Long-term perspective.

The GBP/USD currency pair also declined during the current week, but only on the last two days of the week. That is, on Thursday and Friday. On Thursday, a meeting of the Bank of England took place, during which it became clear that the British regulator would be much more cautious in raising the rate in the future. Given that its growth rate is minimal at the moment, "much more cautious" means raising the rate "from time to time." The key rate has already risen to 4.5%, a "restrictive" level. Therefore, not only inflation but also the economy will be restricted. However, the current economy is limited to 5+, and inflation is still above 10%. Therefore, the BOE has achieved the goal of slowing down the pace of economic growth to zero but has not made noticeable progress with inflation.

Thus, the rate should stop rising, as there is no point in further increasing it. The recession was avoided, but raising the rate to 5.5–6.0% will deliver a powerful blow to the British economy. The regulator clearly won't be making such sacrifices to achieve price stability. Andrew Bailey stated that he expects significant inflation to fall by the end of the year (by half). However, he previously stated that inflation would fall to 2.9% (that is, by three times). This statement looked like a fantasy. Now the Bank of England is taking a more realistic position, and if inflation starts to decrease, it should first evaluate the pace of its slowdown before raising the rate again.

The pound has fallen by 200 points so far, and only the last turn of its growth was 870. As you can see, the correction is minimal, even regarding the last growth turn. We expect further depreciation of the British currency.

COT Analysis.

According to the latest report on the British pound, the "non-commercial" group opened 12.9 thousand buy contracts and 9.5 thousand sell contracts. Thus, the net position of non-commercial traders has increased by 3.4 thousand and continues to grow overall. The net position indicator has been steadily growing for the last nine months. Still, the sentiment of major players has remained "bearish" all this time (only now can it be said to be "bullish," but purely formally), and the pound sterling. However, since it is growing against the dollar (in the medium term), it is very difficult to answer why it does so from a fundamental point of view. We do not rule out the scenario where the pound will fall sharply soon. It may have already started.

Both major pairs are moving similarly right now. Still, the net position for the euro is positive and already implies the imminent end of the upward impulse, and for the pound, it allows for further growth as it is neutral. The British currency has risen by 2300 points, which is a lot. Continuing growth without a strong downward correction will be illogical (even if we ignore the lack of fundamental support). The "non-commercial" group currently has 67.0 thousand sell contracts open and 71.5 thousand buy contracts. We remain skeptical about the long-term growth of the British currency and expect it to fall, but the inertial upward movement may continue.

Analysis of fundamental events.

In the UK this week, all the most important events were scheduled for Thursday and Friday. As mentioned, the results of the Bank of England's meeting were summed up, and GDP and industrial production reports were published on Friday. The first report showed growth of 0.1% in quarterly terms, which fully met forecasts. The second report showed a monthly production growth of 0.7%, which is higher than the forecast of 0.5%. Thus, on Friday, the pound had reasons to strengthen. It did strengthen in the first half of the day (slightly), but in the second - it crashed down.

The key event in the US this week was, of course, the inflation report. However, this time inflation disappointed, showing neither a strong fall nor a rise. For the Fed, even a decrease of 0.1% is good. Core inflation also slowed by 0.1%, which is also very good. But market forecasts were fully justified, so we did not get any reaction to this event. On Friday, the University of Michigan's consumer sentiment index fell from 63.3 to 57.7 in May, but the dollar continued to appreciate, which is a good signal for it in the future.

