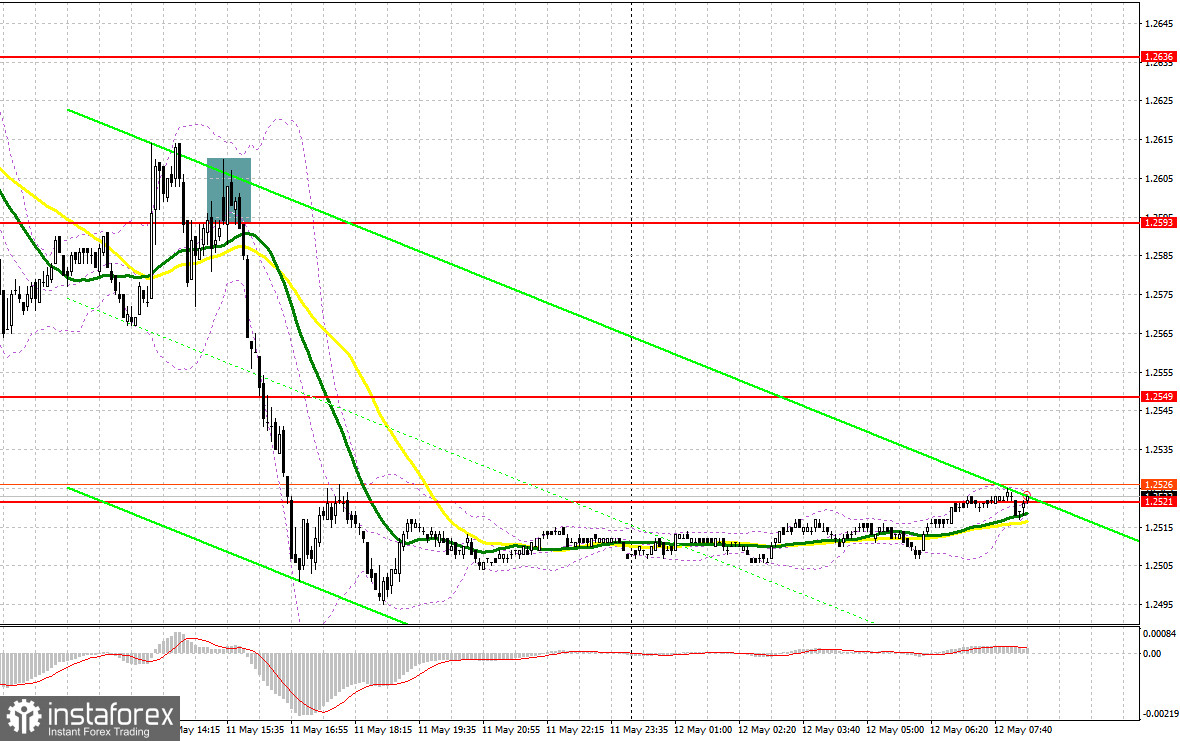

Yesterday, several entry signals were made. Let's look at the 5-minute chart to get a picture of what happened. In my morning article, I turned your attention to 1.2578 and recommended making decisions with this level in focus. Decline and a false breakout through the mark produced a buy entry point, but the pair did not sharply rise. I decided not to leave the positions open in hope for the Bank of England's decision, so I closed the position without any loss. In the second half of the day, a breakthrough at 1.2593 and a false breakout at this mark led to a sell signal. It triggered a drop of more than 50 pips.

Conditions for opening long positions on GBP/USD:

The Bank of England raised rates, keeping the policy aggressive, and made upward revisions to its growth forecasts for the coming years. However, all this did not help the pound, which resulted in another large sell-off in the second part of the day. Today, the volatility surge in the first part of the day will be caused by the reports on the change of the volume of the UK GDP for the 1st quarter of this year, the change of the industrial production and the change of the volume of the manufacturing production in the UK. If we don't see any negative reaction, we can expect the bulls to regain some of yesterday's losses.

