If gold is insurance against inflation, why didn't it shine in 2022 when prices were sky-high? Why did it soar to the area of record highs in 2023 when inflation began to slow down? If precious metals are the best investment option during a default, why does it fall as it approaches date X? The dynamics of XAU/USD is the best evidence of how erroneous people's ideas about gold are. Or maybe we just don't know everything.

The recession could be as severe as the Great Recession. 8 million Americans would lose their jobs. Stock market capitalization would plummet 45%. This is the apocalyptic scenario Treasury Secretary Janet Yellen paints in the event of a default. It is not surprising that global investors surveyed by MLIV Pulse consider gold the best asset when it occurs. RBC Capital Markets calls the precious metal the best tool for hedging against defaults on U.S. debts. So far, this point of view looks like an obvious mistake.

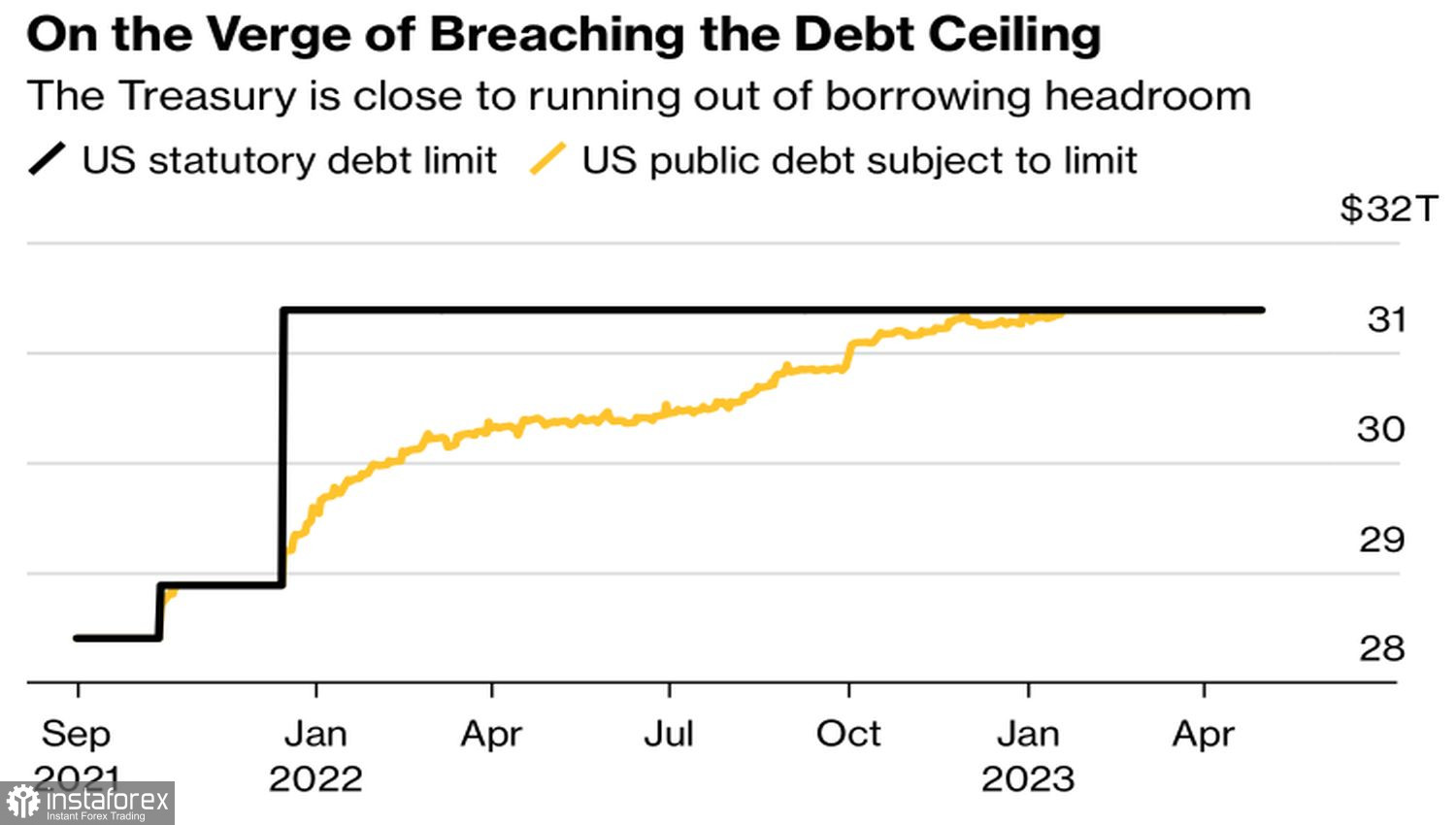

Dynamics of public debt and its ceiling in the USA

In fact, we need to understand clearly that there is no default yet. And the same participants in the MLIV Pulse survey believe that the likelihood of its occurrence is extremely low. Simply because all previous episodes ended with a happy ending. Even in 2011, when date X was missed and the U.S. credit rating was lowered, Democrats and Republicans agreed within a few hours. This calmed the financial markets.

