Both instruments extend a rather weak decline. For the euro, it's more convincing and gives every reason to assume that a new downtrend section is beginning. For the pound, it's less convincing, suggesting the first wave is incomplete. However, the euro and the pound rarely move in different directions, so the current situation should be resolved: either the pound will start to fall faster, or the euro will stop falling altogether. I believe that at least corrective waves should be built, so I'm waiting for both instruments to fall.

On Wednesday, Bank of England Governor Andrew Bailey spoke at the annual event in the UK Chamber of Commerce. I will go through several of the most important theses in detail. The first thing Bailey noted was too high inflation. He stated that it must be returned to 2% at all costs, but this could take a very long time, as its current level is above 10%. The British economy continues to struggle to recover from the pandemic, monthly GDP figures cannot rise to pre-pandemic levels. Bailey noted that the central bank is aware of the problems that people and organizations are facing with the high rates, but high inflation is an even bigger problem, as it hits the least protected sections of the population first.

According to Bailey, inflation is high not because past monetary policy was too soft. The pandemic, Brexit, and the military conflict in Ukraine with all their consequences have become the main reasons for inflation growth worldwide. Central banks were forced to save the economy by applying monetary easing and stimulation, which drove inflation to record values. However, the BoE is now doing everything possible to bring inflation back to pre-COVID levels as quickly as possible. "We do, however, have good reasons to expect inflation to fall sharply over the coming months, beginning with the April number," Bailey stated.

The labor market, according to Bailey, remains "tight," which is driving up wages, and they, in turn, are preventing inflation from falling faster. I remind you that the problem with a shortage of personnel in the UK arose after Brexit when many labor migrants who performed various rough jobs that Brits did not want to undertake left the country. The deficit of many professions persists to this day.

I believe that now the rate of inflation is no longer that important for the pound. No matter how fast and hard it falls, the BoE has already raised rates to the maximum. On the contrary, a sharp decline in inflation will reassure the central bank that a pause would be the right thing to do, so that the full impact of high rates on inflation can be seen. However, a weak decrease in the consumer price index is unlikely to lead to a strong increase in the rate from the current 4.5%.