In my view, traders should act on a correction in the area of 1.2495 support. In fact, a test of this level may occur soon. A false breakout at this mark will give a signal to buy with the target at 1.2531, followed by a recovery. A breakout and consolidation above the range may take place if the bears don't take any actions after weak macro data. An additional buy signal may come with a rally to 1.2567, where the moving averages are, which plays on the bears' side. The most distant target stands at 1.2602, where I will lock in profit.

If the price goes down to 1.2495 and there is no bullish activity there, the process of developing the bearish market will proceed. I will open long positions at 1.2465 after a false breakout. I will also consider buying from a low of 1.2436, allowing a correction of 30-35 pips intraday.

Conditions for opening short positions on GBP/USD:

Bears will have a chance to update the weekly lows, but in my opinion, it is better not to rush to open short positions today. I would hold the shorts till the false breakout at the nearest resistance level of 1.2531, where it will be clear whether there are real bears in the market or not. If the pair fails to break above this level and there is no false breakout, pressure on the pound sterling could increase. It may decline to 1.2495. A breakout and an upward retest of this level will provide a sell signal with a drop to 1.2465. The most distant target is still seen at a low of 1.2436, where I will take profit.

If GBP/USD goes up and there is no bearish activity at 1.2531, amid very good data on the UK economy, I will sell after a test of 1.2567 where the moving averages are passing. A false breakout there will create a sell entry point. If no drop follows, I will sell GBP/USD right on a bounce from a high of 1.2602, , allowing a downward correction of 30-35 pips intraday.

COT report:

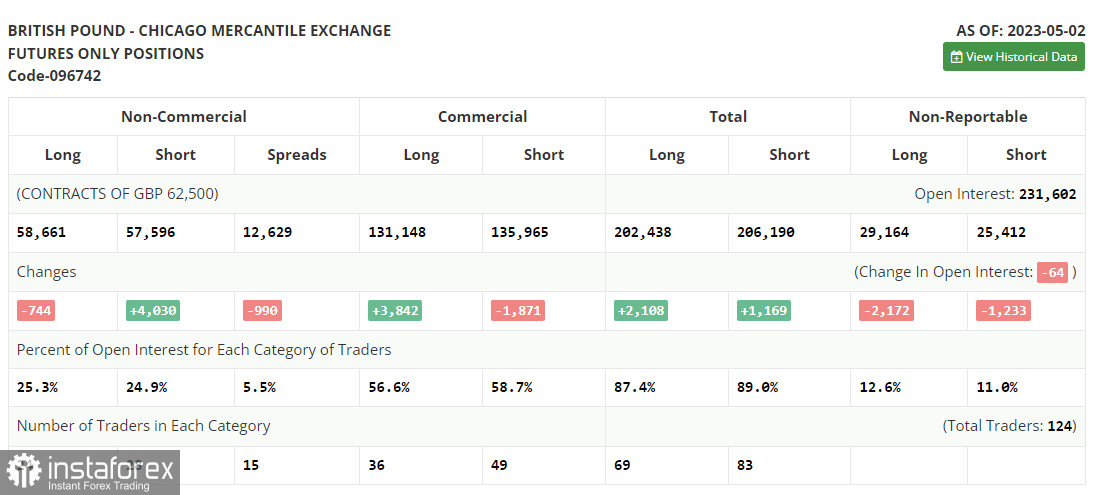

According to the COT report for May 2, there was an increase in short positions and a decline in long ones. The Bank of England is widely expected to hike rates this week. The regulator has long been trying to tame inflation. However, no progress came. The pound sterling will hardly go up if the BoE raises the key rate by 0.25% basis points. Traders have already priced it in. Hence, a deeper correction looks likely this week. The latest COT report showed that short non-profit positions increased by 4,030, to 57,596, while long non-profit positions slid by 744, to 58,661. It led to a decrease in the non-commercial net position to 1,065 against 5,839 a week earlier. This was the first decline in six weeks. So, it was just a correction. The weekly price rose to 1.2481 against 1.2421.

Signals of indicators:

Moving Averages

Trading is carried out below the 30 and 50 daily moving averages, which indicates a further decline.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If GBP/USD declines, the indicator's lower border at 1.2470 will stand as support.

Description of indicators

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.