. Once again, on Friday, the macroeconomic background for both pairs was the same, but the pound appreciated, and the euro currency did not. Thus, we continue to believe that the pound's movements are illogical.

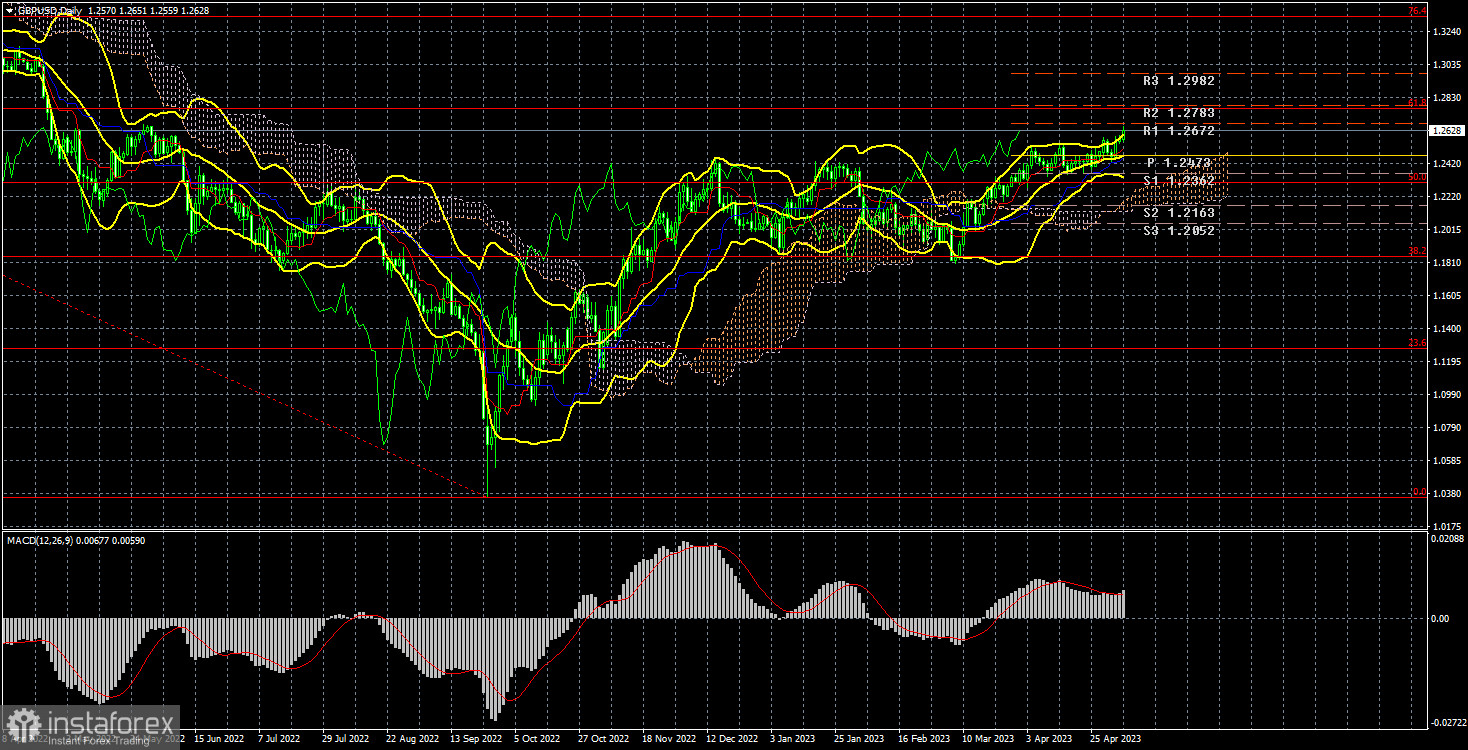

In the 24-hour timeframe, it can be seen that the pair is crawling upward at a rather slow pace. The market is interested in something other than the abovementioned divergence of the MACD indicator, the overbought indicators on the 4-hour timeframe, and the absence of growth factors. It continues to buy anyway. Therefore, the Bank of England meeting next week will have the same significance for traders as the Fed and ECB meetings this week. The pound may decline locally, but it is unlikely to impact the long-term trend. Therefore, analyzing the fundamental or macroeconomic background now makes little sense, as it does not affect the pair's movement. Traders interpret any event or report in favor of the pound.

It looks like this: if the US report is weak, the pound is bought; if the US report is strong, nothing happens. Therefore, the pound cannot even correct slightly downward, although it has been growing almost non-stop for two months. This week was associated with hopes for a change in market sentiment to "bearish," but they once again did not materialize.

COT Analysis.

According to the latest report on the British pound, the "non-commercial" group closed 0.7 thousand buy contracts and opened 4 thousand sell contracts. Thus, the net position of non-commercial traders decreased by 4.7 thousand, but overall it continues to grow. The net position indicator has steadily grown for 8–9 months. Still, the sentiment of major players has remained "bearish" during this time (only now can it be said to be "bullish," but purely formally). Although the pound sterling is growing against the dollar (from a medium-term perspective), it is very difficult to answer why it does so from a fundamental point of view. We do not exclude the possibility that a sharp decline in the pound will begin soon.

Both major pairs are moving roughly the same way. Still, the net position for the euro is positive and even implies the imminent completion of the upward impulse, while for the pound, it allows for further growth. The British currency has already grown by more than 2,200 points, which is a lot, and continuing to grow without a strong downward correction would be illogical. The "non-commercial" group currently has a total of 58.6 thousand contracts open for sale and 57.6 thousand contracts open for purchase. We remain skeptical about the long-term growth of the British currency and expect it to decline, but market sentiment remains "bullish."

Fundamental event analysis:

There were virtually no important events in the UK this week. Only the business activity indices in the service, manufacturing, and construction sectors were notable. The first index rose from 52.9 to 55.9, the second fell from 47.9 to 47.8, and the third rose from 50.7 to 51.1. Overall, we consider this statistic neutral, and it certainly was not the cause of another growth of the British currency.

US statistics were not disastrous for the dollar, and the results of the Fed meeting were even more "hawkish" than expected, as the regulator admitted to new rate hikes in the future if inflation slows down in its decline. Moreover, a strong labor market and minimal unemployment again allow the Fed to raise the key rate as much as needed. Furthermore, the Fed benefits from slightly worsening the labor market situation, as high competition for jobs creates wage growth, which drives inflation, which the regulator fights against. Thus, we would bet on another 0.25% rate hike in 2023.

Trading plan for the week of May 8–12:

- The pound/dollar pair has left the sideways channel of 1.1840–1.2440. Despite this, short positions are still more relevant, as the pair is heavily overbought. Without sell signals, we do not recommend opening short positions, but the pound could drop 500–600 points or even more soon, as we did not see a serious correction after the growth in the second half of last year. We do not see any basis for the pound to continue growing, but all technical indicators are pointing upward. Therefore, there is no need to rush with sales.

- As for purchases, they can be considered now. However, we advise trading upward only in the short term, preferably intraday. We still believe that there is a great danger of the British currency collapsing. Even if this does not happen, it is better to hedge and trade more modestly and cautiously after a gain of 2,200 points.

Explanations for illustrations:

Support and resistance price levels, Fibonacci levels - levels that serve as targets when opening purchases or sales. Take Profit levels can be placed around them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on COT charts - the size of the net position of each category of traders.

Indicator 2 on COT charts - the size of the net position for the "non-commercial" group.