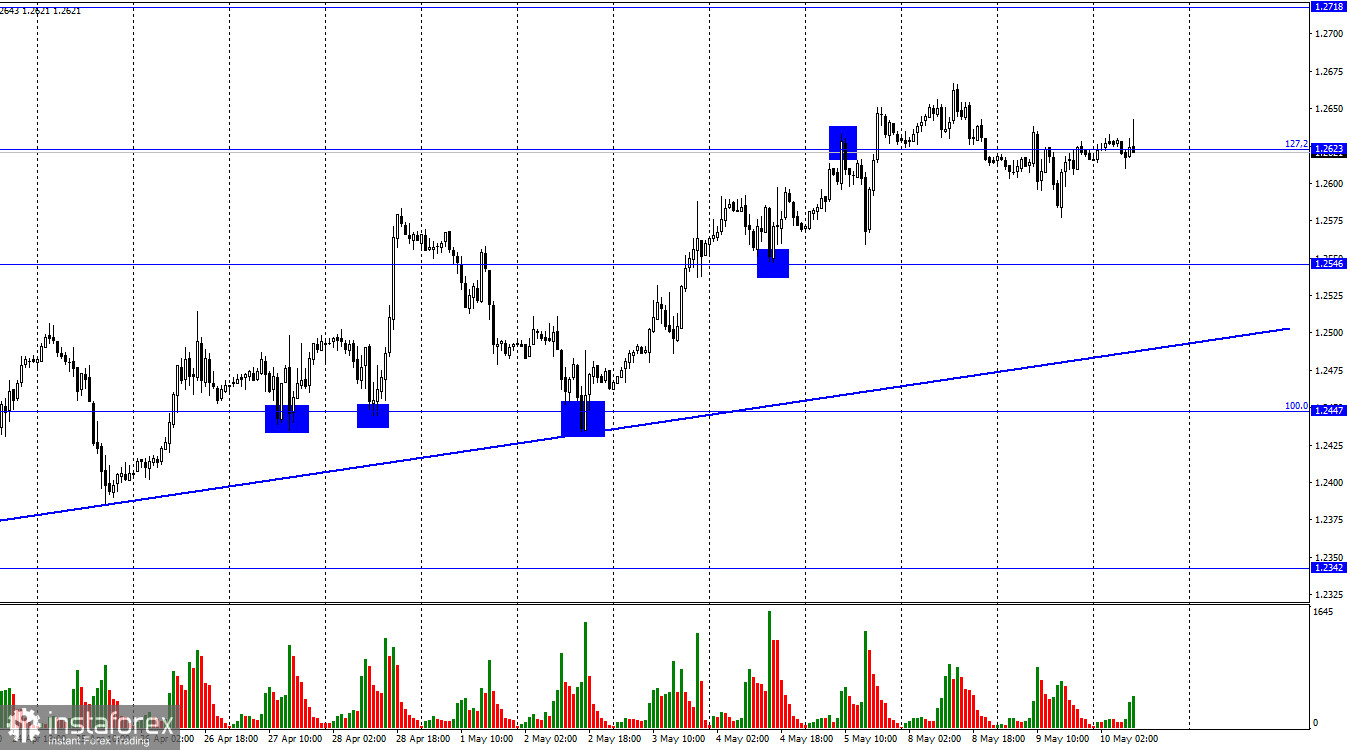

On Tuesday, GBP/USD was trading flat on the 1-hour chart, and the trading activity was rather slow. At the moment, the pair is trading around the 127.2% Fibonacci retracement at 1.2623 and does not show any dynamic at all. There is currently no rebound or closure near this level, so we have zero signals to trade. It seems that traders are cautious ahead of the US inflation data and the policy meeting of the Bank of England which will take place on Thursday. So, they prefer to stay out of the market for now. Meanwhile, the ascending trendline still indicates a bullish sentiment.

In the previous article discussing EUR/USD, we touched upon the upcoming US inflation report. If inflation data does not come in line with traders' expectations, the pound/dollar pair could move in any direction. However, it is unlikely that anyone expects a resurgence in inflation, as the Federal Open Market Committee (FOMC) has consistently addressed the issue of raising interest rates at its every meeting. Thus, the key question now is whether the report shows a decline in April or whether consumer prices stayed at the current level.

