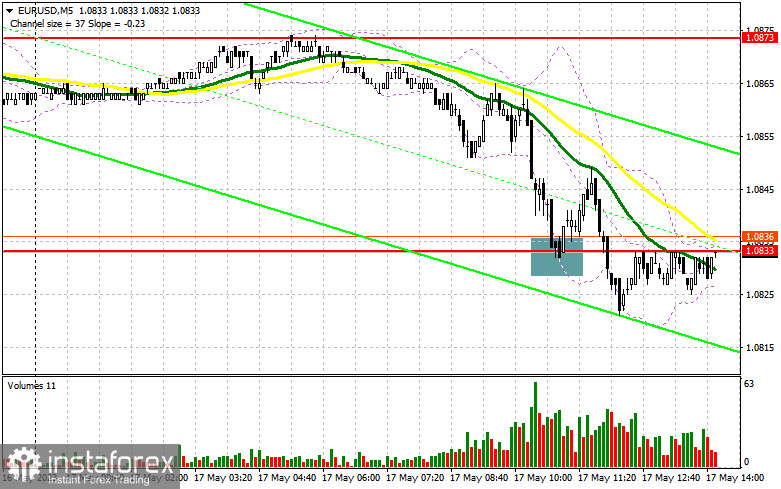

In my morning article, I turned your attention to 1.0833 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. A decline and a false breakout of this level in the morning led to an excellent buy signal. However, an upward movement did not take place. In the afternoon, the technical outlook was slightly revised.

When to open long positions on EUR/USD:

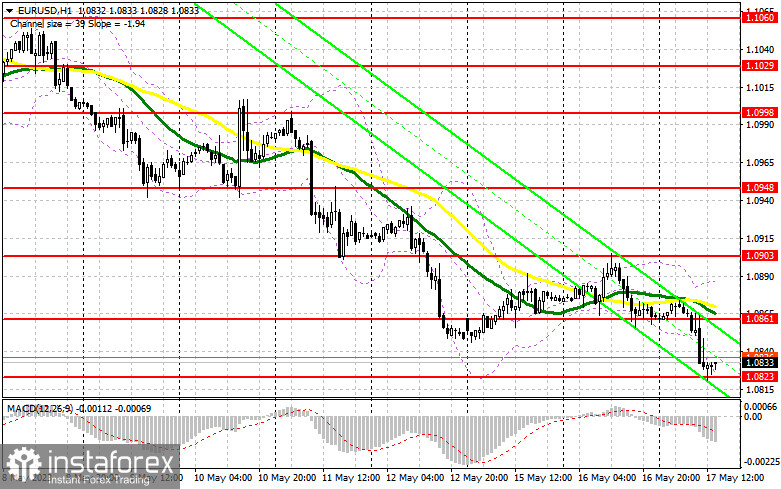

The inflation report in the eurozone was in line with economists' expectations, which led to a further decline in the euro against the US dollar. In the afternoon, the US will release data on building permits and housing starts. If these indicators exceed forecasts, showing the stability of the real estate market despite high interest rates, a further fall of the pair looks likely.

For this reason, it is better to go long after a false breakout of a new weekly low of 1.0823, formed in the morning.

A drop in housing starts could lead to an increase in EUR/USD and a return to the resistance level of 1.0861. Only a breakout and a downward retest of this level after the Fed officials' speeches may stimulate demand for the euro and give a new entry point into long positions. The pair could rise to 1.0903. A more distant target will be the 1.0948 level where I recommend locking in profits.

If EUR/USD falls and bulls show no activity at 1.0823 in the afternoon, which is likely, the bearish trend will persist. Therefore, only a false breakout of the support level of 1.0790 will provide new entry points into long positions. You could buy EUR/USD at a bounce from 1.0748, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Bears continue to control the market. In the case of an upward correction after the US macro stats, bears need to defend the resistance level of 1.0861. A false breakout of this level could generate a sell signal that may push the pair down to 1.0823. Consolidation below this level as well as an upward retest may trigger a decline to a new monthly low of 1.0790. A more distant target will be the 1.0748 level where I recommend locking profits.

If EUR/USD rises during the US session and bears show no energy at 1.0861, bulls may regain the upper hand. In this case, I would advise you to postpone short positions until a false breakout of 1.0903. You could sell EUR/USD at a bounce from 1.0903, keeping in mind a downward intraday correction of 30-35 pips.

COT report

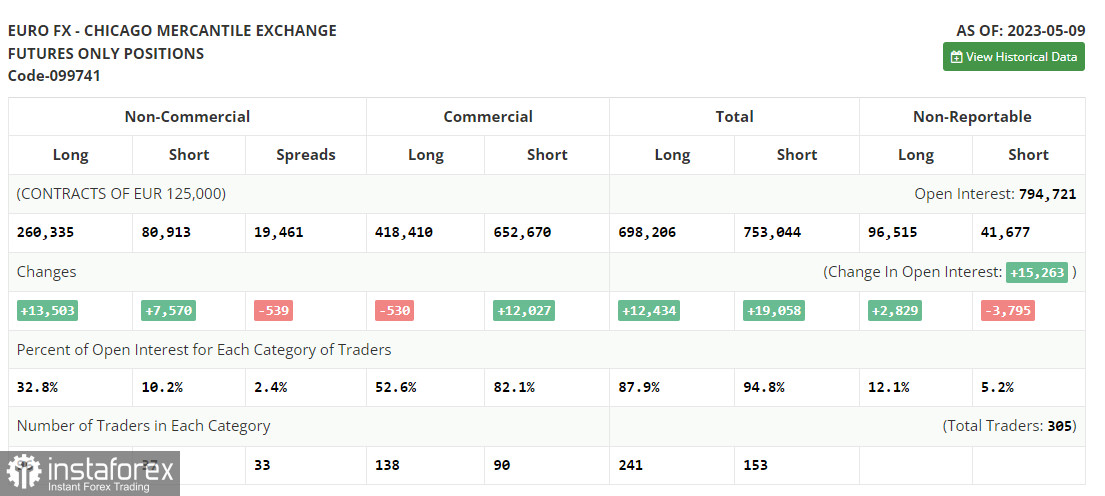

According to the COT report (Commitment of Traders) for May 9, there was a rise in long and short positions. This report takes into account the changes that have taken place in the market after the Fed and ECB meetings. The majority of traders are increasing long positions on the euro. A new downward correction which already occurred last week will provide a buy signal. The euro needs new strong drivers to start a correction. Given that there are no important reports this week and only a few speeches from Fed officials, the pressure on the pair may continue. The COT report indicates that long non-commercial positions jumped by 13,503 to 260,335, while short non-commercial positions advanced by 7,570 to 80,913. At the end of the week, the total non-commercial net position increased to 179,422 against 173,489 a week earlier. The weekly closing price declined to 1.0992 against 1.1031.

Indicators' signals:

Trading is carried out below the 30 and 50 daily moving averages, which indicates the continuation of the bear market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD rises, the indicator's upper border at 1.0885 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.