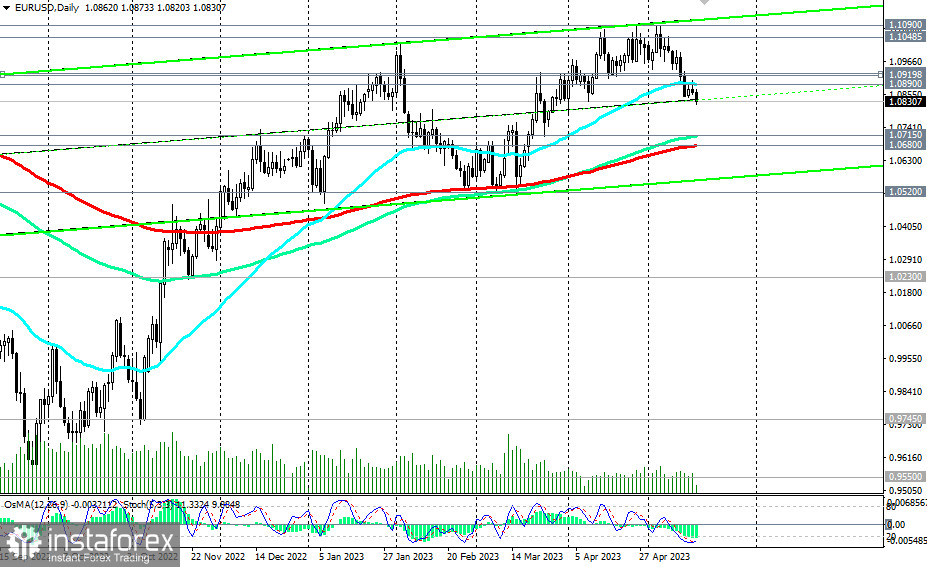

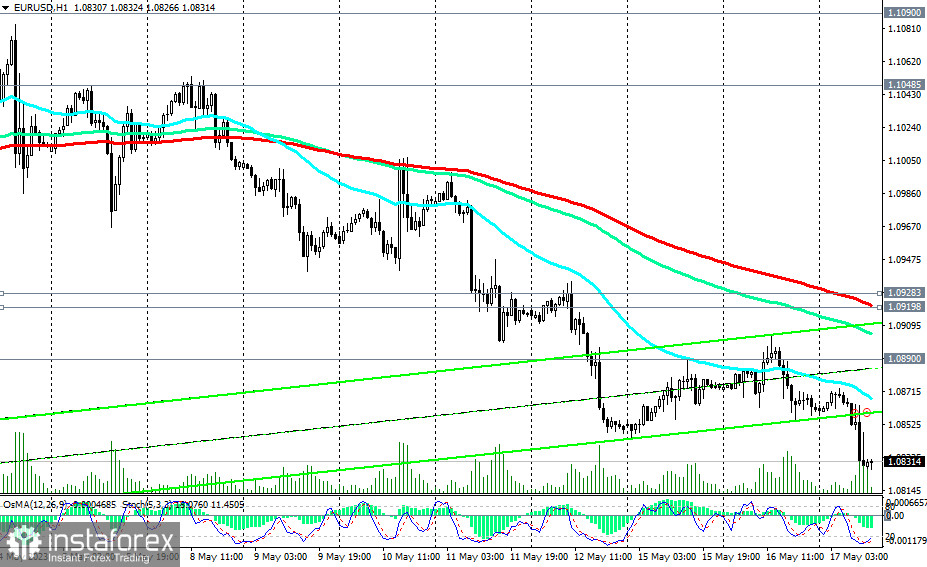

As of writing, EUR/USD was trading close to the 1.0830 mark, having broken through the support at 1.0890 (50 EMA on the daily chart) the day before. From a technical standpoint, nothing is stopping the pair from falling into the key support levels zone at 1.0715 (144 EMA on the daily chart), 1.0680 (200 EMA on the daily chart).

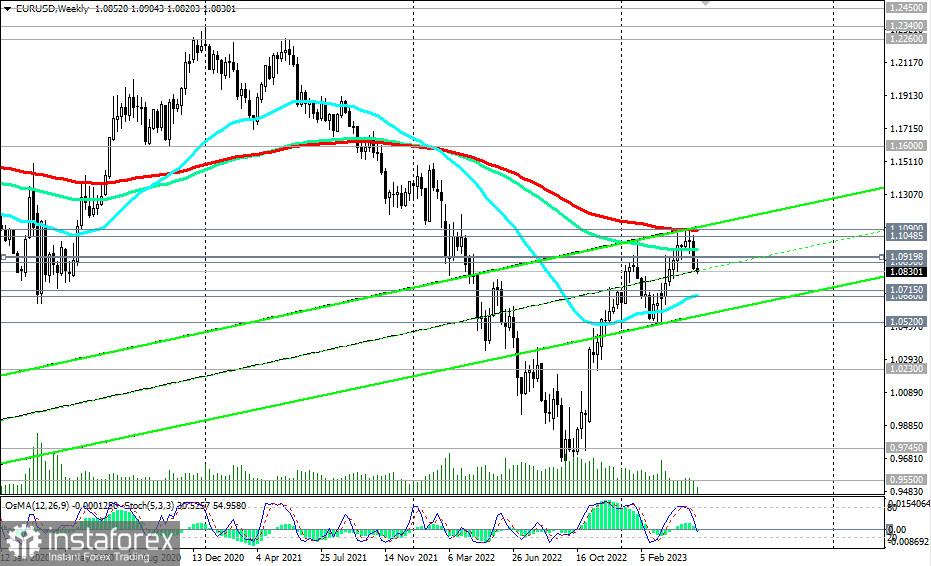

The space for downward movement is open, and the technical indicators OsMA and Stochastic on the daily and weekly charts are on the sellers' side.

Breaking through today's low at 1.0820 may prompt the pair to continue its decline.

At the same time, in the current situation, one should not be complacent: the downward dynamics of EUR/USD can very quickly turn in the opposite direction. But for now, purchases are possible only with tight stops, or when breaking into the zone above the level of 1.0890. A more convincing signal will be a breakthrough of important short-term resistance levels at 1.0920 (200 EMA on the 1-hour chart), 1.0928 (200 EMA on the 4-hour chart).

If the pair consolidates in this zone, the target for its growth becomes the resistance level of 1.1090 (the upper border of the upward channel and 200 EMA on the weekly chart).

However, for a definitive breakthrough into the long-term bull market zone, the pair needs a confirmed breakthrough of this mark.

In the event that this scenario unfolds successfully for the pair, the target for growth becomes the resistance level of 1.1600 (200 EMA, 144 EMA on the monthly chart), which separates the global bullish trend from the bearish one.

Support levels: 1.0800, 1.0715, 1.0680, 1.0600, 1.0520

Resistance levels: 1.0890, 1.0920, 1.0928, 1.1000, 1.1050, 1.1090, 1.1125, 1.1200, 1.1300, 1.1400, 1.1500, 1.1600