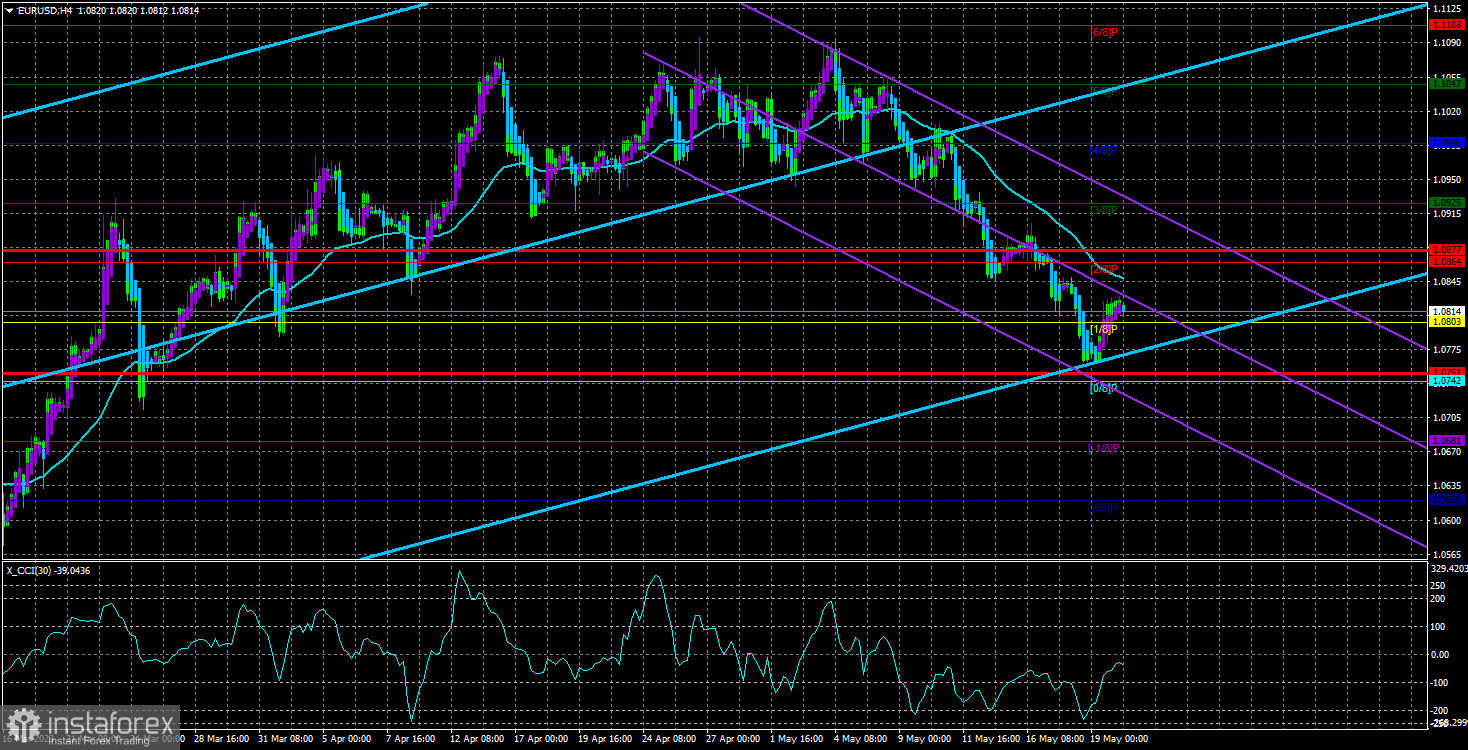

On Friday, the euro/dollar pair started gaining in value, which is clearly seen on the trading chart. At the moment, the price has not even reached the moving average line. That is why now, the current movement could be considered a correction or a pullback. The downward trend continues and the euro is rapidly falling. We believe that the decline should continue in the medium term as the euro remains at very high levels. Thus, corrections are inevitable. The pair may increase by a total of 100-150 pips but then the downward movement should resume. Any other development will be considered illogical.

Last week was quite rich in events. Although there was a series of speeches made by officials of the ECB and the Federal Reserve, there was little important information. Essentially, we can only note the unchanged rhetoric of ECB officials, who continue to insist on further tightening of monetary policy, and some contradictions in the rhetoric of the Federal Reserve. The Fed currently does not have a unanimous opinion on the interest rate. Several committee members support further tightening, while the majority believes that the current level of the rate will be sufficient to bring inflation back to 2%. Thus, it should be assumed that the rate will no longer rise.

Jerome Powell spoke on Friday about the need to take a pause to allow the restrictive policy to fully affect inflation. It would seem that the dollar should continue to decline since the Federal Reserve has effectively abandoned rate hikes. Instead, the US dollar is confidently rising. The fact is that before that, it has been falling for two months. The markets have already priced in all the rate hikes by the ECB and the Federal Reserve, so this factor no longer influences the pair's movements.

Jerome Powell cooled bears' enthusiasm but failed to change the market sentiment.

Essentially, all of Powell's comments made on Friday supported the idea to take a pause. We believe that this is absolutely logical and reasonable since inflation in the United States decreases every month sometimes quickly, sometimes slowly. No one said that it should drop by 0.5-1.0% every month. Everything is going according to plan, and there is no reason for panic.

Perhaps the situation will change in a few months since central banks' expectations of inflation decline without interest rate hikes are just expectations. Reality can be much more difficult.

