Throughout the past week and not just that, but since the last European Central Bank meeting, there have been several speeches made by members of the monetary policy committee. Unlike the Federal Reserve representatives, officials from the ECB were much more eloquent. In particular, Peter Kazimir stated that the interest rate may grow longer than previously assumed, as inflation remains very high. Some other committee members also believe that the rate should continue to rise as long as possible. However, I believe there is a fundamental difference between the comments of officials from the Fed and the ECB.

The Fed is a central bank that is not controlled by the US government. Or better to say, an organization that fulfills the duties of a central bank. The US is a single whole, one country. The ECB is a combination of 27 central banks, 27 countries. The interests of each country and central bank need to be taken into account. Some countries are more resilient to shocks, crises, some are less so. Some countries are rich, some are poor. Obviously, countries like Germany or France can afford high ECB rates. Countries like Poland and Romania cannot. Therefore, if we assume that the maximum permissible rate for Germany is 6%, and for Romania - 3-4%, then the ECB needs to bring out some average value to satisfy everyone. That is why the ECB does not have the potential for a significant rate hike.

And that is why the opinions of ECB members who head the largest central banks in the eurozone cannot be considered final. For example, Luis de Guindos, who serves as Vice President of the ECB, said on Saturday that "they are in the final stages of the tightening process." De Guindos noted that the bank had started to return to normal conditions, hence it reduced the step to 25 basis points. "An economic slowdown and a rise in rates will lead to an increase in the cost of bank financing and an increase in the number of problem loans," he said. Much was said during the interview, but the phrase about the final stage is most interesting. In other words, the second person in the ECB believes that the rate should rise one or two more times. And his opinion is more valuable than the opinion of Peter Kazimir or Francois de Galo.

Based on all of the above, I believe that the ECB may stop at 4%, and the market will no longer have serious reasons to increase demand for the euro. The FOMC has also likely finished tightening, but at least a downward corrective wave should be built for both instruments according to wave analysis. However, a strong news background is needed for a new rise in the euro and pound.

