Markets continue to focus on the negotiations over the US debt ceiling. However, upcoming minutes from the latest Federal Reserve meeting will also take up attention.

Traders will be interested in the central bank's view on inflation dynamics, incoming economic data, and the banking crisis. The prospects of interest rates is also important as there are Fed members, such as James Bullard, who advocate for at least one more rate increase.

Another key event is the release of US GDP data for the first quarter, which is expected to confirm a slowdown in economic growth to 1.1%. Core CPI data is also due, and it is expected to show growth of about 0.3% m/m and 4.6% y/y for April.

If the data align with expectations, the Fed may proceed with another interest rate hike due to concerns that inflation may stop declining. This is why markets are very nervous, exacerbated by political confrontation that threatens to lead the US government to default.

Therefore, even if an agreement is reached and the US debt ceiling is raised, it may only lead to a temporary boost in optimism and asset prices. Afterwards, all focus will undoubtedly shift to the outcome of the Fed meeting and the prospect of a 0.25% increase in the key interest rate to 5.50%.

Forecasts for today:

USD/JPY

The pair is trading above 137.70. If it remains above this level, there will be further growth to 139.50.

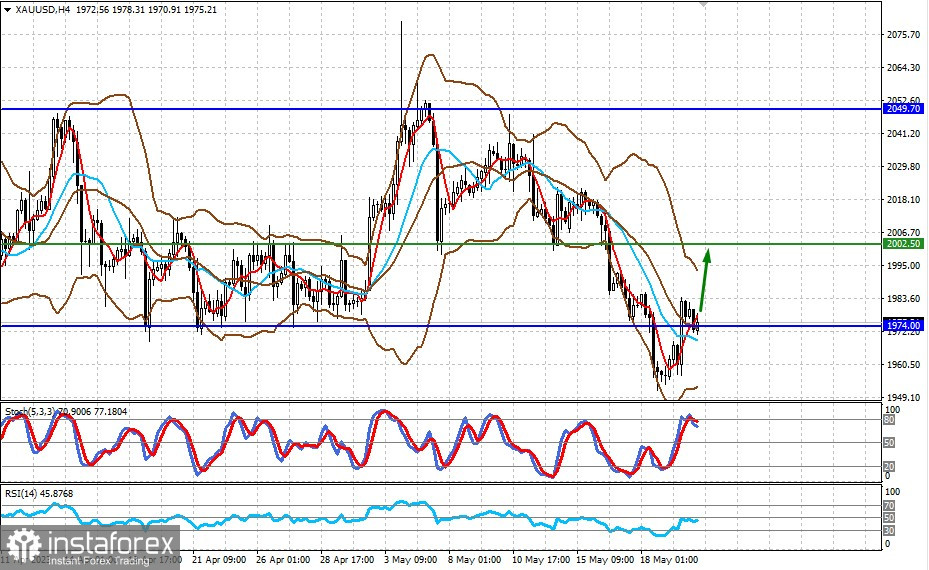

XAU/USD

Gold remains above 1974.00. If pressure on dollar persists, there will be an increase towards 2002.50.