Trading plan for the week of May 15–19:

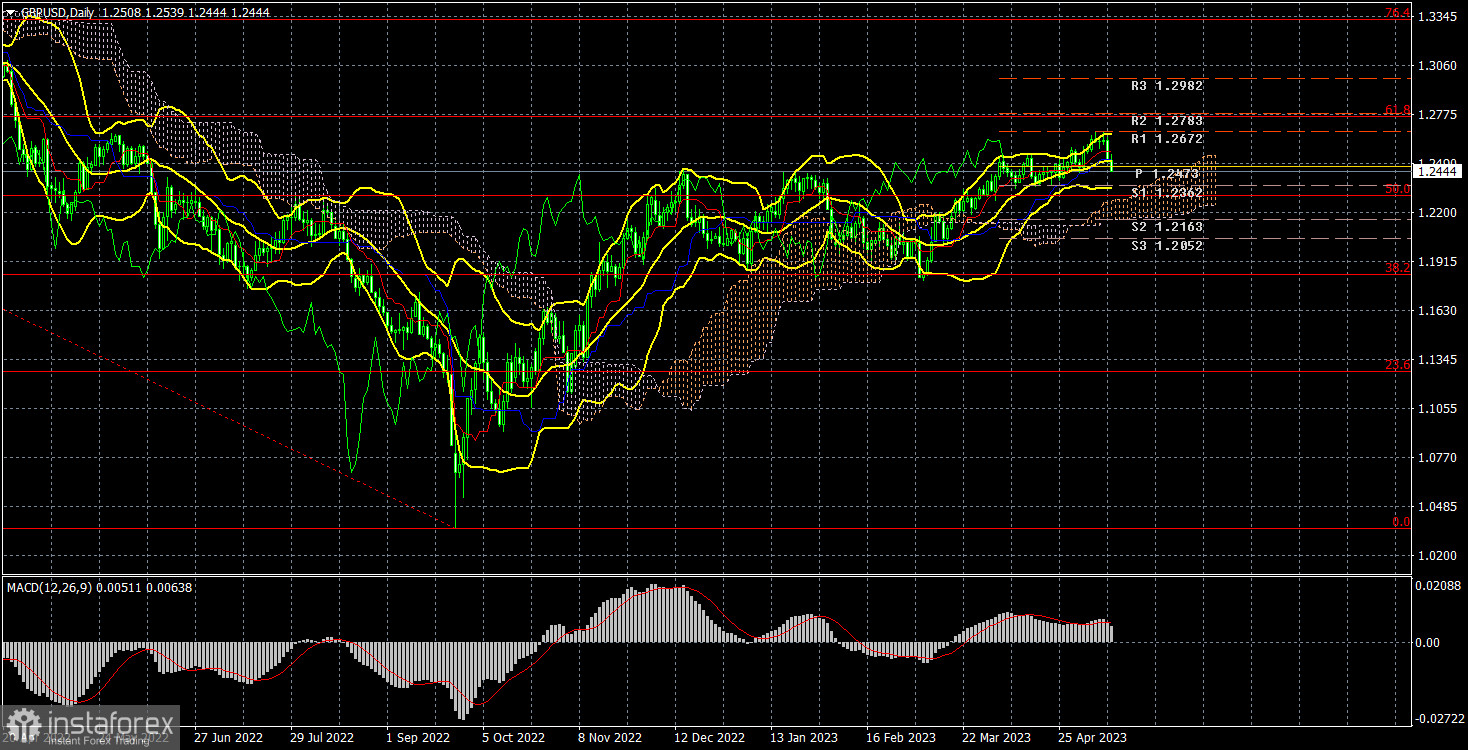

- The pound/dollar pair began to decline at the end of this week, which could be another micro pullback. However, the price is still fixed below the critical line, so the fall may continue with the goal of the Senkou Span B line, which lies at the level of 1.2165. Making small sales with the support of deals on a 4-hour TF is now advisable. The potential for the pair to fall is large, 500-600 points.

- As for purchases, further upward movement is quite doubtful after a rise of 2300 points without strong corrections. It should also be remembered that the fundamental background supporting the pound needs to be present. Therefore, long positions are not relevant for now. Formally, they will become relevant in the case of a new consolidation above the critical line, but even in this case, they should be cautiously approached.

Explanations for the illustrations:

Price support and resistance levels, Fibonacci levels - these are the levels that are targeted when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts - the size of the net position of each category of traders.

Indicator 2 on the COT charts - the size of the net position for the "non-commercial" group.