Volatility in AUD quotes may significantly increase tomorrow: at 02:00 (GMT), China's National Bureau of Statistics will publish another monthly report with data on retail sales levels and industrial production volumes in the country, and at 01:30 (GMT), the minutes of the RBA's May meeting will be published. Dovish rhetoric from bank leaders regarding inflation, in particular, will put downward pressure on the AUD, while hawkish rhetoric will put upward pressure.

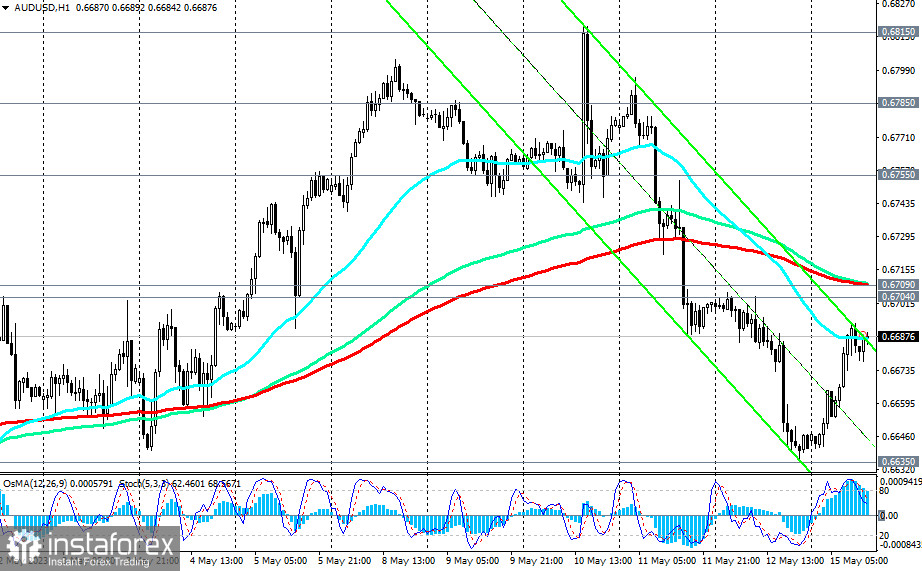

Buyers of the Australian dollar reacted positively to the outcome of the RBA's May meeting, which led to a sharp strengthening of the AUD. Meanwhile, the AUD/USD pair resumed its upward dynamics at the beginning of this month and was able to test for a breakout of the key resistance level at 0.6785 (200 EMA on the daily chart), updating the 3-month high at the 0.6815 mark (which also represents a strong resistance level of 50 EMA on the weekly chart).

However, the decline on Thursday and Friday almost completely negated the AUD/USD's growth achievements since the beginning of this month.

As of writing, AUD/USD was trading near the 0.6688 mark, trying to break through the short-term resistance level (200 EMA on the 15-minute chart). In case of further growth, breaking through resistance levels at 0.6704 (200 EMA on the 4-hour chart) and 0.6709 (200 EMA on the 1-hour chart) will signal the resumption of long positions in AUD/USD.

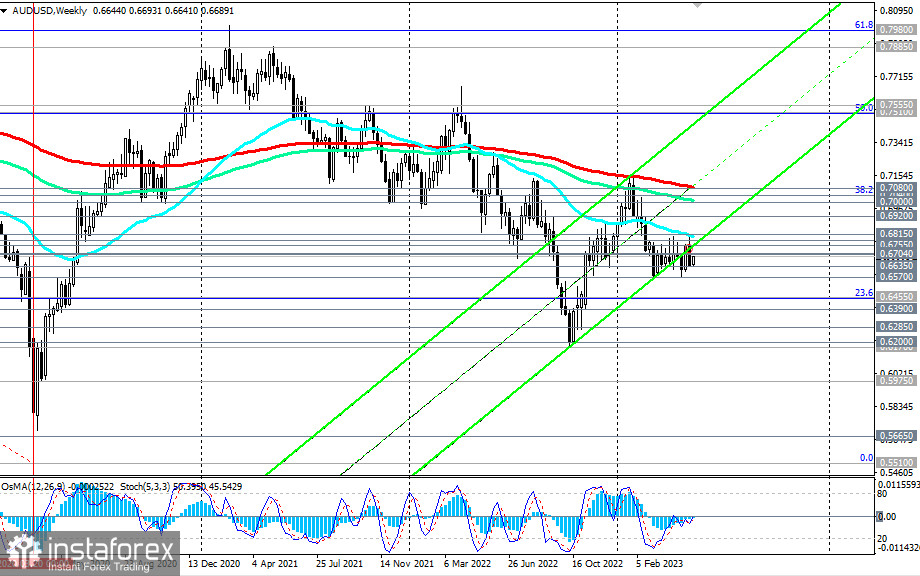

A confirmed breakout of the 0.6815 resistance level may trigger further growth of the AUD/USD towards resistance levels at 0.7000 (144 EMA on the weekly chart), 0.7040 (38.2% Fibonacci retracement level of the decline wave from 0.9500 in July 2014 to multi-year lows and the 0.5500 level reached in March 2020). A breakout of the 0.7100 level (200 EMA on the weekly chart) will put the pair into the long-term bull market zone.

Support levels: 0.6635, 0.6600, 0.6570, 0.6500, 0.6455, 0.6390, 0.6285, 0.6200, 0.6170

Resistance levels: 0.6688, 0.6704, 0.6709, 0.6755, 0.6785, 0.6800, 0.6815, 0.6900, 0.6920, 0.7000, 0.7040, 0.7080, 0.7100