Analysis of macro data:

There will be little macro data on Friday, but it includes important reports. The eurozone is not scheduled to release any important data, but the UK does have two reports that may attract the attention of traders. I am referring to the GDP in the first quarter and industrial production for March. GDP is expected to grow by 0.1% in quarterly terms, but the actual value could be lower. Remember that the British and European economies have been around zero GDP growth for three consecutive quarters. Industrial production is likely to grow by 0.0-0.2% in monthly terms, but again the actual value could be lower. I believe that the scheduled UK reports are unlikely to support the pound.

In the US, novice traders may only pay attention to the University of Michigan's consumer sentiment index, which can only cause a market reaction if the actual value significantly deviates from the forecasted one.

Fundamental events:

There will be quite a few fundamental events on Friday. In the eurozone, there will be another speech by Luis de Guindos, Vice President of the European Central Bank. In the UK, the Bank of England's chief economist Hugh Pill will deliver a speech. In the US, we have Federal Reserve Monetary Committee members Michelle Bowman and James Bullard. We all know that not every speech by a senior official contains resonant phrases that can immediately provoke a market reaction, but these officials' speeches will help traders understand what to expect from central banks in the near future. I don't believe that these events will provoke strong movements in the market, so volatility may be low again on Friday.

General conclusions:

On Friday, the UK GDP report will be the only really important event during the day. And even then, we can only expect a strong reaction in case the actual value deviates from the forecast by more than 0.2%. All other reports are of secondary importance. The speeches of central bank representatives are mostly scheduled for the evening when novice traders should have already left the market. And immediately after the meetings of all three central banks, their officials are unlikely to make resonant statements. Friday may turn out to be relatively dull.

Basic rules of the trading system:

1) The strength of the signal is determined by the time it took the signal to form (a rebound or a breakout of the level). The quicker it is formed, the stronger the signal is.

2) If two or more positions were opened near a certain level based on a false signal (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.

3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.

4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours when all positions must be closed manually.

5) You can trade using signals from the MACD indicator on the 30-minute time frame only amid strong volatility and a clear trend that should be confirmed by a trendline or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

