Trading recommendations

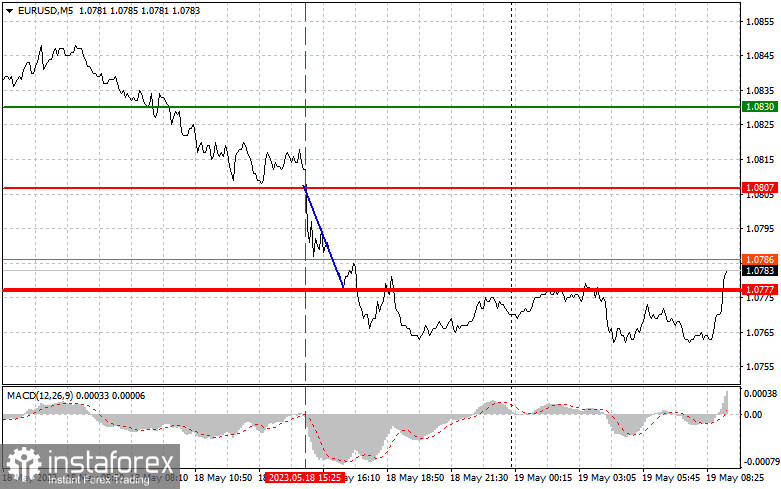

The first test of 1.0825 occurred at a time when the MACD indicator moved down considerably from the zero level. It limited the downward movement of the pair. For this reason, I did not sell the euro. After a short period of time, another test occurred, which seemed to give a good buy signal according to scenario No. 2. However, these positions brought losses. In the afternoon, the pair made an attempt to break through 1.0807 at the moment when the MACD started declining. It provided new entry points into short positions. A downward movement was almost 30 pips.

The empty economic calendar did not help the euro rise. Upbeat US initial jobless claim data signaled the likelihood of further monetary tightening. Today in the morning there will be no crucial economic reports. So, traders are anticipating the speeches of ECP President Christine Lagarde and ECB Executive Board Member Isabelle Schnabel. Short positions according to scenario No. 2 on a rise look more likely. There might be a slight correction of EUR/USD during the European session.

Buy signal

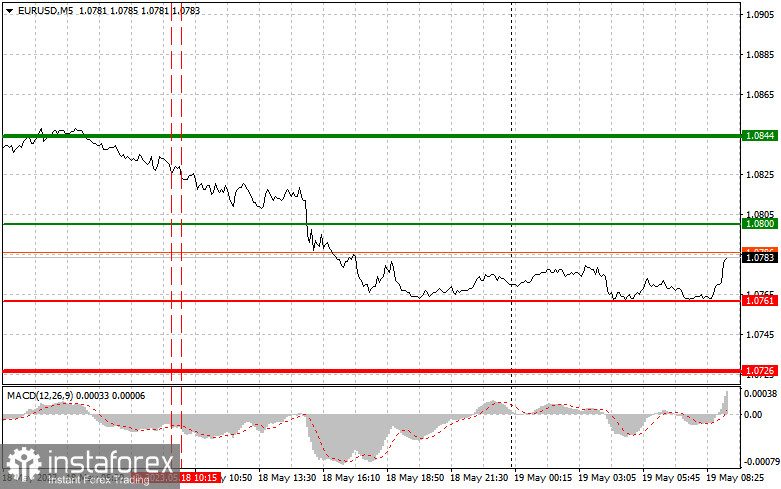

Scenario No.1: You could buy if the price reaches 1.0800 plotted by the green line on the chart with the target level at 1.0844 (thicker green line on the chart). I would recommend leaving the market at 1.0844 and then selling the euro in the opposite direction, bearing in mind a 30-35-pip downward move from the market entry point. The pair could rise if it starts a correction after a rather long fall for the second week in a row. Important! Before opening long positions, make sure that MACD is above the zero mark and it has just started to climb from it.

Scenario No.2: it is also possible to buy the euro today in case of two consecutive tests of 1.0761. At this moment the MACD indicator should be in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. You can expect a rise to 1.0800 and 1.0844.

Sell signal

Scenario No. 1: You could sell the euro today only after the price drops below 1.0761 (red line on the chart). This will lead to a rapid decline in the pair. The target for sellers will be the 1.0726 level where I recommend closing sell orders and immediately opening buy orders (expecting a move of 20-25 pips in the opposite direction from the level. The pressure on the euro will intensify in case of hawkish comments from ECB officials. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just started to fall from it.

Scenario No. 2: it is also possible to sell the euro today in the case of two consecutive price tests of 1.0800. The MACD indicator should be in the overbought area. This will limit the pair's upside potential and lead to a downward market reversal. You can expect a decrease to the levels of 1.0761 and 1.0726.

What we see on the trading chart:

A thin green line is a key level at which you can place long positions on EUR/USD.

A thick green line is the target price since the price is unlikely to move above it.

A thin red line is a level at which you can place short positions on EUR/USD.

A thick red line is the target price since the price is unlikely to move below it.

A MACD line - when entering the market, it is important to pay attention to the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions to enter the market. Before the release of important reports, it is better to stay out of the market to avoid sharp fluctuations in the price. If you decide to trade during the news release, place Stop Loss orders to minimize losses. Without Stop Loss orders, you can lose the entire deposit, especially if you do not use money management and trade in large volumes.

Notably, for successful trading, it is necessary to have a clear trading plan. Relying on spontaneous trading decisions based on the current market situation is a losing strategy for an intraday trader.