Notably, officials of the Bank of England, the ECB, and the Federal Reserve believe that the effect of hawkish policies on the economy can be observed for a period of up to 18 months. We believe that this is a too long period. However, in the next few months, the consumer price index could slow down thanks to the tightening measures. Therefore, the best option for the Federal Reserve is to take a pause. Especially considering that the United States is already facing the bankruptcy of the fourth or fifth major bank. Further interest rate hikes will only exacerbate the banking crisis. Jerome Powell also noted that a high interest rate will have a negative impact on economic growth and unemployment. In other words, further tightening of the policy will only worsen the situation.

As we have already mentioned, the current situation is not a bearish factor for the dollar. In the medium term, we even believe that the pair may enter a prolonged consolidation phase and remain within a sideways channel in the 24-hour time frame. The euro has no grounds for a further rise. That is why a decline is quite logical. On the daily chart, the pair failed to surpass the Senkou Span B line and is unlikely to do so today amid an empty macroeconomic calendar. Therefore, a rebound and a slight increase in the pair are possible. The resumption of the upward trend is theoretically possible but it would be a new phase of the movement.

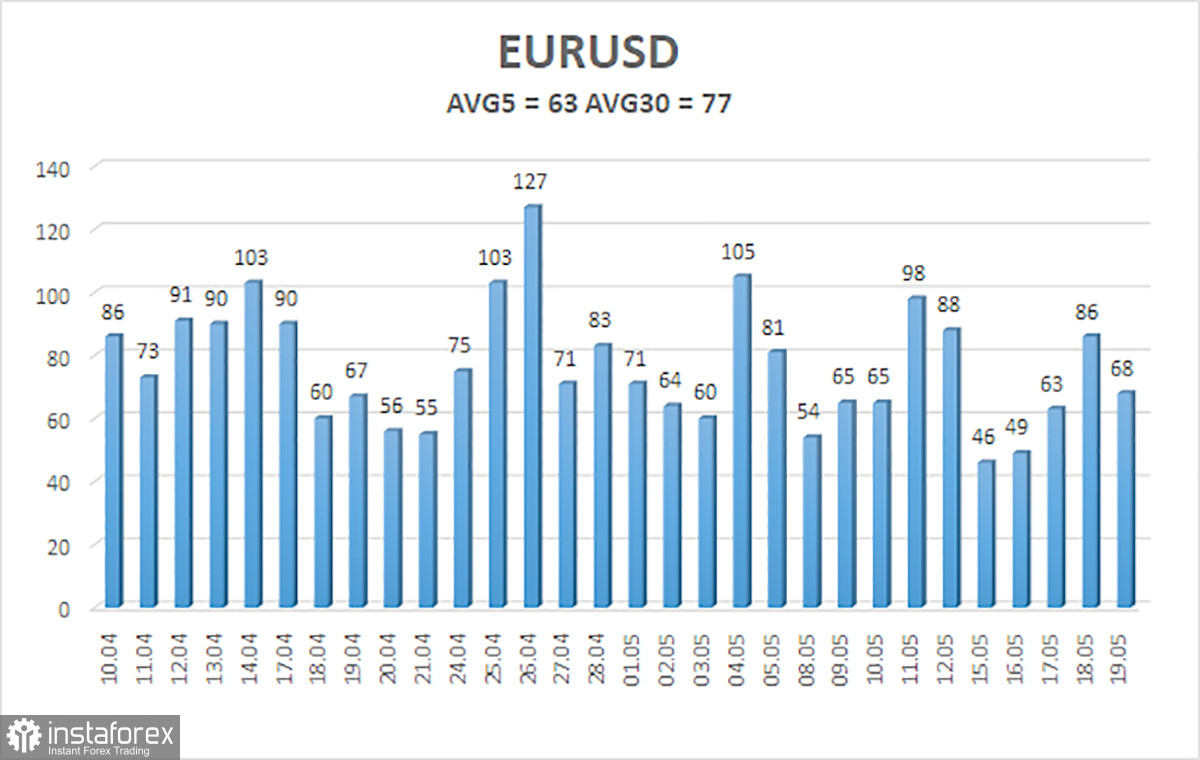

As of May 22, the average volatility of the EUR/USD pair over the last 5 trading days is 63 pips. We expect the pair to move between the levels of 1.0751 and 1.0877 on Monday. A downward reversal of the Heiken Ashi indicator will point to a resumption of the downward movement.

The nearest support levels:

S1 - 1.0803

S2 - 1.0742

S3 - 1.0681

The nearest resistance levels:

R1 - 1.0863

R2 - 1.0925

R3 - 1.0986

Trading recommendations:

The EUR/USD pair continues its confident downward movement. At this time, new short positions should be considered with targets at 1.0751 and 1.0742 in case of a downward reversal of the Heiken Ashi indicator or a price bounce from the moving average. Long positions will become relevant only after the price consolidates above the moving average with a target of 1.0925.

What we see on the trading chart:

Linear regression channels help determine the current trend. If both channels are headed in one direction, it indicates a strong trend.

The moving average line (20.0 - smoothed) determines the short-term trend and the direction in which trading should be conducted.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) stand for a probable price channel in which the pair will trade in the next 24 hours based on current volatility indicators.

CCI indicator. If it enters the oversold area (below -250) or overbought area (above +250), it points to an upcoming trend reversal in the opposite direction.