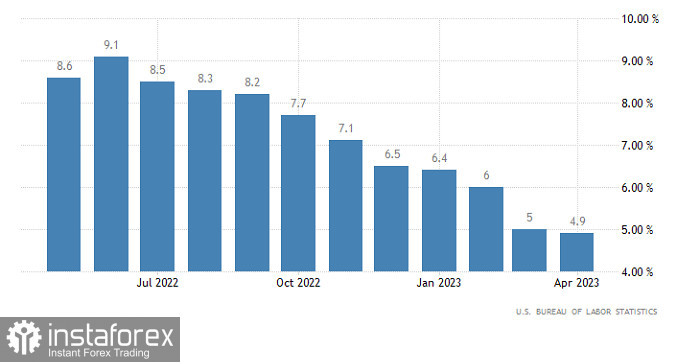

Although US inflation dropped from 5.0% to 4.9%, dollar fell slightly as market players remain unsettled by the monthly data. According to the report, consumer prices rose by 0.4% over the month, exceeding the forecast of 0.3%. This indicates that high inflation could persist for a rather long time, which means that the Fed is unlikely to lower the rates by the end of the current year.

Inflation (US):

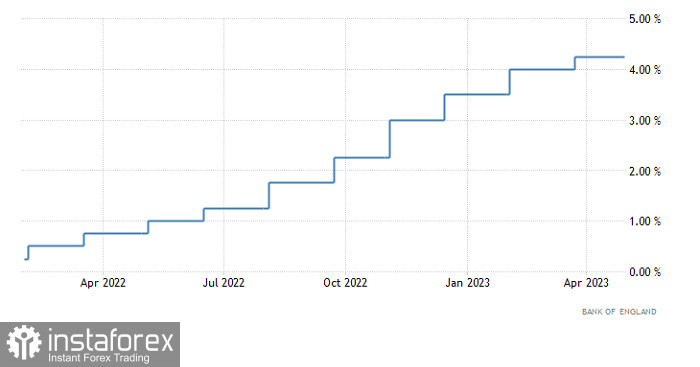

The Bank of England is having its board meeting today, and many expect to see a rate hike by 25 basis points. There are also hints that this will be the last rate increase. However, inflation in the UK is rising, unlike the US and the EU, so there is a chance that interest rates will be raised by 50 basis points. If this happens, dollar will decline sharply. But if rates increase by only 25 basis points, the situation in markets will not change.

Interest rate (UK):

Although EUR/USD hit 1.1000 recently, it is still trading within the range of 1.0950/1.1080. Therefore, for further growth, traders have to keep the quote above 1.1000. Otherwise, there will be drop below 1.0950.

GBP/USD updated the high in the medium-term, but failed to stay at the level so there was a pullback, followed by a stagnation. Now, there is a chance for a jump, but this will depend on the monetary policy decision of the Bank of England.