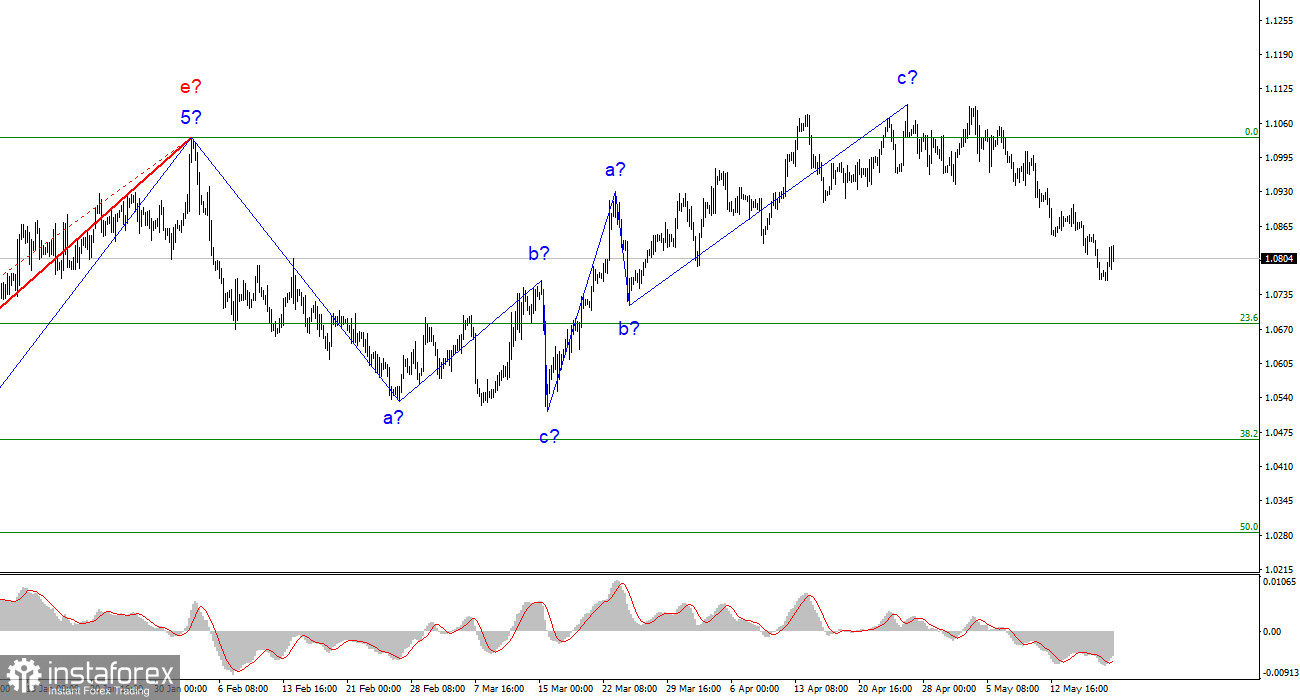

The wave markup on the 4H chart for the euro/dollar pair has remained unchanged for several weeks. The quotes began to move away from the previously reached highs. So, the three-wave upward structure can be considered complete. The entire upward section of the trend may still take a five-wave, corrective form. At this time, I am betting on a new downward section of the trend, which is likely to turn out to be a three-wave structure. I have already mentioned said that the instrument could trade near the 5th line in the future. From this level, the euro started an upward movement some time ago.

The upper line of the trend section was slightly above the highest level of the previous upward section. Since December last year, the movement of the instrument has been horizontal. It is likely to last for a while. In the last 2-2.5 months, demand for the euro has been constantly growing. However, there have almost no strong drivers. Thus, it was wise to build ascending waves in order to begin the construction of descending ones.

Empty economic calendar on Friday

The euro/dollar pair climbed by 30 pips on Friday. It was a rebound but the bearish movement prevailed. The economic calendar for the US or the EU was empty. However, there were some important events. ECB President Christine Lagarde said on Friday that the regulator's main priority is to return inflation to 2%. This comment did not come as a surprise. All ECB policymakers have already voiced the same onion. Lagarde said that the regulator could undertake less aggressive rate hikes. In other words, she hinted at a cautious approach and a smaller rate increase at the next meetings.

