Details of the economic calendar on May 10

The U.S. annual inflation rate in April amounted to 4.9%, the lowest figure since April 2021. On a monthly basis, inflation growth was 0.4%, which is also at the consensus level. However, compared to the previous period, there is noticeable growth, which may have caused concern among investors.

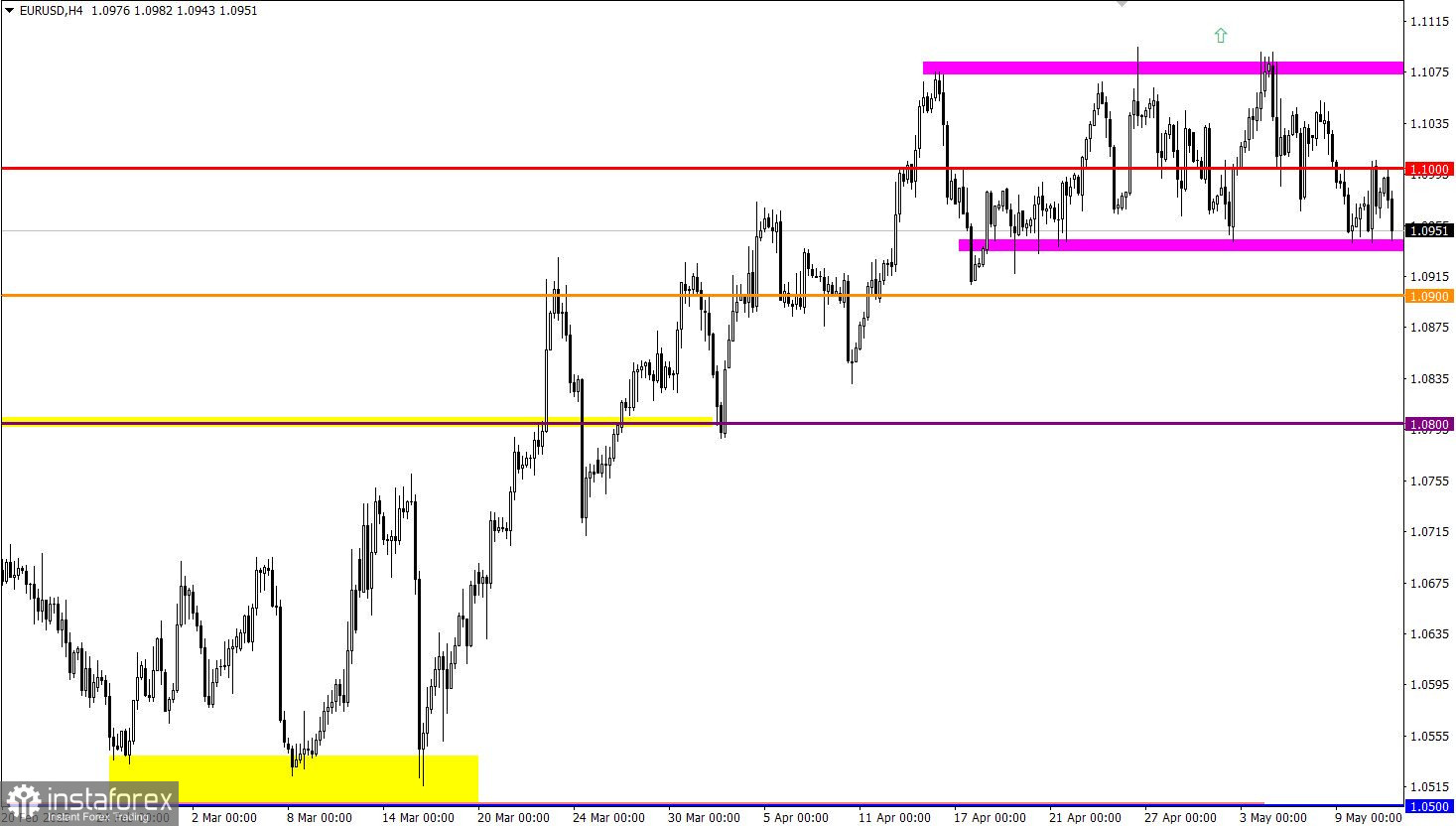

Analysis of trading charts from May 10

The EUR/USD exchange rate rose to the 1.1000 level, but failed to stay above this mark, and the quote retraced to the 1.0950 level.

