Gold has been declining since May 4.

But looking at the percentage decrease in the metal and the percentage increase in dollar, it is clear that demand for dollar greatly affects gold's dynamics.

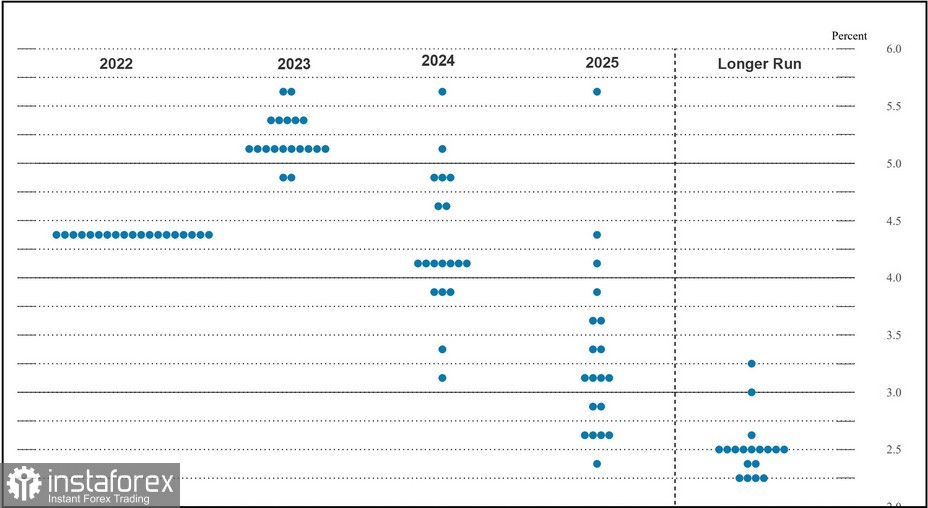

The main reason why dollar is going up and gold is going down is the recent comments of Fed representatives. It reinforced the determination to keep interest rates high, which is confirmed by the dot plot from December 2022 that shows that high rates will be maintained throughout 2023.

Another important statement from the Fed is that a rate cut is unlikely this year. However, even though increasing rates curb high inflation, it also causes an economic downturn, which lowers the prices of goods and services. This is a problem for the Fed as it operates on the principle of supply and demand, and higher prices for goods and services reduce demand.

Even so, Chicago Fed President Austan Goolsbee stated that it is still too early to talk about lowering rates. Cleveland Fed President Loretta Mester said a similar thing, stressing that rates have not yet reached a point where they could remain stable.