Last week, we received various economic information, and, in my humble opinion, this information did not support the European currency. The euro did not appreciate by the end of the week, but the pound continues to actively rise. This could be due to the upcoming Bank of England meeting. The market likely believes that the central bank will raise the rate by another 25 basis points, which would be the twelfth consecutive tightening of monetary policy. Personally, I have been expecting the formation of a downward wave set for both instruments and I don't think that the news background is so bad for the US currency that traders should ignore it. However, not all analysts agree with my opinion.

Commerzbank economists warn their clients against long positions in the dollar. They refer to the quite likely completion of the Federal Reserve's monetary tightening process and also note the possible default due to the lack of a solution on the US Treasury debt ceiling. A couple of weeks ago, it seemed that this problem would be resolved promptly, as neither party in Congress wants a default. Nevertheless, Congress has not yet voted to raise the ceiling, and analysts are forced to worry about the "bright American future." I still believe that by June (when America will no longer be able to fulfill its obligations due to a lack of money in the budget), the issue will be resolved. The same situation arose last year, and Janet Yellen also fueled market panic due to the approaching default.

Commerzbank notes that other analysts are misinterpreting the risks associated with a possible default. They believe that for many, it's rational to bet on the scenario with the highest probability. But if that were to go wrong, it could end badly for the dollar. The market itself does not want to take the risk of buying US currency if the government debt issue remains unresolved. This may be one of the reasons why the dollar has so little potential for strength right now, as well as due to the Fed's policies.

Nordea analysts compare ECB and Fed rates. Objectively, the ECB needs to make more rate hikes this year, which may also be related to the consistently high demand for the euro (although it has not increased significantly in recent weeks). Nordea economists believe that the euro could see moderate growth by the end of the year, but will enter a sideways movement next year. I admit that the sideways trend has already begun, as the ECB slows down its policy tightening pace, indicating the approach of its completion. Nordea also believes that global and American recession uncertainty could help the dollar but in the long term. The general opinion is that the euro could continue its moderate growth in the coming months, but a trend reversal will inevitably follow.