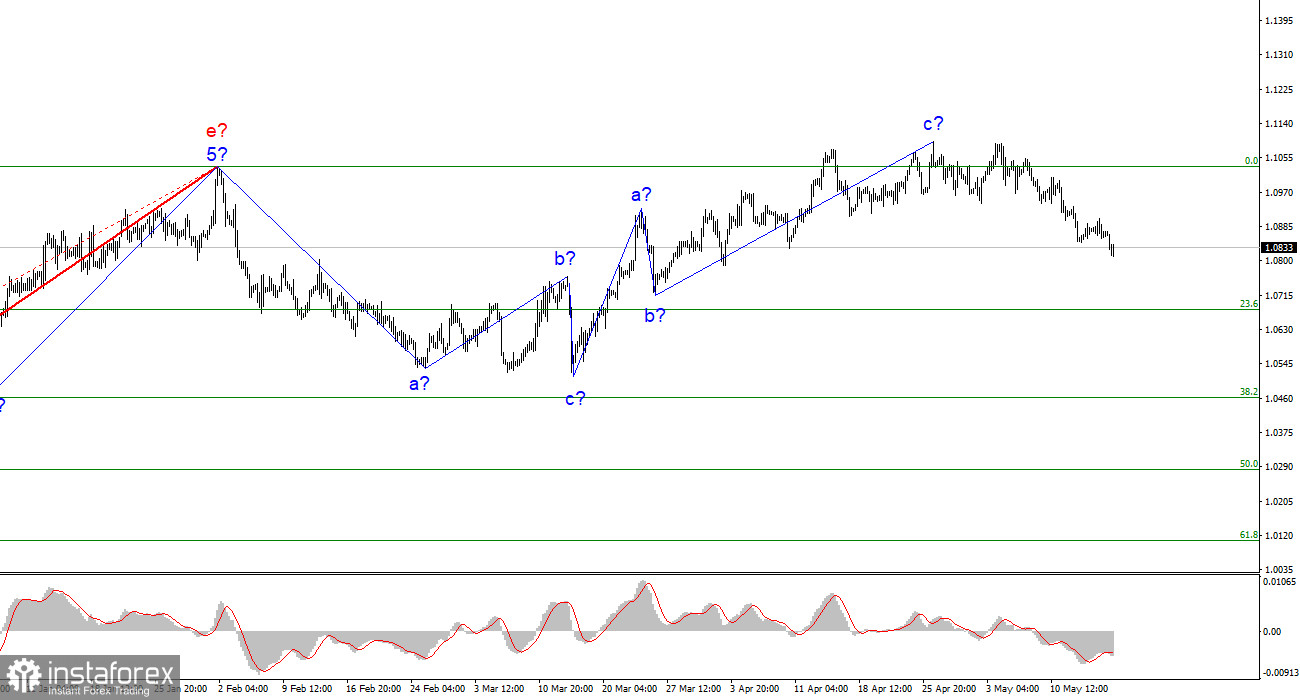

Based on the analysis conducted, I conclude that the construction of an uptrend section is completed. Therefore, you can now consider short positions, and the instrument has quite a large space for decline. I think that targets in the area of 1.0500-1.0600 can be considered quite realistic. With these goals, I advise selling the instrument on downward reversals of the MACD indicator as long as the instrument is below the 1.1030 mark, which corresponds to 0.0% by Fibonacci.

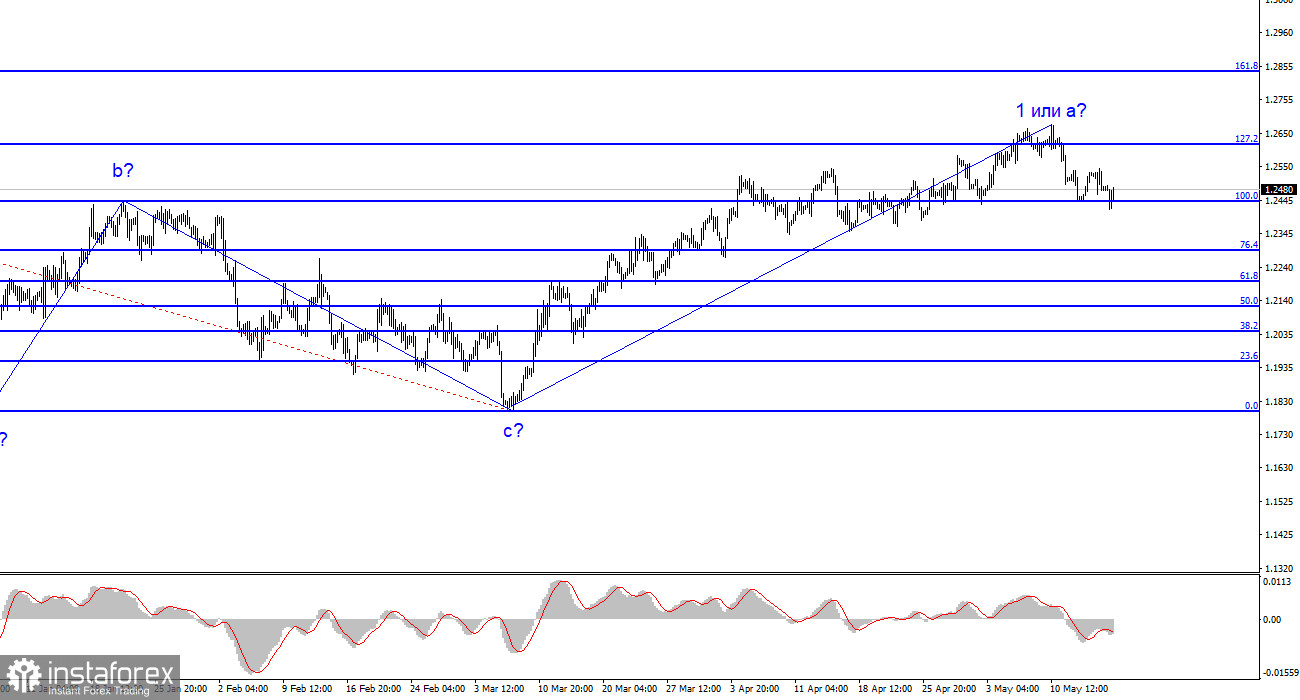

The wave pattern of the GBP/USD pair has assumed the construction of a new downward wave. I don't see factors that would support the pound in the long term, and wave b can turn out to be very deep, but so far we're not entirely sure that it has started. I believe that it is more likely for the pair to fall right now, but the first wave of the upward section may become even more complicated. An unsuccessful attempt to break through the 1.2615 mark, which corresponds to 127.2% by Fibonacci, indicates the market's readiness to sell, but there was also an unsuccessful attempt to break through the 1.2445 mark, which is equated to 100.0% by Fibonacci.