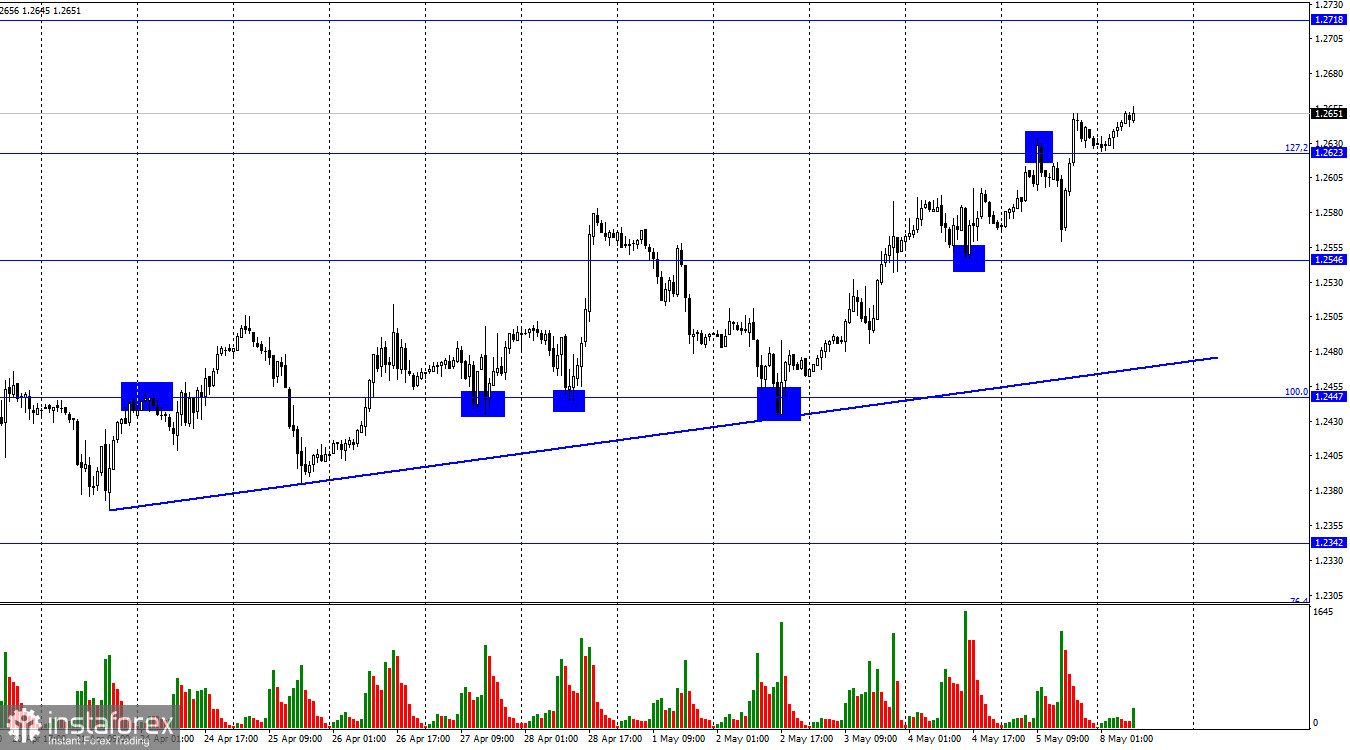

On Friday, GBP/USD declined on the 1-hour chart after bouncing off the 127.2% Fibonacci retracement level at 1.2623. However, by the end of the session, it managed to resume growth and closed above 1.2623. So, the British pound may well extend its rise towards the next level of 1.2718. A close below 1.2623 will favor the US dollar and may initiate a fall towards 1.2546. The market is still bullish on the pair.

On Friday, the GBP/USD pair could have moved in any direction. At first glance, the economic statistics in the United States appeared very strong as the unemployment rate decreased to 3.4%, and the number of new jobs in April was 253K, significantly surpassing expectations. However, upon closer examination, not everything was as positive as it seemed. The March payrolls reading was revised from 236K to 165K, meaning the decline in March was more significant than the April forecast. A decline in the unemployment rate could not protect the US dollar from another drop.

In my opinion, the current information background is quite contradictory. Even on Friday, the greenback could have avoided further decline, given the better-than-expected April nonfarm payrolls and the unemployment rate. Nevertheless, the pound sterling currently capitalizes on any opportunity for growth, with the dollar having little to counter it. Neither the US Federal Reserve's rate hike nor the relatively strong statistics last week managed to halt the pound's rise.