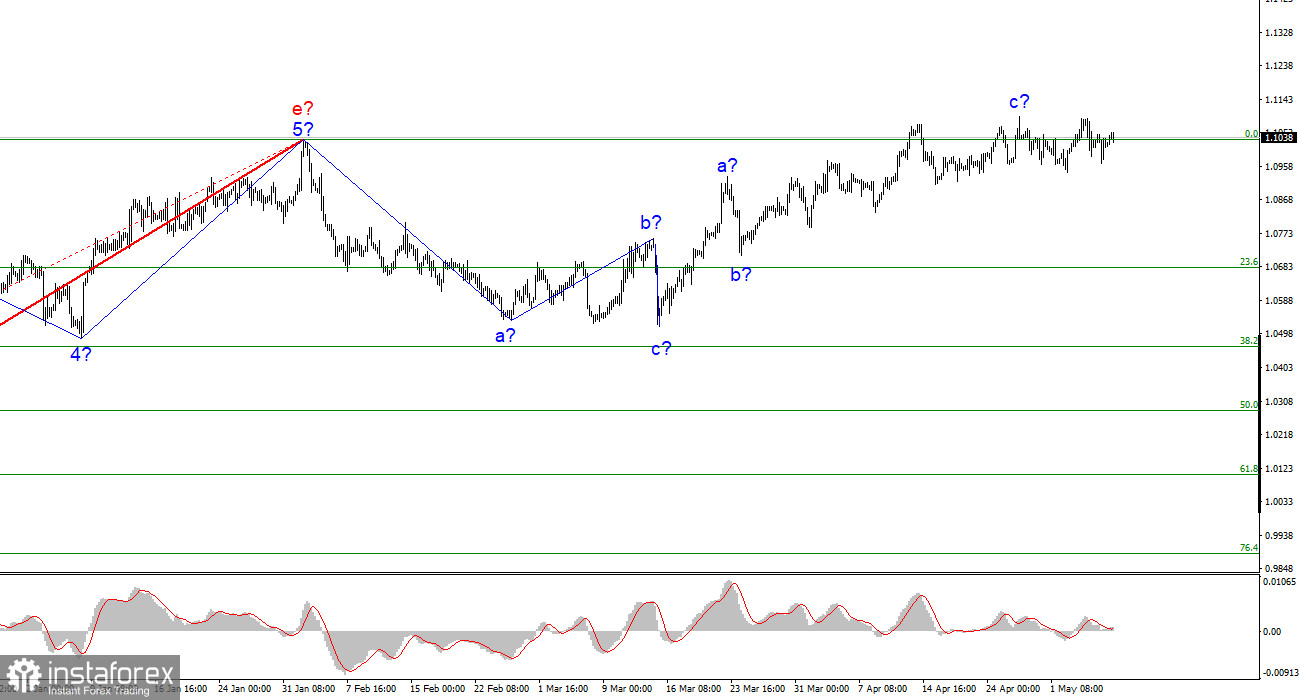

Based on the analysis conducted, I conclude that the construction of the uptrend segment is approaching its end. Therefore, it would be better to sell, and the instrument has quite a large room for decline. I think that targets in the 1.0500-1.0600 area can be considered quite realistic. With these goals in mind, I recommend selling the instrument on downward reversals of the MACD indicator as long as the instrument is below the 1.1030 mark, corresponding to 0.0% Fibonacci.

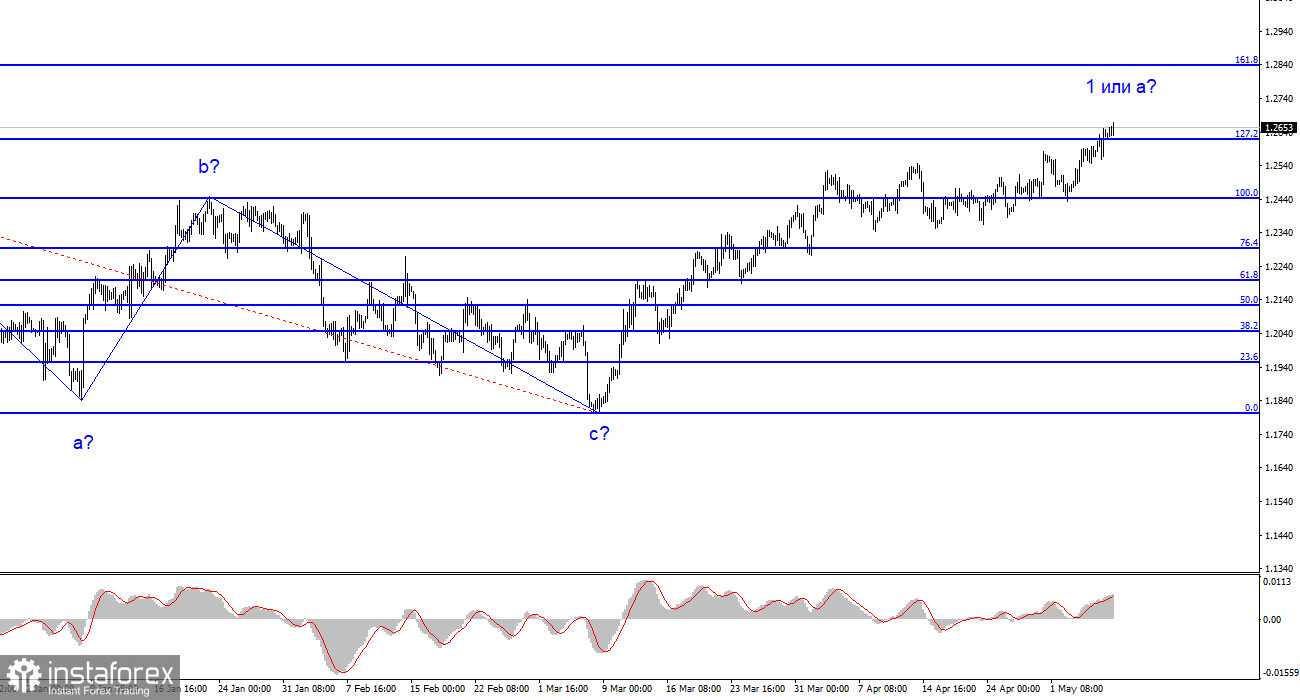

The wave pattern of the GBP/USD pair has long suggested the construction of a new downward wave. The wave marking is now not entirely unambiguous, as is the news background. I do not see factors that would support the British currency in the long term, and wave b could be very deep but has not even started yet. I believe that the pair will most likely fall from now on, but the first wave of the ascending segment continues to become more complex, and quotes have moved away from the 0.0% Fibonacci level. Now it will be more difficult to determine the beginning of wave b construction.