EUR/USD had been declining for the past week as risk appetite decreased due to growing expectations that the ECB will keep interest rates high for a much longer time. A recent survey showed that market players expect rates to decrease only in the second quarter of 2024, much later than the previous forecast. This means that interest rates will remain at 3.75% for at least nine months.

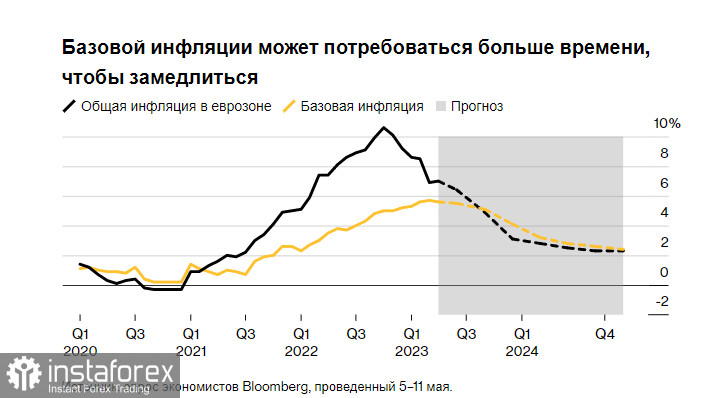

Such a scenario is supported by the fact that core inflation, which excludes volatile categories and is currently the preferred indicator of ECB officials, is likely to decrease slowly, remaining at 2.4% in the fourth quarter of next year. This is significantly higher than the bank's target figure of 2%.

Many politicians have expressed concern over the sustainable nature of core inflation. Earlier, the ECB raised the deposit rate by 25 basis points to 3.25%, promising to continue pushing up borrowing costs until a sufficiently restrictive level is reached. After that, the bank plans to keep rates at the peak as long as necessary. Latvian Central Bank president Martins Kazaks said in an interview that the expected quarter-point increase in June and July may not be enough to curb inflation. Bundesbank President Joachim Nagel said the same thing, stating that the ECB may have to continue tightening policy "after the summer holidays". Isabel Schnabel also commented that rates should continue to rise until there are signs that core inflation will decrease.

Today, the European Commission will publish economic forecasts for the eurozone, and a further gradual recovery of GDP is expected, with growth rates gradually increasing to 0.4% in the latter half of next year. Negative forecasts and downwardly revised expectations will lead to a momentary drop in risk assets, which players can take advantage of, aiming to find the lows of the downward trend.

In terms of the forex market, euro is bearish, but seeing growth is not impossible. For this, the quote has to reach 1.0880, or at least stay above 1.0850. This will allow a rise beyond 1.0910, heading towards 1.0940. In case of a decline around 1.0850, euro will fall to 1.0800 and 1.0770.

In GBP/USD, bulls are trying to recover losses, but to see growth, the quote has to consolidate above 1.2475. Only that will trigger a much larger rise to 1.2500 and 1.2540. In case there is a decline, bears will attempt to take 1.2450, which could lead to a fall to 1.2390 and 1.2350.