Moreover, what Yellen announced on June 1 may not be date X. The Treasury Secretary herself admitted that the deadline could arrive a little later. If the government makes it to the middle of the first month of summer, when new taxes start coming in, the critical date may shift to July–August.

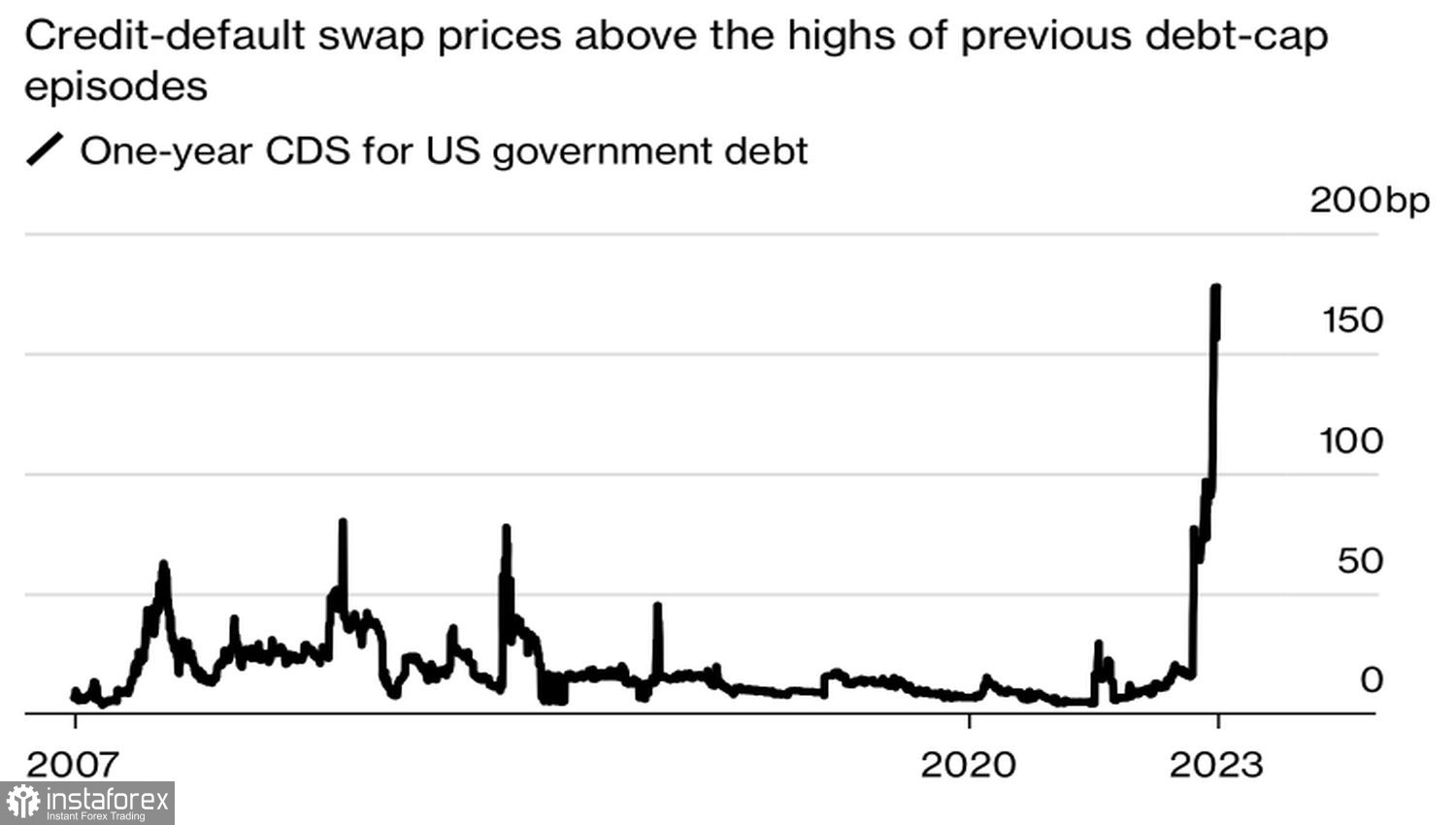

Dynamics of the cost of insurance against default in the USA

Thus, despite the political spectacle being played out, markets are not overly worried about the deadlock with the debt ceiling. The fall of XAU/USD is driven by other factors. The rise of precious metals to record highs was due to fears of an approaching recession and hopes for a dovish pivot by the Fed. Neither materialized.