For the British pound, the Bank of England's meeting scheduled for tomorrow is a more crucial event. The primary focus here is the interest rate, which could potentially rise by another 0.25%. While some economists speculate that the central bank may pause its rate hikes, others remain skeptical due to the UK's persistently high inflation rate, meaning that there is still room for further monetary tightening. Consequently, it is more likely that the regulator will raise the rate again, potentially triggering a new cycle of growth in the pound.

At the moment, it is difficult to identify factors that could lead to a strong rally in the US dollar, at least based on trendlines on the H1 chart. Nonetheless, examining longer-term charts reveals that the pound's growth over the past three quarters has been impressive, despite the Federal Reserve raising rates more aggressively than the BoE and the relatively healthy economic data in the US.

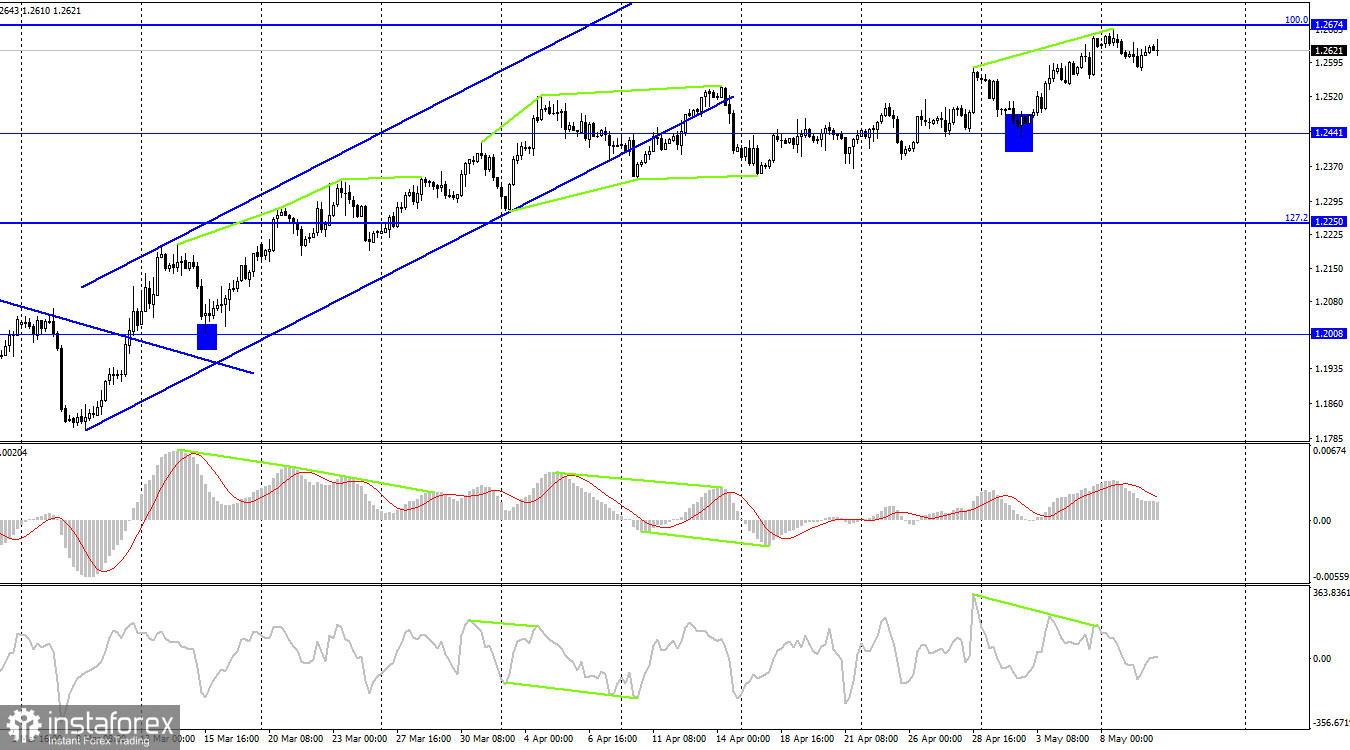

On the 4-hour chart, the pair has consolidated below the ascending trend channel but showed no signs of a decline. However, the bounce from the 1.2441 level worked in favor of the pound sterling so that it resumed growth towards the 100.0% Fibonacci level at 1.2674. The emerging bearish divergence in the CCI indicator has been canceled. I think a decline in the pair would be logical in the current circumstances.

