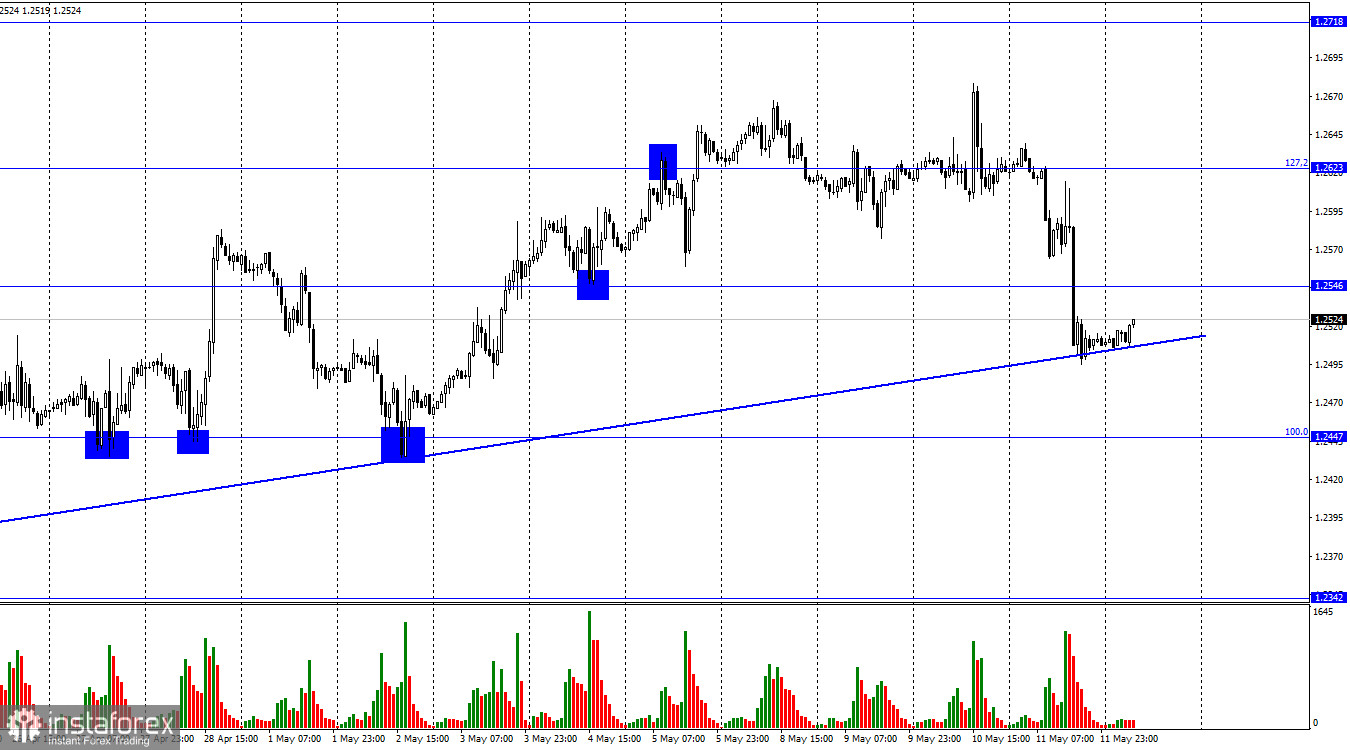

On the hourly chart, the GBP/USD pair continued its decline on Thursday and dropped to the rising trend line, which characterizes traders' sentiment as "bullish" even after yesterday's drop. Consolidation of the pair's rate below this line will favor the continuation of the fall toward the Fibonacci level of 100.0% (1.2447). A rebound from the trend line will allow a new rise toward the corrective level of 127.2% (1.2623).

The Bank of England's meeting was both disappointing and not disappointing simultaneously. As traders expected, the interest rate rose by 0.25%, and the number of bank executives who voted to raise the rate was not lower than forecasts – 7. However, Governor Andrew Bailey's rhetoric at the press conference left some questions unanswered. On the one hand, Bailey stated that the regulator will continue to tighten monetary policy in the future, as inflation is still double-digit, which does not correspond to the position of the Bank of England. On the other hand, for the second meeting in a row, the rate only grew by 0.25%, and many experts believe that the British regulator will wind down the rate hike program in the near future.