A strong job market, consistently high inflation, and growing retail sales suggest that the U.S. economy is still standing strong. FOMC officials and investors are increasingly talking about a soft landing. This is fundamentally different from a recession. If there is no downturn, why buy gold? Especially as the chances of a federal funds rate cut in 2023 are fading in front of our eyes. Derivatives give a 52% probability of monetary expansion in September. Before the April employment data came out, it was 90%. It becomes clear why XAU/USD quotes are falling.

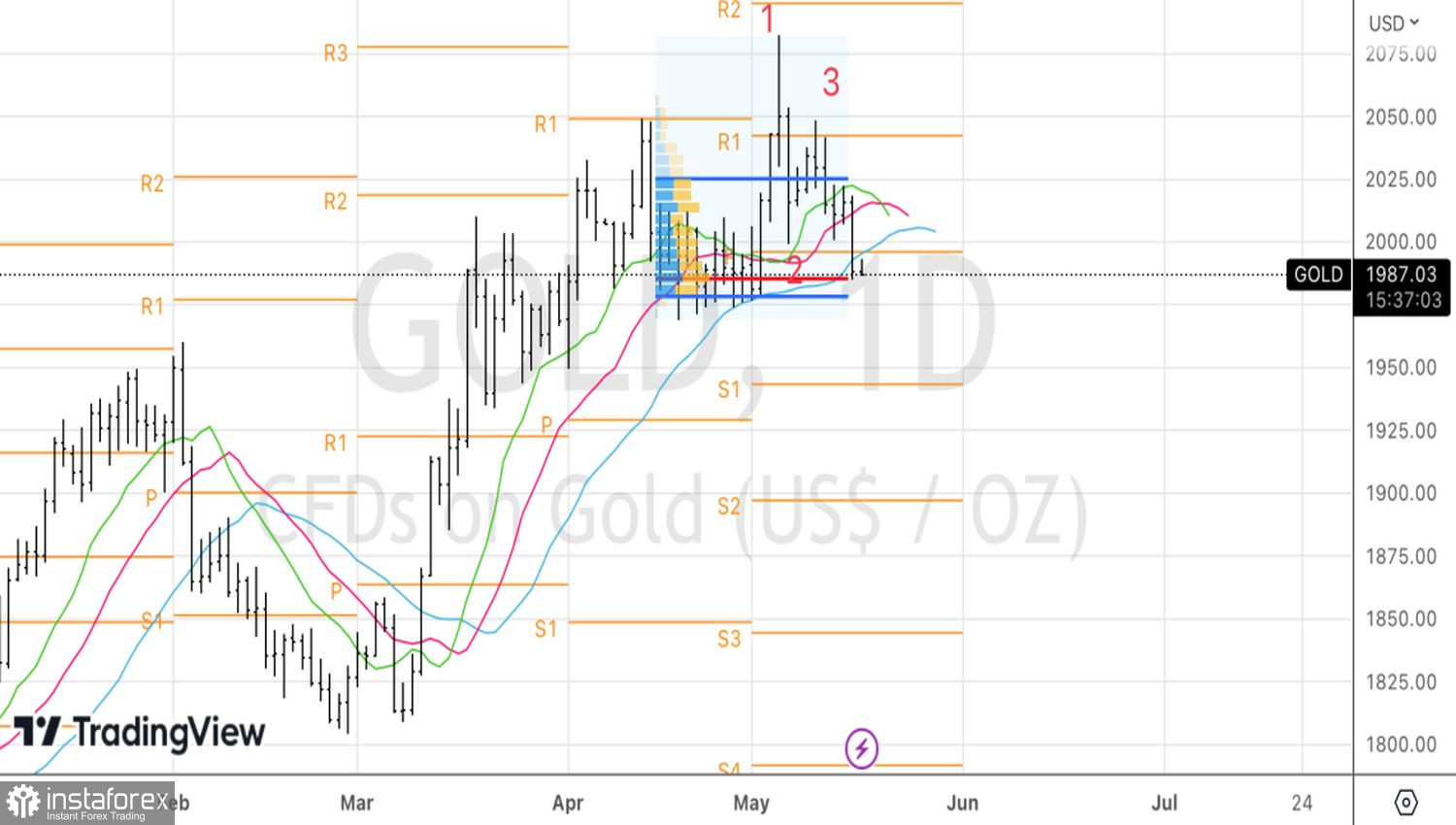

Technically, on the daily chart of gold, the 1-2-3 pattern worked out clearly. This allowed us to enter shorts from the level of $2,013 per ounce. I recommend holding them and building on pullbacks. The initial target is the $1,950 mark.