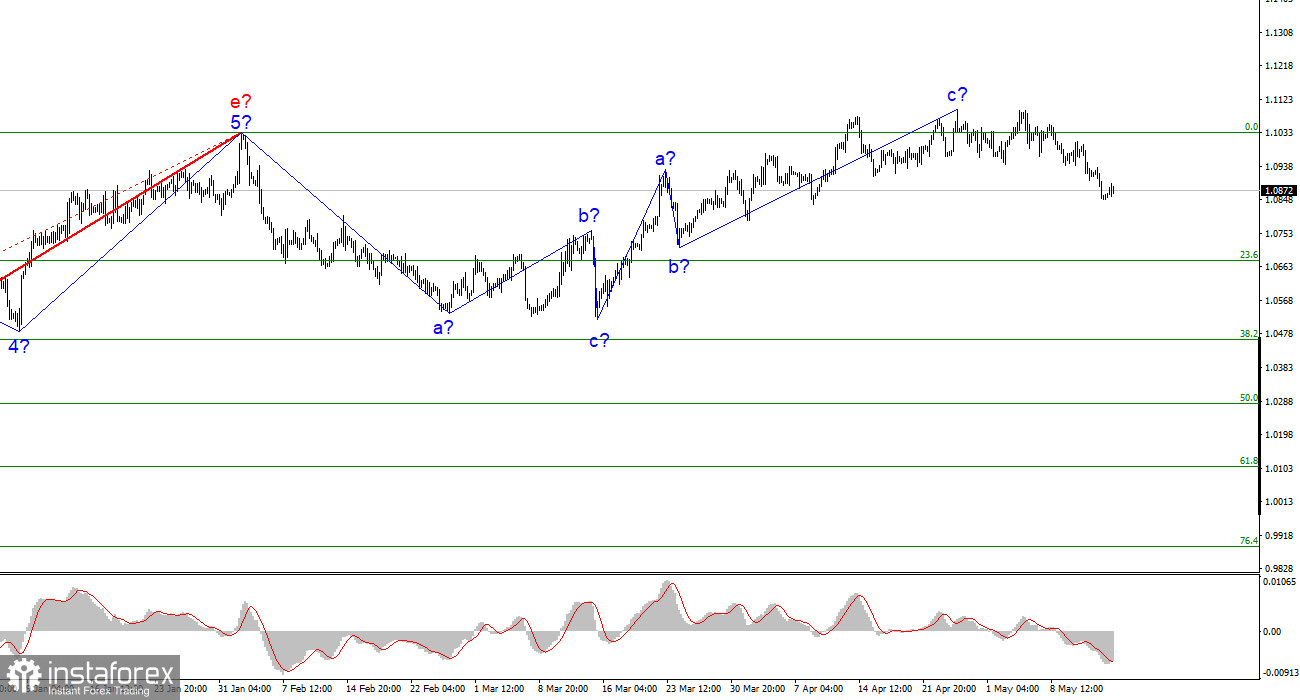

Based on the analysis conducted, I conclude that the construction of an upward section of the trend is completed. Therefore, you can now consider short positions, and the instrument has quite a large space for decline. I think that targets in the area of 1.0500-1.0600 can be considered quite realistic. With these targets, I advise selling the instrument on downward MACD reversals as long as the instrument is below the 1.1030 mark, which corresponds to 0.0% Fibonacci.

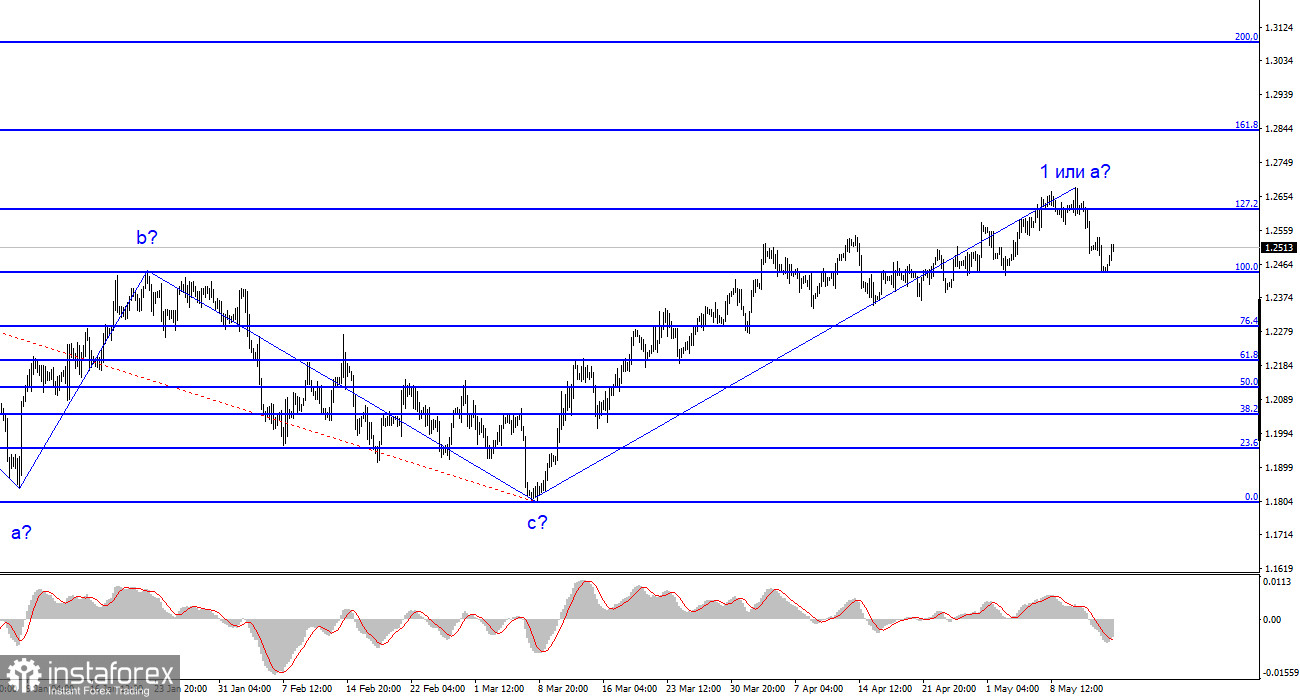

The wave pattern of the GBP/USD pair has long suggested the construction of a new descending wave. The wave marking is not entirely unambiguous right now, as is the news background. I do not see factors that would support the pound in the long term, and wave b could turn out to be very deep, but we're not entirely sure that it has begun. I believe that the pair is more likely to fall, but the first wave of the upward section may become even more complicated. A failed attempt to break through the 1.2615 mark, which corresponds to 127.2% Fibonacci, indicates the market's readiness for short positions, but failure to break through 100.0% Fibonacci also took place.