Dollar is obviously overbought, so it is not a surprise that it declined on Monday as soon as the Asian session started. However, the correction stopped when the Euro area reported that the 2.0% growth in its industrial sector was replaced by a 1.4% decline. The forecast was only a slowdown to 1.1%.

Industrial production (Europe):

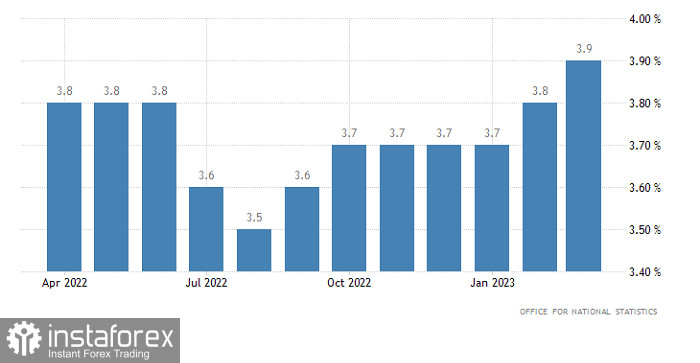

The situation with the overbought dollar was aggravated by the labor market data published this morning in the UK. According to the report, the unemployment rate rose from 3.8% to 3.9%. Pound immediately went down, while euro stopped rising.

Unemployment rate (UK):

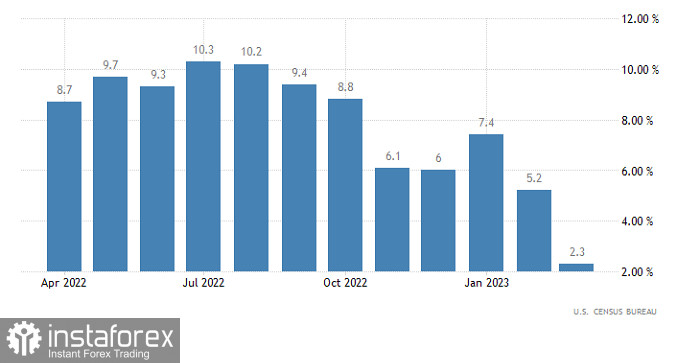

Most likely, the market will remain still during the European trading session, especially since the second estimate for the eurozone's 1st quarter GDP is coming. US statistics could be a reason for dollar to weaken, but that will happen only if retail sales growth slows from 2.9% to 1.4%. Industrial production growth decreasing from 0.5% to 0.3% will be a sign that the US is approaching recession.

Retail sales (US):

EUR/USD slowing around 1.0850 triggered a rebound, but did not lead to significant changes. The market is still bearish, so a correction could still happen. However, everything will change if the pair returns above the level of 1.0900.

A similar scenario is seen in GBP/USD. The level of 1.2450 serves as a support on the way of a correction, in relation to which there was a reversal. To see growth, the pair has to stay above the level of 1.2250. Until then, the risk of further decline persists.