The rhetoric on inflation could have been clearer. The Bank of England still expects inflation to slow down quickly and halve by the end of the year. However, inflation itself holds a different opinion, and inflation forecasts for this and next year have been raised. The situation at the Bank of England is complicated. To ensure inflation falls towards the target level, it is necessary not just to raise the rate 1-2 times but to continue raising it by no less than 0.50%. However, yesterday the rate rose to 4.5%, which is already a high value and significantly "limits" the economy. The British economy shows good results against tightening, but further rate hikes may lead to negative GDP results. By the way, today, the GDP report for the first quarter will be released.

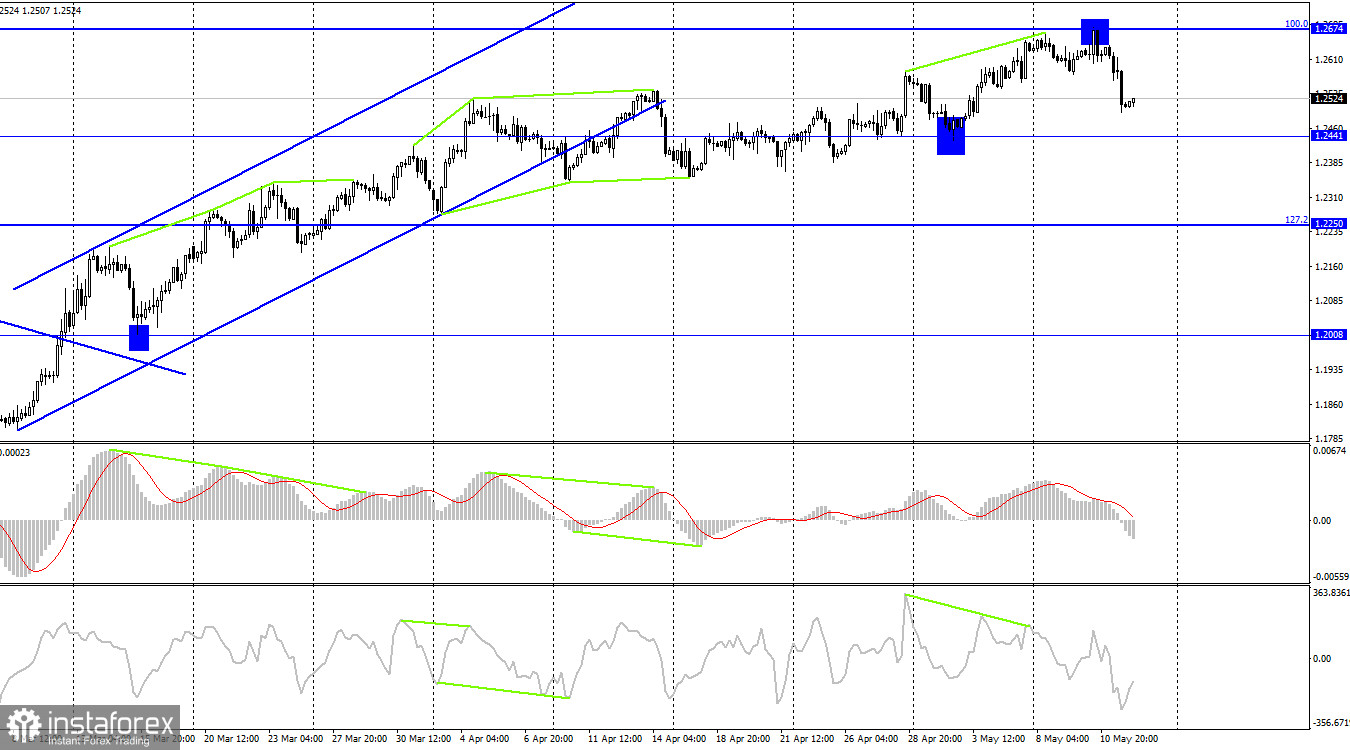

On the 4-hour chart, the pair consolidated below the rising trend corridor, but nothing happened, and the decline did not start. However, a rebound from the 1.2674 level allowed for a reversal in favor of the US currency and started a decline toward the 1.2441 level, which will hopefully continue. A rebound of quotes from the 1.2441 level will favor the pound, and a return to the 1.2674 level and a close below 1.2441 – will increase the likelihood of a continued fall toward 1.2250.

