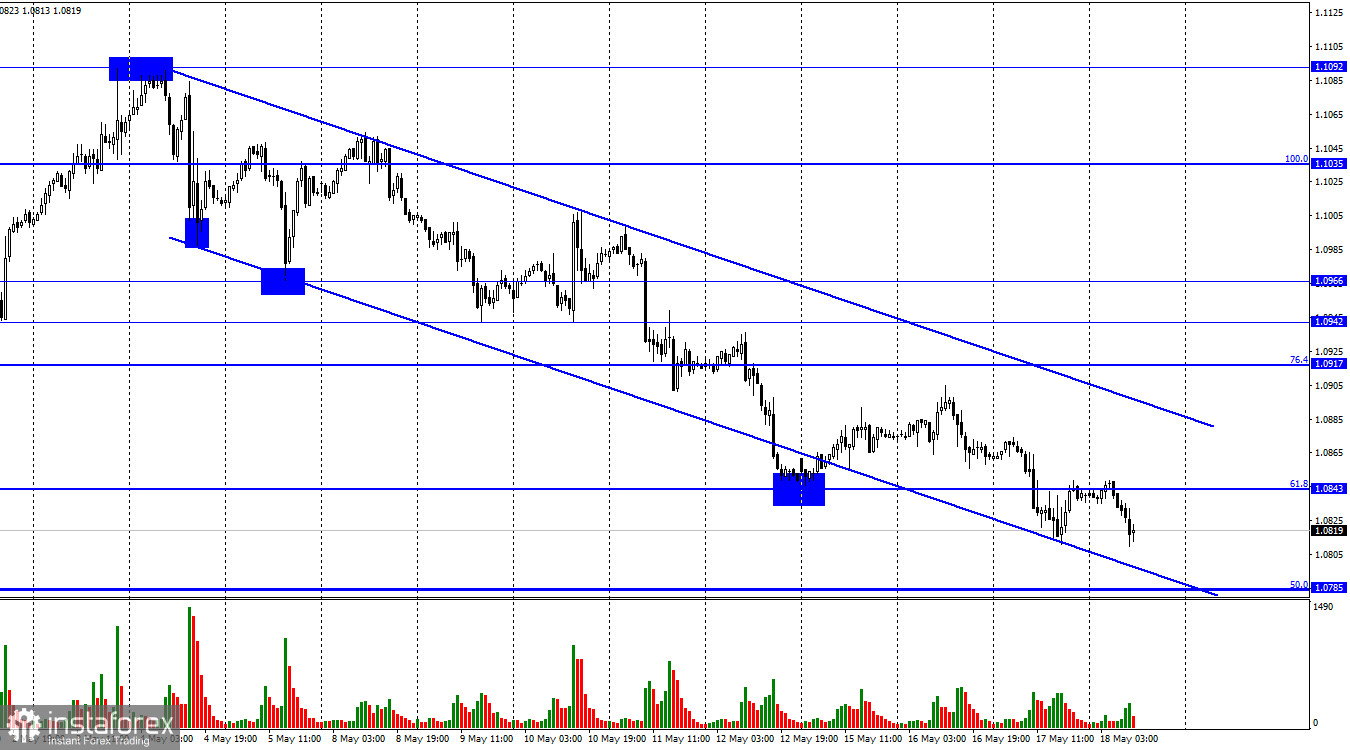

The EUR/USD pair continued falling on Thursday and completed consolidation below the corrective level of 61.8% (1.0843). Thus, the fall of quotes can be continued towards the next Fibonacci level of 50.0% (1.0785). A rebound of quotes from 1.0785 will favor the euro currency and some growth within the downward trend corridor. Consolidation below 1.0785 will increase the chances of continuing to fall toward the next corrective level of 38.2% (1.0726).

The European economy continues to stagnate, and inflation remains high. In such a situation, it would be logical to assume that the ECB will continue to tighten monetary policy and that traders are receiving exactly these signals from its members. However, the step of raising the interest rate has been reduced to 0.25%, which may mean the imminent end of the tightening program. Thus, the ECB rate may rise by another 0.25–0.50%, and a full stop will be put on it.

Yesterday, inflation in the European Union showed growth again, up to 7% year-on-year. At the same time, core inflation, which some economists consider more important, fell to 5.6% in April. The main inflation indicator remains more significant, and since it is falling quite slowly, the regulator should continue to raise the interest rate for longer than at the next two meetings. However, the depreciation of the European currency over the past week and a half suggests that the bulls are retreating from the market. If they were expecting a strong ECB rate hike, such a move would not have been observed, as the FOMC likely finished the tightening process simultaneously. Traders have already considered 1-2 more ECB rate hikes and are not ready to buy more euro currency. The pair will continue to fall.