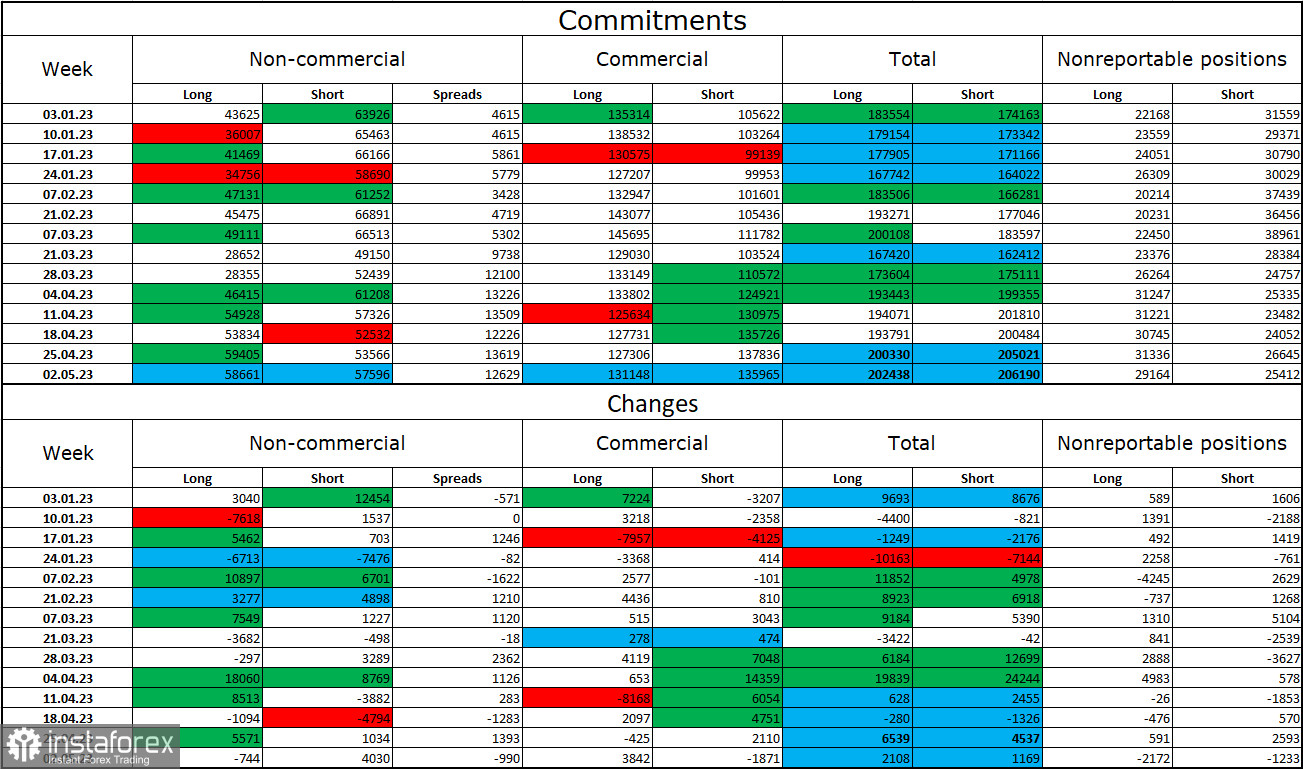

Commitments of Traders report

The sentiment of the non-commercial group of traders has become less bullish over the past week. The number of long contracts dropped by 744 while the number of short contracts increased by 4,030. The overall sentiment of large market players remains bullish although it had been bearish for quite a long time. Yet, the number of long and short contracts is almost equal, with 57,500 vs 58,500 respectively. The pound keeps rising but at a much slower pace than a few months ago. The outlook for the pound remains rather optimistic although it may easily decline in the near term. A rate hike by the Bank of England won't come as a surprise to traders after eleven consecutive rounds of monetary tightening.

Economic calendar for US and UK

US – Consumer Price Index (12-30 UTC).

On Wednesday, only one macroeconomic report on US inflation will be in the focus of traders. Therefore, the influence of the information background on the market sentiment can be moderate throughout the day.

GBP/USD forecast and trading tips

I recommend selling the pound with the targets at 1.2546 and 1.2500 in case of its pullback from the 1.2674 level on the H4 chart. The pullback has almost been completed. Buying the pair will be possible when the price closes above 1.2674 on H4 with the targets at 1.2718 and 1.2810.