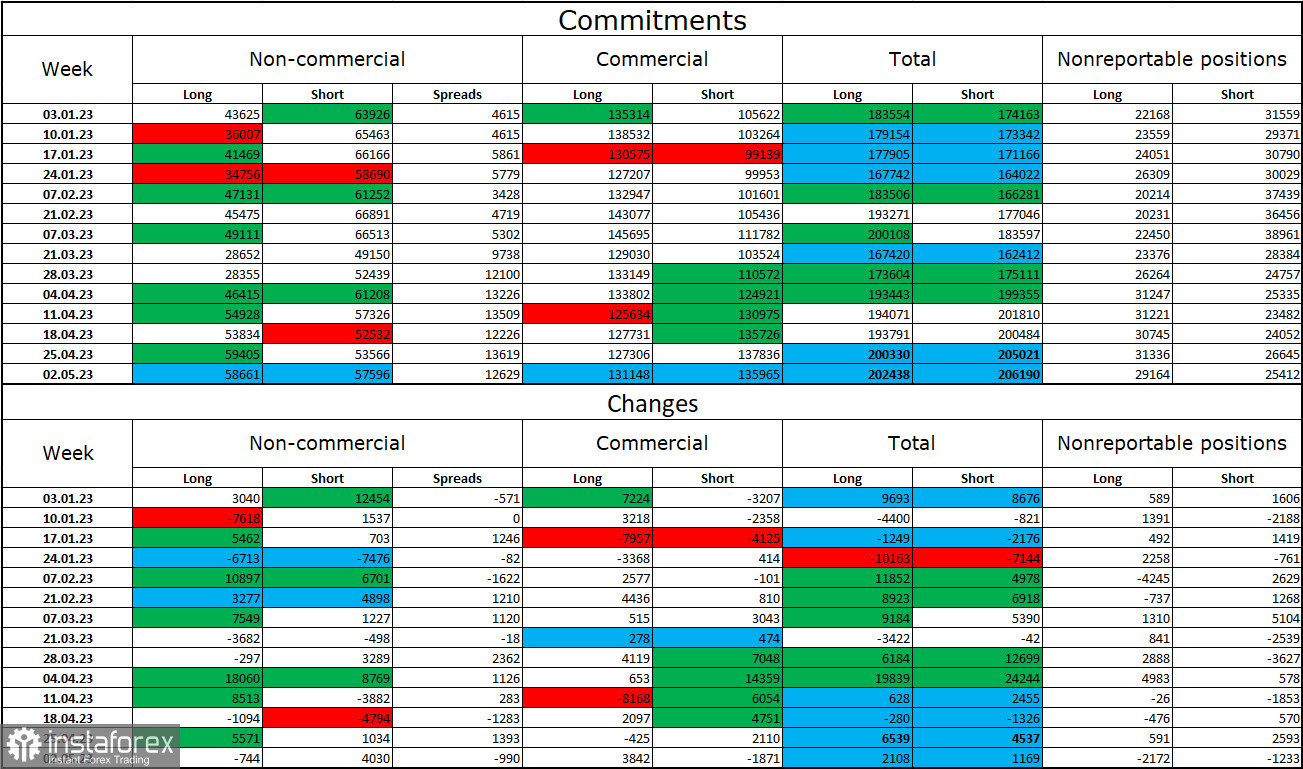

Commitments of Traders (COT) report:

The mood of the "non-commercial" trader category has become less "bullish" over the last reporting week. The number of long contracts held by speculators decreased by 744 units, and the number of short ones increased by 4030. The overall sentiment of major players remains fully "bullish" (it had been "bearish" for a long time), but the number of long and short contracts is now almost equal - 57.5 thousand and 58.5 thousand, respectively. The British pound continues to rise predominantly, although very few factors support its buyers. The prospects for the pound remain good, but a drop can be expected soon. The Bank of England's decision to raise the rate will not surprise traders after eleven MPC tightenings.

News calendar for the USA and the UK:

UK - GDP for the first quarter (06:00 UTC).

UK - Industrial production volume (06:00 UTC).

USA - Consumer sentiment index from the University of Michigan (14:00 UTC).

On Friday, the economic events calendar contains several entries, the most important being in the UK. The impact of the news background on trader sentiment for the remainder of the day may be moderate in strength.

GBP/USD forecast and trader advice:

I advised selling the pound with targets at 1.2546 and 1.2500 in case of a bounce from the 1.2674 level on the 4-hour chart. The targets were reached. New sales - when closing below the trend line on the hourly chart with a target of 1.2447. Buying the pound is possible with a bounce from the trend line on the hourly chart, with targets of 1.2623 and 1.2718.