The Bank of England will summarize the result of its meeting on Thursday. In anticipation of this event, the pound is showing mixed dynamics against the dollar, trading in a narrow price range of 1.2600–1.2650. Yesterday, GBP/USD bears tried to test the 25th figure, but ended in vain as Tuesday's trades ended at 1.2616. Traders' caution is quite justified, as the results of the May meeting could significantly "redraw" the fundamental picture for the pair.

Base Scenario

According to the majority of currency strategists at major banks, the Bank of England will increase interest rates by another 25 basis points tomorrow – to 4.5%. This is the basic, widely expected scenario, the implementation of which is unlikely to surprise GBP/USD traders and cause strong volatility. While any deviations from this scenario will trigger price turbulence: for example, if the regulator takes a wait-and-see position (such an option is not completely ruled out) or raises the rate by 50 basis points at once (an extremely unlikely course of events).

If the central bank does implement the base scenario, the main focus of traders will be on the text of the accompanying statement, the rhetoric of Bank of England Governor Andrew Bailey, and other meeting details (e.g., the ratio of those voting "for" a rate hike and "against"). In other words, market participants will be interested in the future prospects of tightening monetary policy.

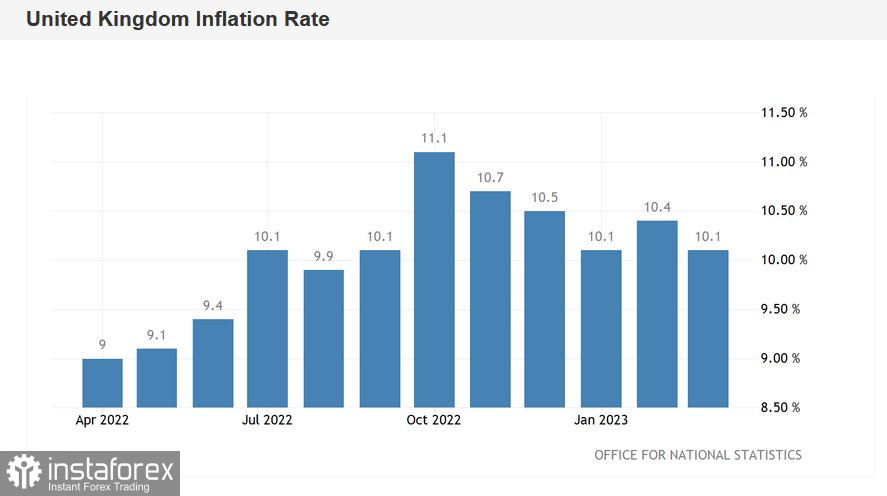

Assessing the likelihood of a 25-point rate hike, it is necessary to evaluate primarily the dynamics of the UK's key macroeconomic indicators. First and foremost, in the field of inflation. And here, the situation is on the side of the pound. The latest report on the growth of British inflation surprised with its "green color": the overall Consumer Price Index (CPI) in annual terms came in at 10.1%, while most experts predicted a decrease to 9.8% (the indicator has been above the psychologically important 10% mark for seven consecutive months). In monthly terms, the overall CPI fell to 0.8%, with a forecast decline to 0.5%. The core consumer price index, excluding food and energy prices, remained at the February level of 6.2% in March, while most analysts predicted a decrease to 6.0%.

Other inflation indicators also came out in the "green zone." For example, the Retail Price Index in annual terms was at 13.5% in March, with a forecast decline to 13.3%. The Producer Purchase Price Index fell to 7.6%, with a forecast of 7.0%. A similar dynamic was demonstrated by the Producer Selling Price Index (8.7%, forecast – 8.6%). The inflation report structure suggests that food and non-alcoholic beverage prices rose by 19.1% last month (from 18% in February). Utility prices increased by 26%, transportation services by 0.8%. Restaurant and hotel prices grew by 11.3%.

