The second half of the day will be filled with American politicians' comments about persistent inflation and the fight against it, which could lead to a small correction of the pair downward. I will take advantage of this. I will try to get buy signals according to scenario No. 2, which I will discuss in detail below. If there is no reaction to Powell's statements, the pound may continue to rise.

Buy signal

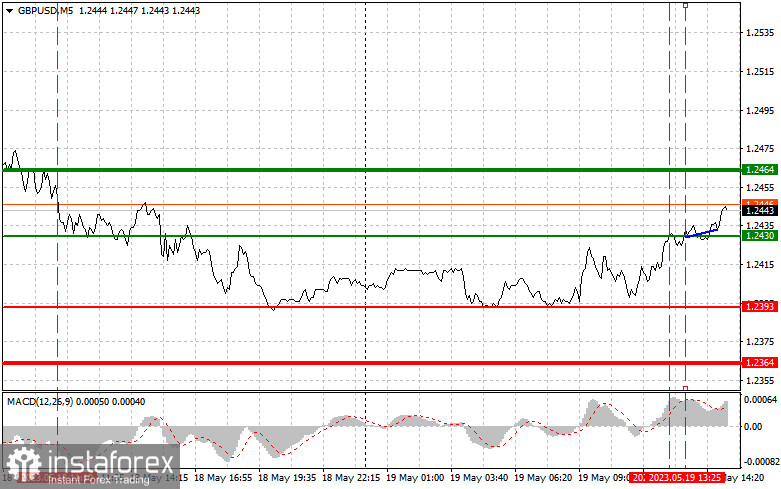

Scenario No. 1: Today, you can buy the pound when reaching the entry point around 1.2455 (the green line on the chart) to rise to the 1.2505 level (thicker green line). Around 1.2505, I recommend exiting purchases and opening sales in the opposite direction (counting on a 30-35 point move in the opposite direction from the level). The pound's growth will continue against the background of profit-taking. Important! Before buying, ensure that the MACD indicator is above the zero mark and only starting its rise from it.

Scenario No. 2: Today, you can also buy the pound in the case of two consecutive tests of the 1.2423 price when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. You can expect growth to the opposite levels of 1.2455 and 1.2505.

Sell signal

Scenario No. 1: Today, you can sell the pound only after the 1.2423 level is updated (red line on the chart), leading to a rapid decline of the pair. The key target for sellers will be the 1.2386 level, where I recommend exiting sales and opening immediate purchases in the opposite direction (counting on a 20–25 point move in the opposite direction from the level). A fall in the pound is possible only in the case of hawkish statements by Powell. Important! Before selling, ensure that the MACD indicator is below the zero mark and only starting to fall from it.

Scenario No. 2: Today, you can also sell the pound in the case of two consecutive tests of the 1.2455 price when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. You can expect a decline to the opposite levels of 1.2423 and 1.2386.

What's on the chart:

Thin green line - the entry price at which you can buy the trading instrument.

Thick green line - the estimated price at which you can set a Take profit or independently fix profits, as growth beyond this level is unlikely.

Thin red line - the entry price at which you can sell the trading instrument.

Thick red line - the estimated price where you can set a Take profit or independently fix profits, as further decrease below this level is unlikely.

MACD indicator. When entering the market, it's important to be guided by overbought and oversold zones.

Important. Beginner traders in the forex market must be very careful when deciding to enter the market. Before releasing important fundamental reports, staying out of the market is best to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. You must set stop orders to avoid losing your entire deposit, especially if you do not use money management and trade in large volumes.

And remember, successful trading requires a clear trading plan, like the one I presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.