Both instruments continue to decline. The pound has been hesitant about whether it should keep falling, but in the end it couldn't take it. Thus, both instruments started to build downward waves, which is fully consistent with their correlation with each other. Let me remind you that the euro and the pound do not often trade in different directions. In order for the current wave pattern to remain intact, the demand for the U.S. currency should continue to grow. I think there are plenty of reasons for that now, as the American economy and macro data look objectively stronger than the British and European ones. But it's not even the news background that is more important, but the fact that both instruments should build downward waves or sets of waves. Based on this, even without a strong (for the US currency) news background, the demand for the dollar may continue to increase.

On Thursday, Federal Reserve Bank of Chicago President Austan Goolsbee said there is still some possibility of achieving a soft landing after substantial tightening of monetary policy. He also reported that unemployment in America is not increasing, but fear is often greater than the reality. Many economists expect the rate to increase in 2023, which could lead to economic downturn and recession. His colleague, Atlanta Fed president Raphael Bostic said that the Fed will have to stay 'super strong' in its inflation commitment if unemployment begins to rise and inflation stops decreasing. Bostic reported that the Fed is 'far beyond success' on its employment mandate, but a 'bit of pulling back' in the aid of lowering inflation is 'justifiable and appropriate'. Wages didn't fully catch up to inflation in 2022. This year another round of raises, but weaker than inflation. At the end of his speech, he added that there is still some way to go until inflation is beaten.

Earlier this week, Goolsbee noted that the full impact of interest rates on inflation has not yet manifested itself. He confirmed that the Fed's goal is to return inflation to target levels without triggering a recession. The central bank has to track massive streams of information and pay close attention to the credit sector. And Bostic hinted on Monday that the Fed rate may rise again if needed. He noted that the easiest part of fulfilling the Fed's mandate is behind us. Ahead lies a longer and more complex path for the Consumer Price Index to return to where it should be. Between two final rate scenarios, Bostic leans towards a higher value, admitting he may vote for another hike.