This week, the Bank of England is set to hold a meeting, and the current rise in the pound may be related to this event. Traders expect the Bank of England to raise interest rates by 0.25% even though a pause in the tightening process was actively discussed a few weeks ago. However, inflation in the United Kingdom remains at a concerning level, thus calling for more tightening measures. Nonetheless, I believe that the pound's current growth is excessive. The US dollar and the US economy are not in such a dire position, while the pound and the United Kingdom have little to boast about.

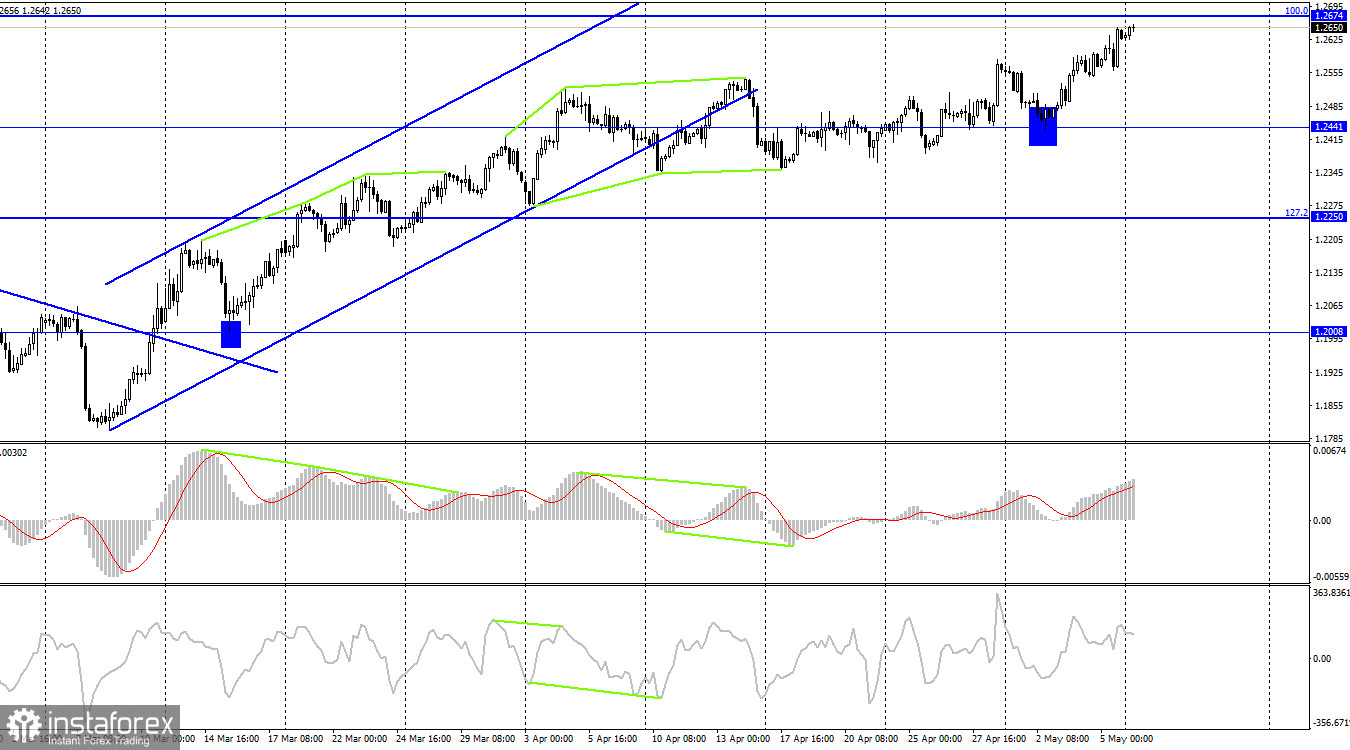

On the 4-hour chart, the pair has consolidated below the ascending trend channel but showed no signs of a decline. However, the bounce from the 1.2441 level worked in favor of the pound sterling so that it resumed growth towards the 100.0% Fibonacci level at 1.2674. The emerging bearish divergence in the CCI indicator has been canceled. I think a decline in the pair would be logical under the current circumstances but only in case of a bounce from the 1.2674 level.