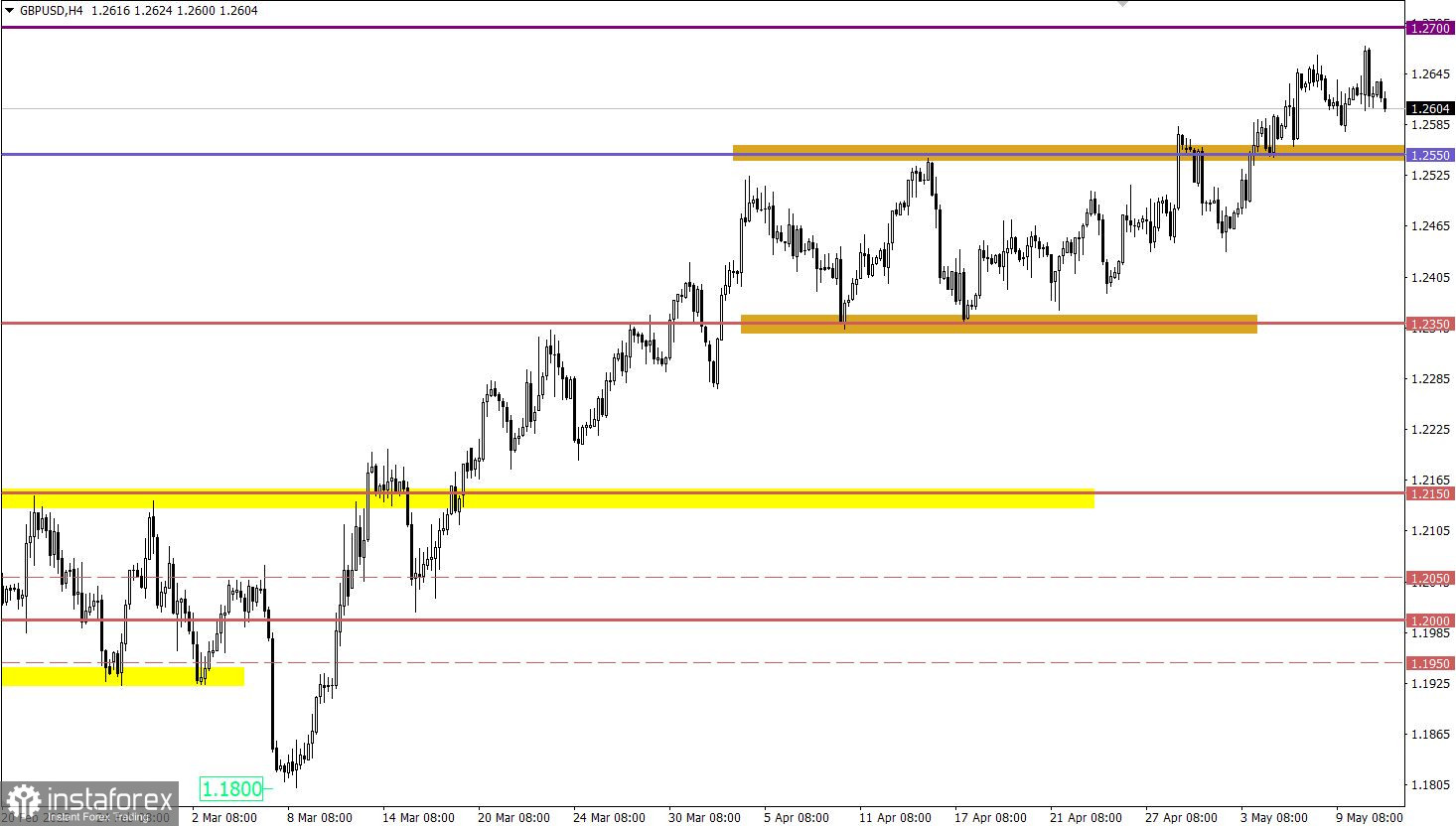

The GBP/USD currency pair locally updated the high of the medium-term trend due to market speculation. However, the buyers' joy did not last long, as a pullback occurred almost immediately. The trading day ended at the opening level.

Economic calendar for May 11

Today, the Bank of England meeting is on the agenda, where a 25 basis point interest rate hike is expected. The media is actively discussing the topic of a possible pause after the current rate hike. Thus, if information about a pause appears after the meeting or the number of votes by board members goes in favor of maintaining the current level, it will put pressure on the British currency's rate, leading to its decline.

Time targeting:

Bank of England meeting results – 11:00 UTC

EUR/USD trading plan for May 11

In this situation, the 1.0950/1.1080 amplitude cycle may end its formation if the price holds steadily below 1.0930 over a four-hour period. Until then, there remains the risk of a price rebound.

GBP/USD trading plan for May 11

With the upcoming Bank of England meeting, new speculation is not ruled out during the announcement of its decisions. From a technical analysis perspective, to increase the volume of long positions further, it is necessary to keep the quote above the 1.2650 value over a four-hour period. This will allow the medium-term trend to continue. At the same time, a downward scenario is possible if the price holds below the 1.2600 mark, which could strengthen short positions towards the 1.2550 level.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.