The latest weekly gold survey shows that retail investors remain optimistic. At the same time, the opinions of Wall Street analysts are evenly divided: many suggest that traders should differentiate between short-term volatility and the broader trend.

According to Ole Hansen, head of commodity strategy at Saxo Bank, gold has strong fundamental support, so he is personally inclined to be patient. However, as investors react to the covering of short positions in the U.S. dollar, speculative volatility caused by positioning is likely to lead to a price drop this week. As long as gold is trading above $1,950, the precious metal remains in an upward trend.

Sean Lusk, co-director of commercial hedging at Walsh Trading, is also monitoring the $1,950 level. Despite this, he is bearish for the coming week. Nevertheless, in the long term, he believes in rising prices since the overall economic uncertainty provides solid support to the precious metal.

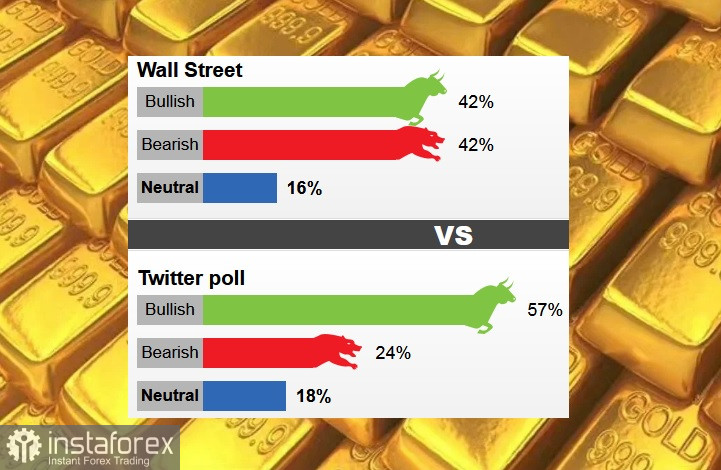

19 Wall Street analysts participated in the gold survey. With equal voting, both bearish and bullish positions garnered eight votes each, representing 42% each. Additionally, 16%, or three analysts, remained neutral.

In online polls, a total of 665 votes were cast. Of these, 382 respondents, or 57%, expect gold prices to rise. Another 162, or 24%, believe it will fall, and 121 voters, or 18%, remained neutral.

Interest in safe-haven assets is increasing as recession fears continue to grow. The Federal Reserve's monetary policy, which influences the U.S. dollar, remains a driving force.

Some analysts believe that gold will face challenges as the Fed has indicated that it is not prepared to lower rates due to persistent inflation.