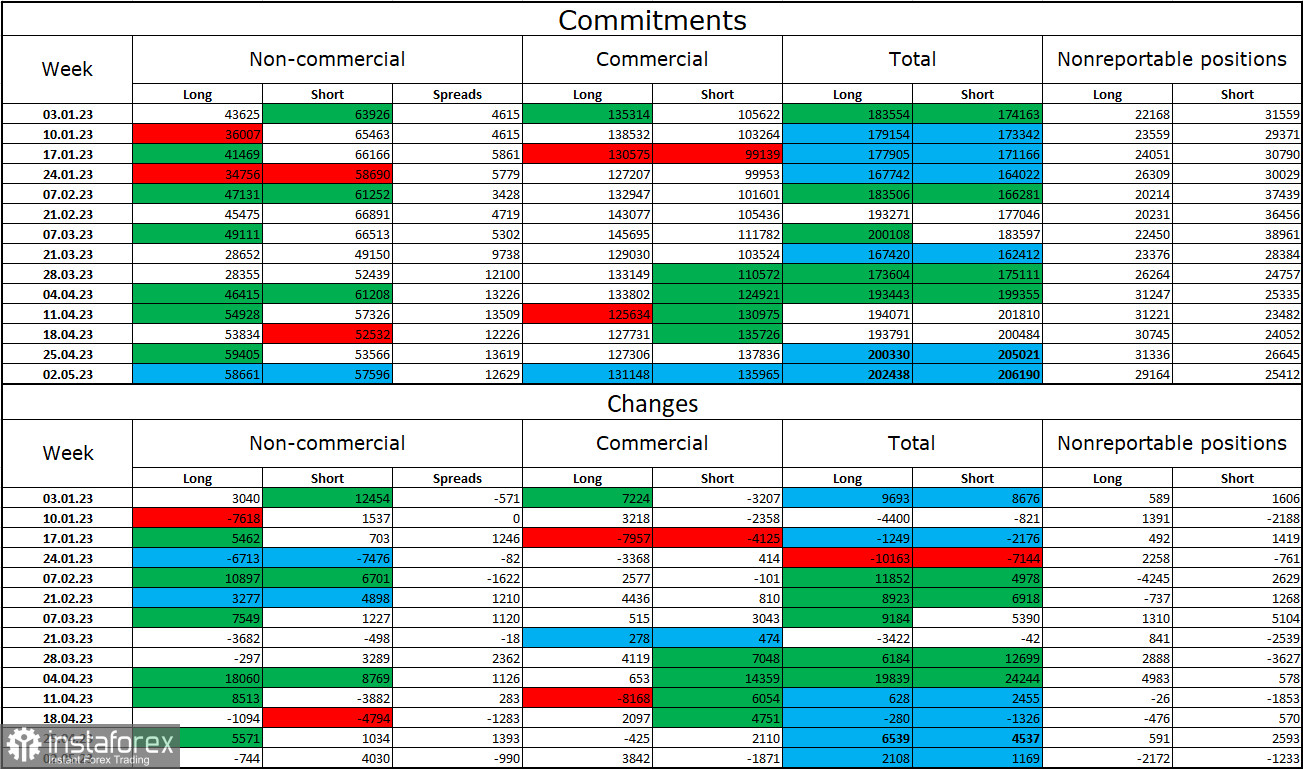

Commitments of Traders report

The sentiment of the non-commercial group of traders has become less bullish over the past week. The number of long contracts dropped by 744 while the number of short contracts increased by 4,030. The overall sentiment of large market players remains bullish although it had been bearish for quite a long time. Yet, the number of long and short contracts is almost equal, with 57,500 vs 58,500 respectively. The pound keeps rising but at a much slower pace than a few months ago. The outlook for the pound remains rather optimistic although it may decline in the near term. A rate hike by the Bank of England won't come as a surprise to traders after eleven consecutive rounds of monetary tightening.

Economic calendar for US and UK

The economic calendar has no important events on Monday. Therefore, the information background will have no influence on the market.

GBP/USD forecast and trading tips

I recommend selling the pound with the target at 1.2546 if the price closes below 1.2623 on H1. There was a buying opportunity when the price rebounded from 1.2447, with the possible targets at 1.2546 and 1.2575. Both targets have been reached, and the level of 1.2623 is on the way. You can keep your buy positions open until the pair closes below 1.2623.