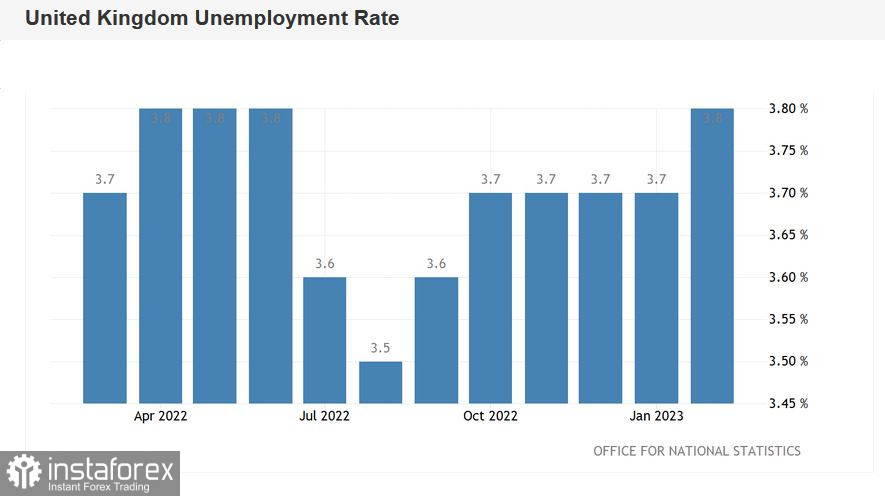

The latest data in the UK labor market also surprised, although almost all components came out in the "red zone" except for the pro-inflationary one. In particular, the UK unemployment rate unexpectedly rose to 3.8%, and the number of jobless claims increased by 28,000, with a forecast decline of 11,000. At the same time, wages in the UK (excluding bonuses) increased to 6.6% (in annual terms) against the expected 6.2%. Including bonuses, this indicator rose to 5.9%, with a forecast growth to 5.1%.

All this suggests that the English regulator will decide on another 25-point rate hike, but at the same time, the central bank is unlikely to "wave a sword," announcing further tightening of monetary policy.

The devil is in the details

Recall that following the previous (March) meeting, the English regulator increased the interest rate by 25 basis points, contrary to rumors about the end of the current monetary policy tightening cycle. The head of the central bank made it clear that he is ready to tighten monetary policy further if inflation accelerates. At the same time, two members of the Committee voted against raising the rate. In particular, Swati Dhingra warned her colleagues against further interest rate hikes: in her opinion, many effects of previous increases have not yet manifested, and excessive tightening of monetary policy "poses a more significant risk." By the way, Dhingra did not vote for an increase in the rate at previous meetings, as did her colleague Silvana Tenreyro. If the number of those voting "against" is more than two (following the May meeting), the pound will be under pressure despite the 25-point increase.

According to many experts (including TD Securities), the English regulator will decide on another rate hike (in addition to the May one) at the June meeting, after which it will take a break at least until the end of the current year. Therefore, any hints at "continuing the party" will support the British currency. And judging by the dynamics of inflationary growth and pro-inflationary indicators (in particular, the wage indicator), such a scenario seems most plausible.

However, if the central bank's rhetoric has a "conclusive" character, the pound will come under significant pressure. The Bank of England may hint that the next rate hike will only be taken as a last resort if previously adopted measures do not help curb inflationary growth. For example, the Bank of Canada took such a position, voicing the corresponding rhetoric.

Conclusions

The Bank of England is highly likely to raise interest rates by 25 basis points following the May meeting. Unlike the March meeting, the market is fully prepared for this scenario, so the mere fact of the increase will not provoke strong volatility in the GBP/USD pair. With the implementation of the base scenario, traders will react to other factors, paying attention to the number of votes "for/against," the wording of the accompanying statement, and the rhetoric of Governor Andrew Bailey.

Considering the growth of inflation and pro-inflationary indicators, the Bank of England is more likely to leave the door open for further tightening of monetary policy. This fact will allow GBP/USD buyers to test the resistance level of 1.2700 (the upper line of the Bollinger Bands indicator on the weekly chart). However, a less likely scenario is also possible (considering the rise in unemployment and weak economic growth), in which the English Central Bank effectively announces a pause, admitting the option of another rate hike only in case of extreme necessity. In such a case, the GBP/USD currency pair may return to the base of the 25th figure – the price mark of 1.2500 corresponds to the middle line of the Bollinger Bands on the daily chart, which coincides with the Kijun-sen line.