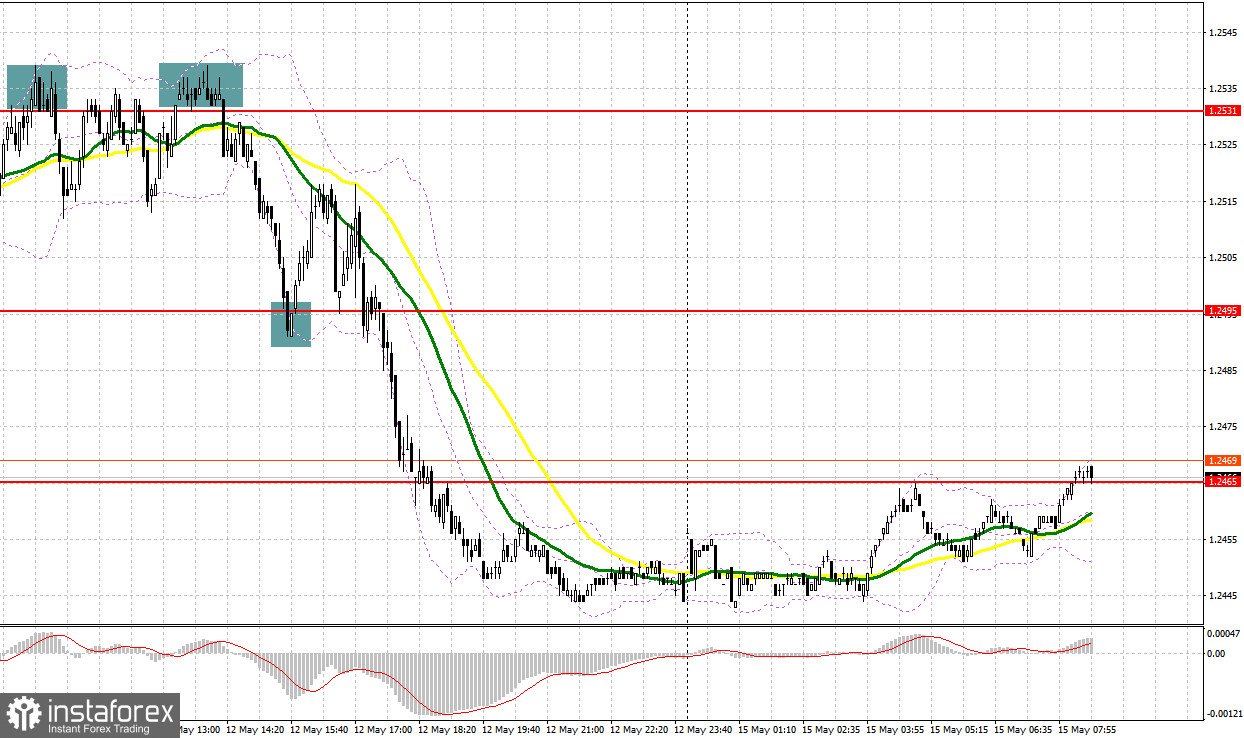

Last Friday, the pair formed several entry signals. Let's have a look at the 5-minute chart to see what happened there. In my morning review, I mentioned the level of 1.2531 as a possible entry point. A rise to this level and its false breakout formed a nice entry point into short positions. Yet, the pair failed to develop a deeper fall. Having declined by 15 pips, the pound recovered from the pressure but stayed under the control of the sellers. In the second half of the day, a similar sell signal emerged and sent the price down by more than 30 pips. Bullish activity at 1.2495 created an entry point for going long which resulted in a 20-pip rise. After that, the pair continued to move downwards.

For long positions on GBP/USD:

