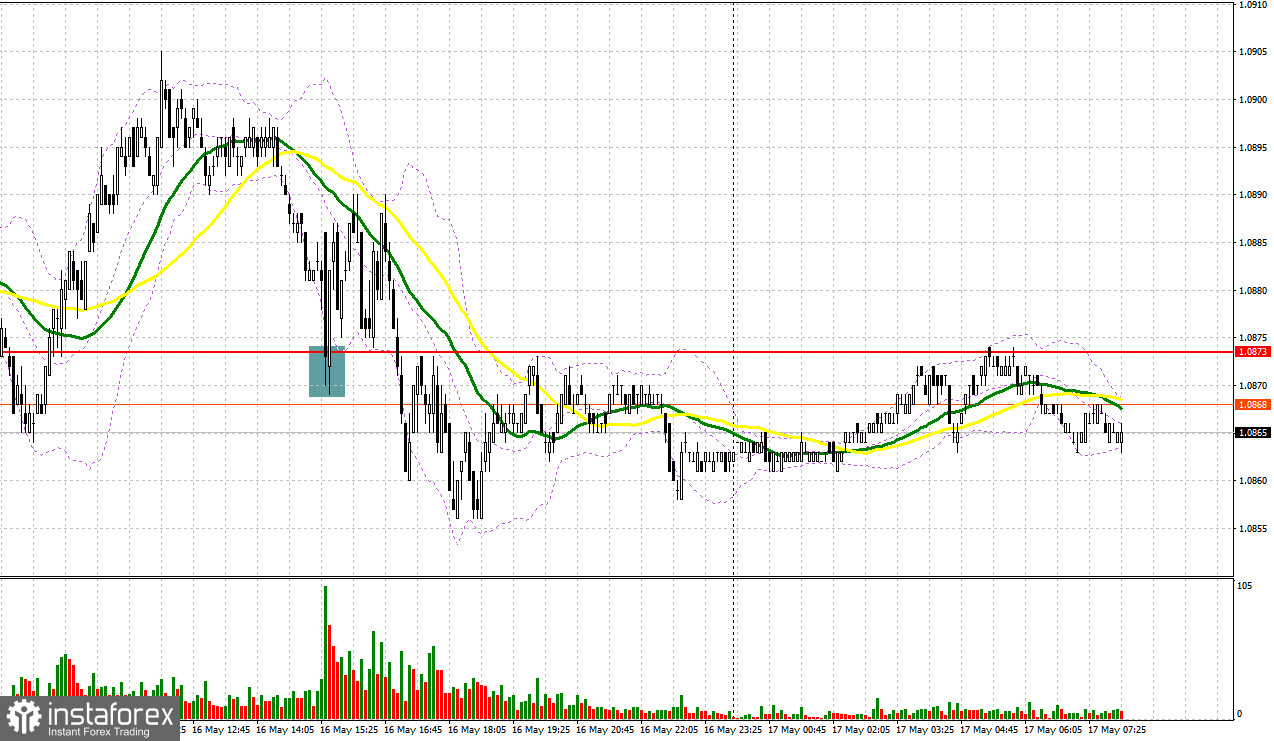

Yesterday, there was only one entry point. Now, let's look at the 5-minute chart and figure out what actually happened. In my morning article, I turned your attention to 1.0890 and recommended making decisions with this level in focus. A rise and a false breakout of this level in the morning led to an excellent sell signal. However, a downward movement did not happen. Trading was carried out around this level. Therefore, I decided to close short positions and revise the technical outlook. In the second half of the day, a false breakout of 1.0873 did not give entry points due to the distance between the entry point and Stop Loss.

When to open long positions on EUR/USD:

Today is going to be a busy day since morning. The Euro Area Consumer Price Index is due. The indicator is expected to grow. The Core CPE is projected to decline. Given that the indicators may be mixed, a significant rise looks unlikely. Speeches by ECB Executive Board members Frank Elderson and Fabio Planeta may cause a surge in volatility which could be bearish for the European currency.

