EUR/USD

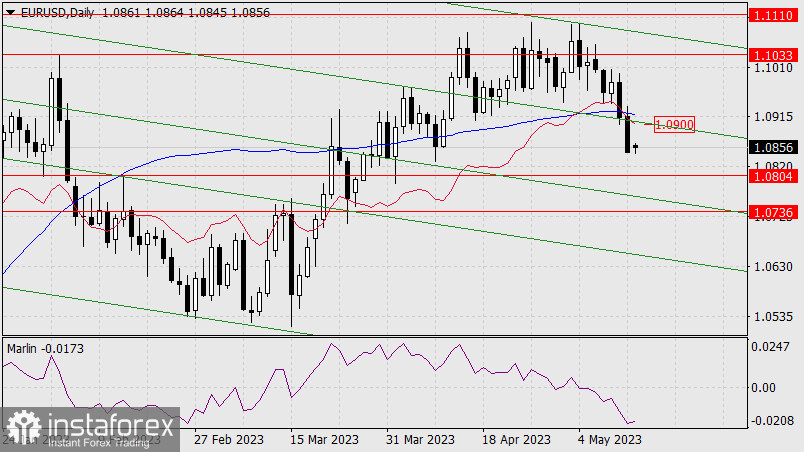

The euro fell by 66 points on Friday. On the weekly chart, there was a divergence with the Marlin oscillator, and the price overcame the Fibonacci level of 138.2%. Now this level acts as resistance to the price in the case of its corrective growth.

In the medium-term perspective, we expect the euro to fall to the Fibonacci level of 161.8% at the price of 1.0025, or slightly higher, if the decline is rapid and the price reaches the Fibonacci line earlier - around the 1.0100 mark.

On the daily chart, the Fibonacci level of 138.2% coincides with the price channel line. Accordingly, the level is strong. The price may return to it to gain a new momentum to decline. The nearest target is 1.0804 (possibly, the correction will occur from this level). The second target is 1.0736.

On the four-hour chart, the price has consolidated below 1.0900. The Marlin oscillator shows the intention to turn upwards. The oscillator has not yet reached the oversold area, which is at the level of 1.0804. However, we might even see a correction from the current levels. We are waiting for the correction to end in the coming days and the resumption of the decline to the indicated targets.