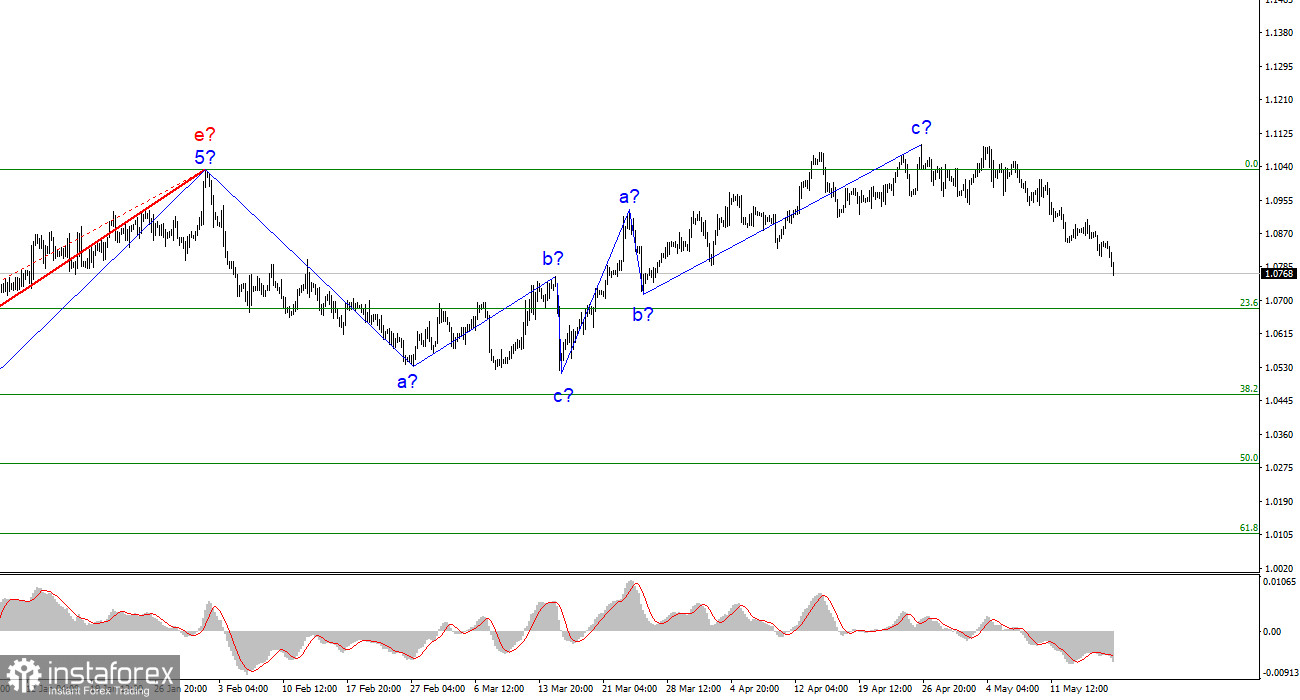

Based on the analysis conducted, I conclude that the construction of an uptrend section is completed. Therefore, you can now consider short positions, and the instrument has quite a large space for decline. I believe that targets in the 1.0500-1.0600 area can be considered quite realistic. With these goals, I advise selling the instrument on downward reversals of the MACD indicator.

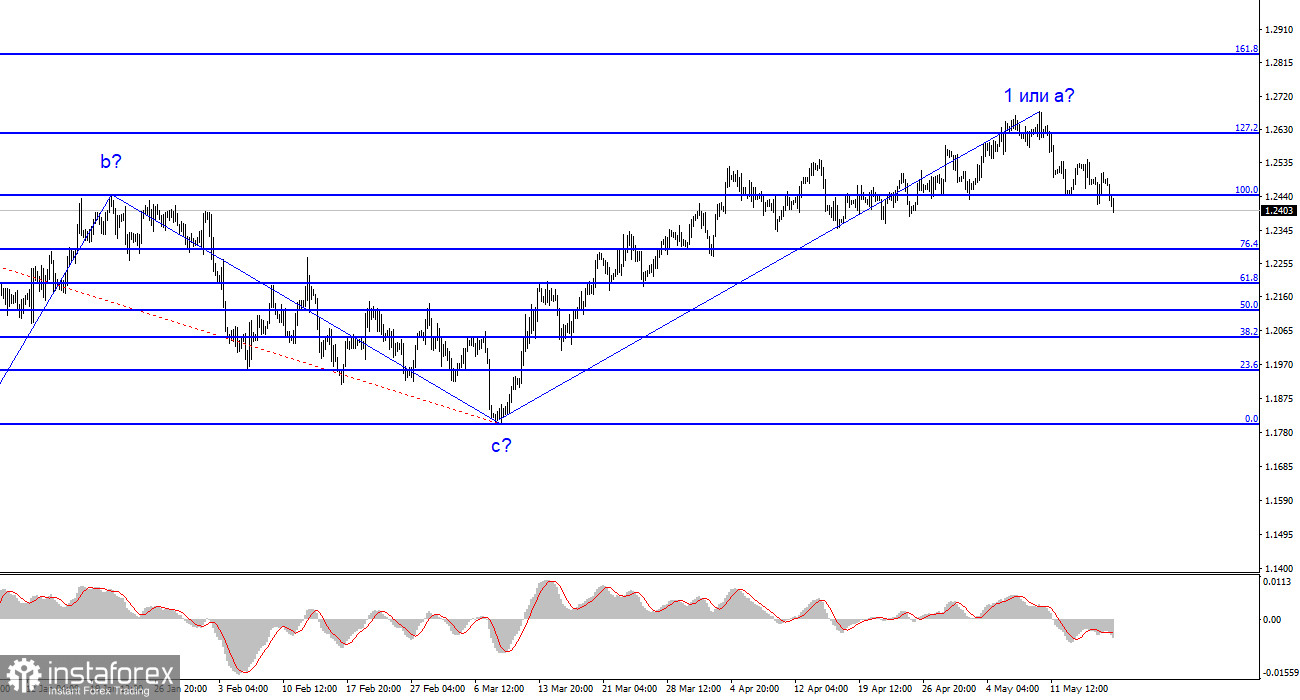

The wave pattern of the GBP/USD pair has long assumed the construction of a new descending wave. Wave b may turn out to be very deep, as all the recent waves are roughly equal. The first wave of the ascending section may become even more complicated. The failed attempt to breach the 1.2615 mark, corresponding to 127.2% Fibonacci, indicates the market's readiness for sales, and the successful attempt to break the 1.2445 mark, equated to 100.0% Fibonacci, repeats this signal.