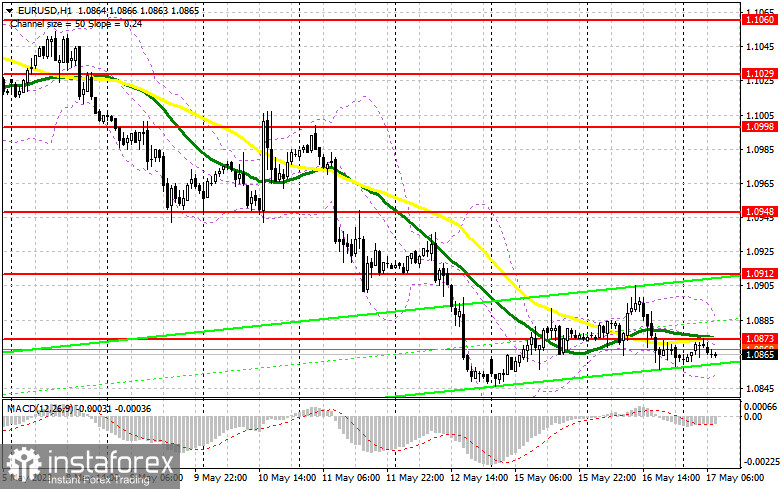

For this reason, it would be wise to avoid long positions. In my opinion, it is better to buy on correction from the new weekly low of 1.0833. It will indicate the presence of large traders in the market who are willing to push the euro up in the middle of the week. A false breakout there will give entry points into long positions. The pair could grow to the resistance level of 1.0873 where the moving averages are benefiting the bears. Only a breakout and a downward retest of this range after the ECB policymakers' speech will boost demand for the euro and generate an additional entry point for building into long positions. The pair may climb to a high of 1.0912. A more distant target will be the 1.0948 level where I recommend locking in profits.

If EUR/USD declines and bulls show no activity at 1.0833, which is quite likely in such a bear market, a bearish trend will persist. Therefore, only a false breakout of the support level of 1.0790 could give new entry points into long positions. You could buy EUR/USD at a bounce from 1.0748, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Bears continue to control the market, especially after yesterday's positive US retail sales data. However, the downward movement cannot last forever. This is why traders should be very careful when opening new positions at weekly lows. If the bears protect the nearest resistance level of 1.0873, where the moving averages are passing, it will lead to a sell signal. A false breakout of this level could give a sell signal that can push the pair to 1.0833. A decrease below this level as well as an upward retest could cause a fall to 1.0790. A more distant target will be the 1.0748 level where I recommend locking in profits.

If EUR/USD climbs during the European session and bears show no energy at 1.0873, which may occur if inflation in the eurozone grows, bulls will try to return to the market. In this case, I would advise you to postpone short positions until a false breakout of 1.0912. You could sell EUR/USD at a bounce from 1.0948, keeping in mind a downward intraday correction of 30-35 pips.

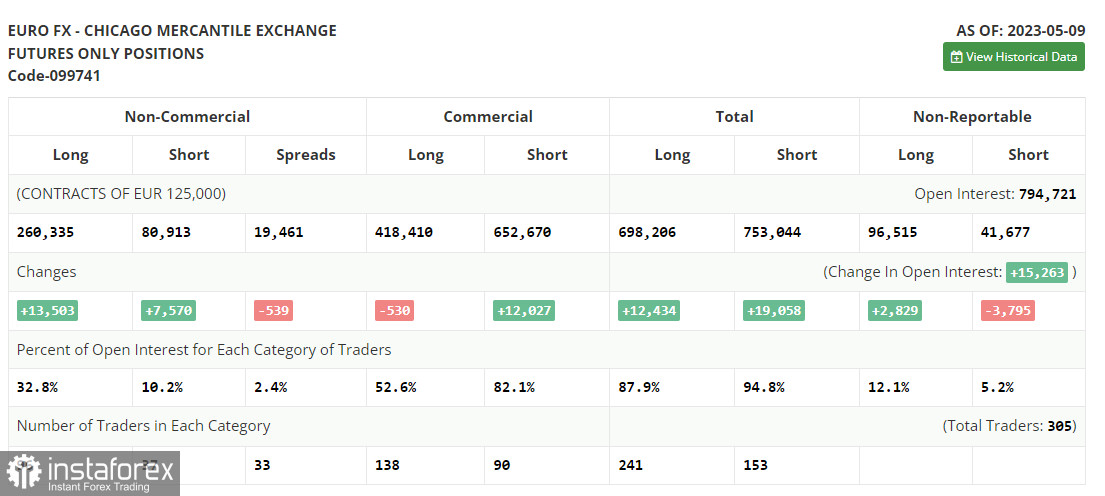

COT report

According to the COT report (Commitment of Traders) for May 9, there was a rise in long and short positions. This report takes into account the changes that have taken place in the market after the Fed and ECB meetings. The majority of traders are increasing long positions on the euro. A new downward correction which already occurred last week will provide a buy signal. The euro needs new strong drivers to start a correction. Given that there are no important reports this week and only a few speeches from Fed officials, the pressure on the pair may continue. The COT report indicates that long non-commercial positions jumped by 13,503 to 260,335, while short non-commercial positions advanced by 7,570 to 80,913. At the end of the week, the total non-commercial net position increased to 179,422 against 173,489 a week earlier. The weekly closing price declined to 1.0992 against 1.1031.

Indicators' signals:

Trading is carried out below the 30 and 50 daily moving averages, which indicates a further drop.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border at 1.0850 will serve as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.