Traders are also betting on such a scenario. They are factoring in 1-2 more rate hikes before a pause in the tightening cycle. These comments have no effect on the wave markup as the instrument is now moving with three-wave structures. The pair has been growing for 2 months. This is why it may drop by the same amount of pips. Fresh news will hardly affect the long-term prospects. To be more precise, the pair is unlikely to significantly change its trajectory in the following months. I expect a decrease to the lower waves a and c of the previous trend section and the construction of a three-wave structure. After that, one should access fundamental background as by that time new strong drivers may appear.

Conclusion

Based on the analysis, the construction of the upward trend section is completed. Therefore, it would be wise to go short. There is a likelihood of a large decline. The pivot points are located at 1,0500-1,0600. I would advise you to open short potions on the bearish divergences of the MACD indicator.

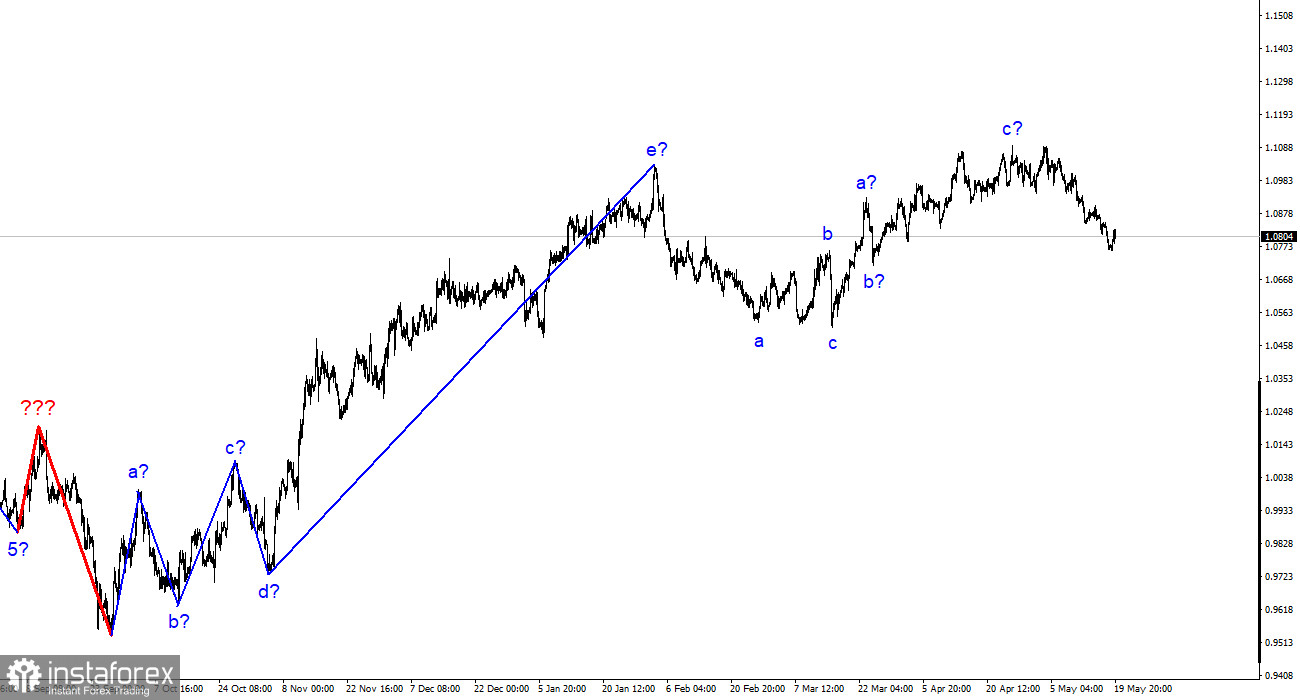

On the larger timeframes, the wave markup of the uptrend section has taken on an extended form but is probably completed. There have been five upward waves, which are most likely the a-b-c-d-e structure. The construction of a downward section may not be completed yet and it can take any form.