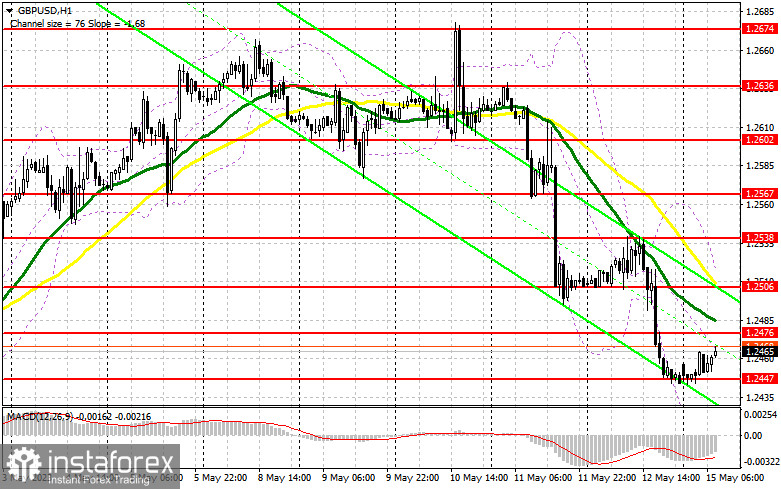

The UK's quarterly GDP growth rate met economists' expectations, while the sharp deceleration in the monthly pace of growth has put more pressure on the pound, triggering another sell-off last Friday. The UK economic calendar for Monday has only one significant event - the statement by the Bank of England's Monetary Policy Committee member, Hugh Pill. So, the bulls may try to develop an upward correction, aiming to win back at least part of Friday's losses. It would be great to see a movement towards the nearest support level of 1.2447 that was formed during the Asian session. However, only a false breakout at this level would provide a buy signal in such a strong bearish market. If so, the price may recover to the level of 1.2476. A breakout and consolidation above this range will be possible amid low selling activity. This will form an additional buy signal, with an upside target at 1.2506 where the moving averages currently play on the side of the bears. The most distant target would be the 1.2538 area where I would recommend taking profit.

If GBP/USD declines to 1.2447 and bulls are idle at this point, the bear market would likely continue. In such a case, I would go long only after a false breakout when the price hits 1.2419. I plan to buy GBP/USD immediately on a rebound from the low of 1.2387, keeping in mind an intraday correction of 30-35 pips.

For short positions on GBP/USD:

The pound sellers still have a chance to retest weekly lows. However, it seems wise not to rush into opening short positions today. I would go short only after a false breakout of the nearest resistance at 1.2476 that was formed last Friday. At this point, the pair should develop a decline fairly quickly. If there is no active sell-off, it would be better to exit short positions. Meanwhile, the bears' target would be the weekly low of 1.2447. A breakout and an upside retest of this range would put more pressure on GBP/USD, forming a sell signal with a drop to 1.2419. The furthest target remains the low of 1.2387 where I would recommend taking profit.

If GBP/USD advances and bears are idle at 1.2476 amid the lack of fundamental background, it would be best to go short only after the test of the 1.2506 level where the moving averages are located. A false breakout of this range would provide an entry point into short positions. If there is no downward movement, I would sell GBP/USD on a rebound directly from the high of 1.2538, anticipating a downward correction of 30-35 pips.

COT report

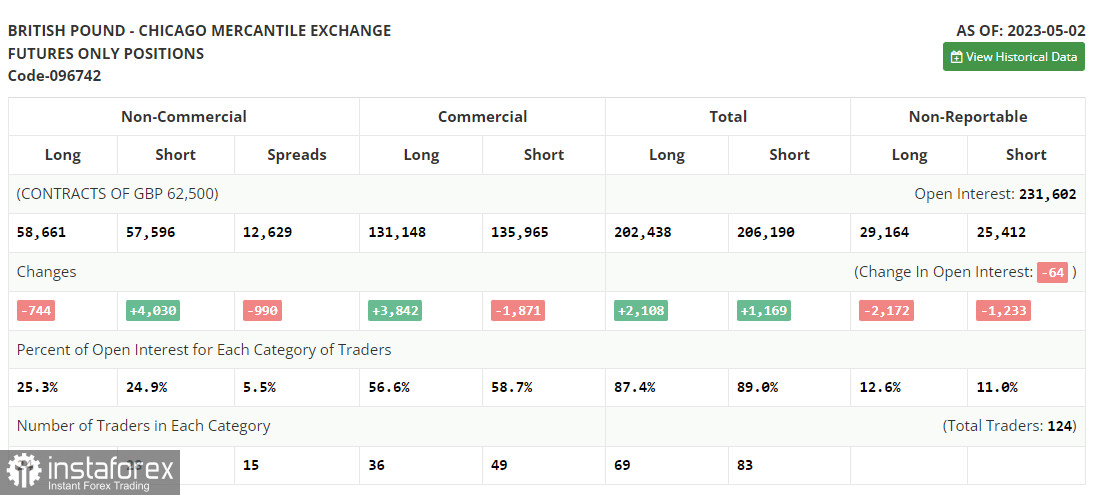

The Commitments of Traders report for May 2 recorded a rise in short positions and a fall in the long ones. Markets are sure that the Bank of England will have to follow suit of other central banks and continue to raise interest rates. The fight against inflation in the UK is far from being over, especially given that the regulator has not reached any impressive results after a year of consecutive rate hikes. The British pound is unlikely to advance on a 25-basis-point rate increase as this scenario has already been priced in by the market. So, we shouldn't be surprised to see even a deeper correction this week. According to the latest COT report, short positions of the non-commercial group of traders went up by 4,030 to 57,596, while long positions declined by 744 to 58,661. As a result, the non-commercial net position decreased to 1,065 against 5,839 from a week ago. This is the first decline in six weeks so it can be viewed as a common correction. The weekly closing price advanced to 1.2481 from 1.2421.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a further decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, the lower band of the indicator at 1.2419 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.