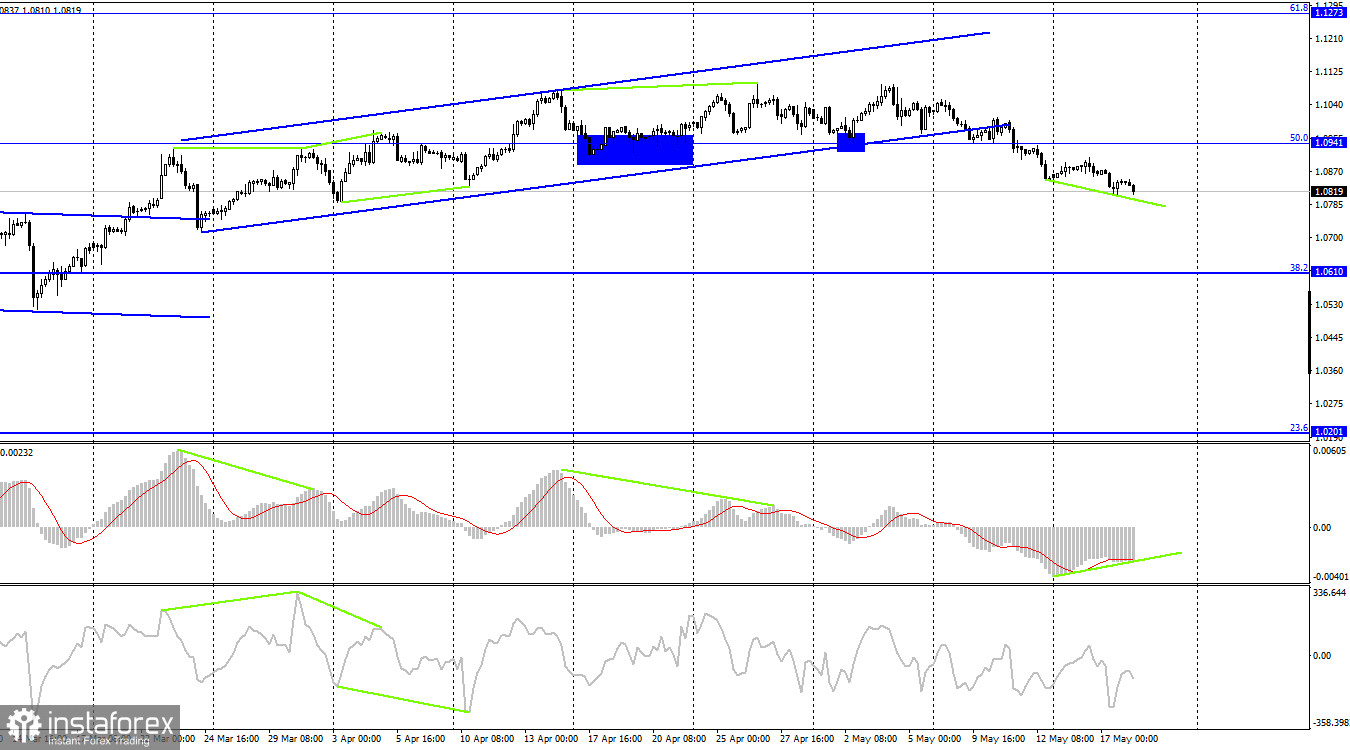

On the 4-hour chart, the pair completed consolidation below the ascending trend corridor, as well as below the corrective level of 50.0% (1.0941), which allows us to count on a continuation of the fall in the direction of the next corrective level of 38.2% (1.0610). Consolidating quotes above the level of 1.0941 will favor the euro currency and the resumption of growth in the direction of level 1.1273. A "bullish" divergence is maturing at the MACD indicator but has not yet fully formed.

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 13,503 long contracts and 7,570 short contracts. The sentiment of large traders remains "bullish" and continues to generally only strengthen. The total number of long contracts concentrated in the hands of speculators now amounts to 260 thousand, and the number of short contracts - only 81 thousand. The European currency has been growing for over half a year, but the information only sometimes supports the pair's growth. The ECB lowered the step of raising the rate to 0.25% at the last meeting, which calls into question the further growth of the European currency. The difference between the number of long and short contracts is threefold, which speaks of the proximity of the moment when the bears will attack. For now, a strong "bullish" sentiment persists, but I think the situation will start to change soon. The euro has retained high positions in recent weeks but has not grown further.

News calendar for the US and the European Union:

European Union - ECB President Lagarde will give a speech (09:00 UTC).

USA - Philadelphia Fed Manufacturing Index (12:30 UTC).

USA - Initial Jobless Claims (12:30 UTC).

USA - Existing Home Sales (14:00 UTC).

On May 18, the economic events calendar contains several important reports and Lagarde's speech. The impact of the information background on traders' sentiment for the rest of the day may be of medium strength but depends mainly on Lagarde's statements.

EUR/USD forecast and advice for traders:

New pair sales could be opened at a close below 1.0843 on the hourly chart with a target of 1.0785. Now these trades can be kept open. Purchases are possible with consolidation above the 1.0843 level on the hourly chart, with a target of 1.0917. Or at the rebound from 1.0785 with a target of 1.0843.