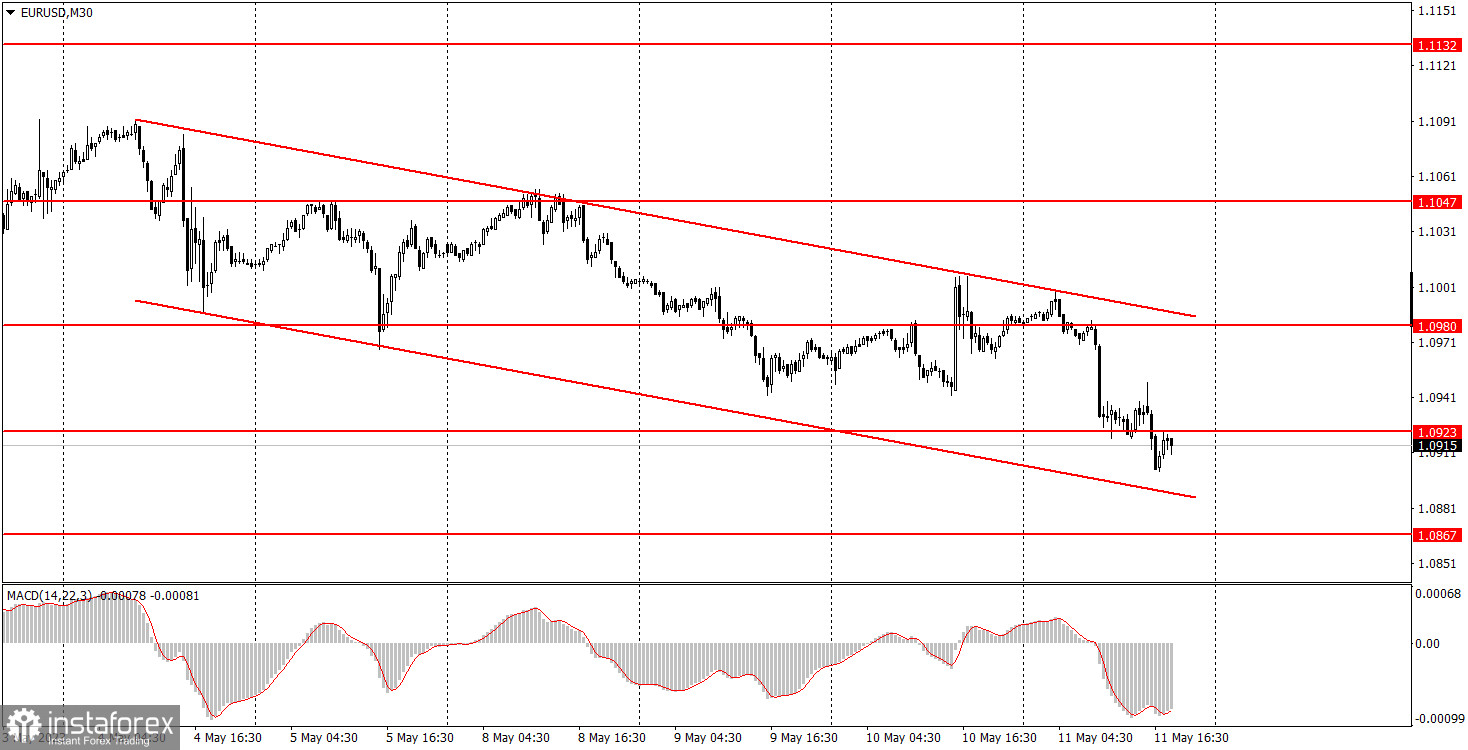

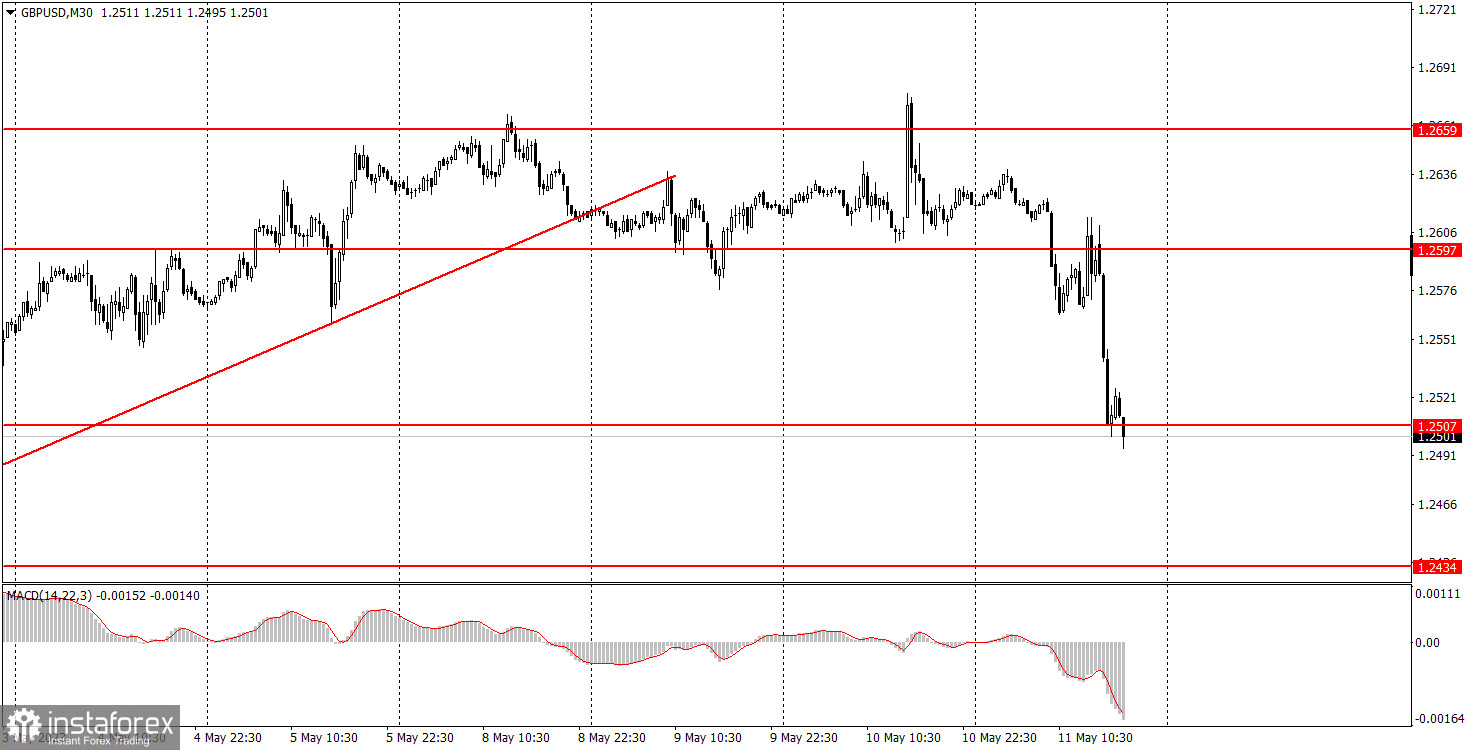

On the chart:

Support and Resistance levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines).

Important announcements and economic reports that can be found on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.