Cautious Wall Street sentiment and the recovery of US Treasury bond yields have helped the US dollar remain stable against a basket of rivals on Monday. The currency closed slightly higher the day before, and today it may also keep its position.

On Tuesday, the business optimism index and the economic optimism index will be published. Market participants will continue to pay close attention to comments from central banks' officials in the absence of important data releases.

The dollar index may rise for the second session in a row as investors are waiting for key inflation reports this week. The data may affect the next Fed interest rate decision.

The consumer inflation report will be released on Wednesday, and the producer inflation report will be issued on Thursday.

Data released on Monday also showed that US business and household lending conditions continued to tighten at the beginning of the year. However, this could be explained by the Fed's aggressive rate hikes rather than recent banking shocks.

Meanwhile, the 12-month US inflation forecast fell to 4.4% in April from 4.7% in March.

Downside risks of the euro

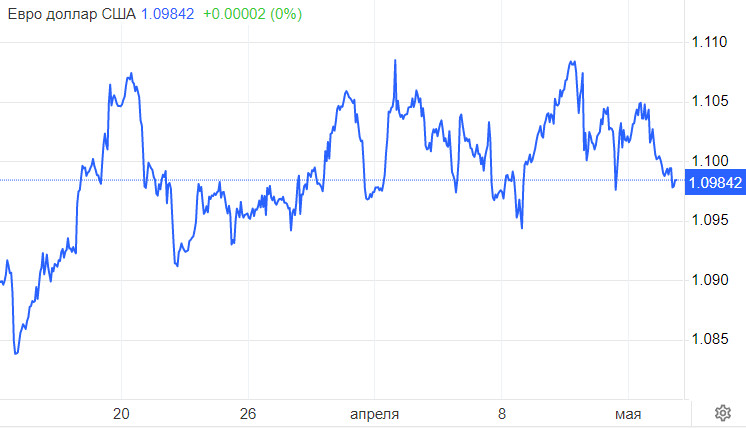

Today, the euro, after a consolidation phase near 1.1000, began to decline again. ECB representative Martins Kazaks said on Tuesday that rate hikes might not end in July. However, this comment did not help the EUR/USD pair gain strength.

It seems to be a difficult week for the European currency. Economic obstacles on the continent could lead to a decrease in the exchange rate to 1.0900.

The euro came under additional pressure when it became known that manufacturing orders in Germany fell by more than 10% in March. This is the biggest decline since the pandemic.

Everything points to the end of the global euro rally. There are no new catalysts for growth, but factors for a decline have emerged. Meanwhile, inflation in Germany is high, the ECB meeting is on the horizon, and the data on the German manufacturing sector and retail sales as a whole was not bad.

The economic picture is still unclear. However, downside risks are emerging as the most hawkish tightening of ECB policy in history begins to affect the economy.

This increases the importance of upcoming economic data, especially from the largest European economies. The euro may come under pressure if any deterioration in the economic situation forces traders to review the ECB interest rate forecasts.

Judging by the European calendar, events are unlikely to have a negative effect on the euro. However, US inflation data may influence the euro/dollar pair. What is more, ECB Executive Board members Philip Lane and Isabel Schnabel will deliver speeches.

As analysts note, it is difficult to decide on opening long positions on the dollar this week. The fact is that all eyes are turned to inflation, whereas the debt ceiling is the second very important indicator. Previously, economists underestimated the pace of inflation growth. Similarly, they may now underrate the pace of its possible decline.

There is almost no use to open short positions on EUR/USD at the moment. Sell orders on the US dollar may prevent the euro from significant declines this week if US inflation continues its nine-month downward trend.

The consensus assumes that inflation is likely to remain at 5% in April. Meanwhile, the more important core inflation level is expected to decrease slightly to 5.6%. from 5.5%

In such a scenario, the greenback will hardly fall unexpectedly and face pressure. However, a greater than anticipated decline in inflation may spur a slump in the US dollar. The fact is that in recent weeks, traders have been betting on the fact that the Fed is likely to cut its interest rate three times by the end of the year.

If buyers manage to push the EUR/USD pair slightly above the 1.1000 mark, the immediate resistance will be at the 1.1020 level and then, at 1.1040. Only a close above the latter barrier can be considered a signal for further growth