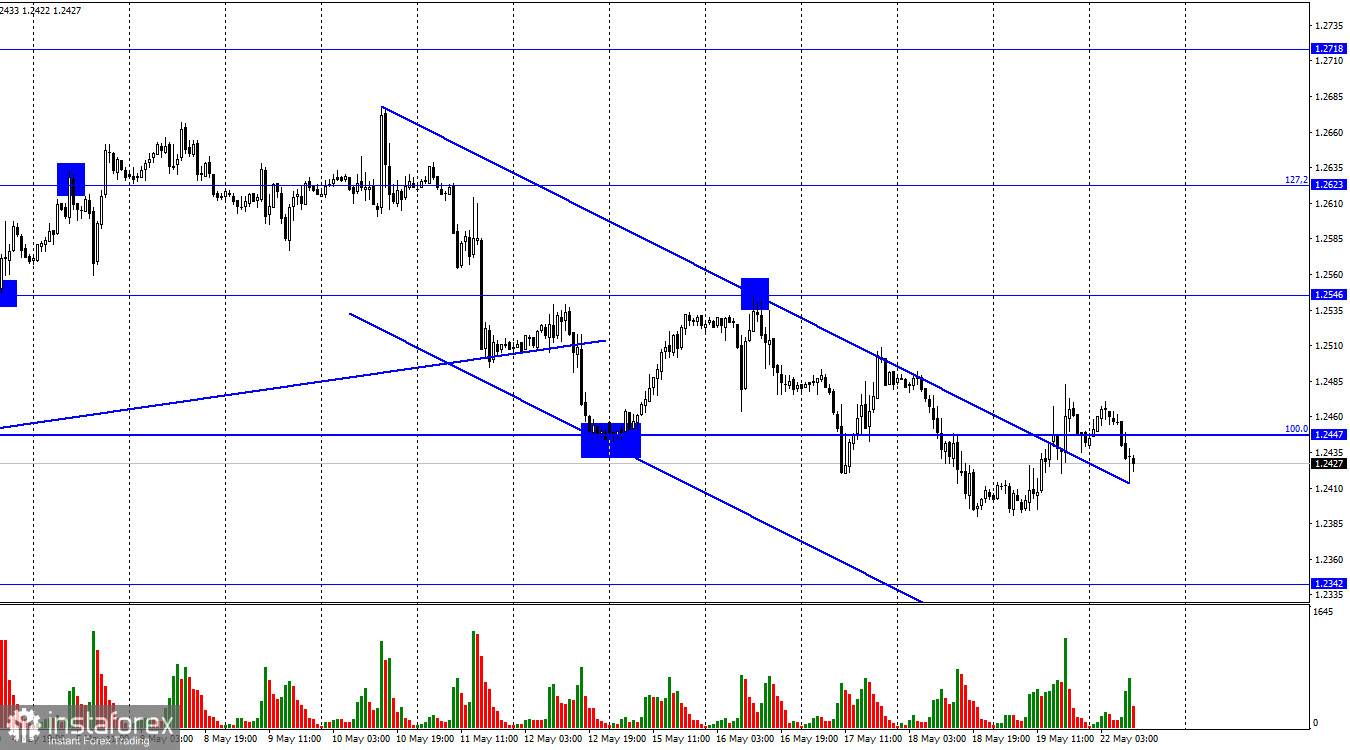

On the hourly chart, the GBP/USD pair reversed in favor of the British on Friday and closed above the 100.0% correction level at 1.2447. Thus, the upward movement could have continued, but the quotes dropped below this level on Monday. Therefore, despite the closure above the descending trend corridor, the decline in quotes may continue toward the level of 1.2342.

On Friday, Jerome Powell, the President of the Federal Reserve System (FRS), stated that the interest rate would likely remain unchanged following the June meeting. It should be reminded that the market considers this scenario the main one, as the FOMC rate has already risen to 5.25%, which is a sufficiently restrictive level to expect a further inflation slowdown. In addition, Powell stated that the economy might continue to grow in the next quarter, but the pace of growth will decrease, and unemployment may rise. However, recent quarters have shown that the American economy is in good shape. In particular, unemployment is at its lowest level in half a century, and the labor market regularly creates new jobs in sufficient numbers. Only GDP growth is slowing down, which is entirely understandable given the significant increase in interest rates and the rise in borrowing costs. If loans become more expensive, deposit rates will also rise. Thus, investors prefer to accumulate and invest more rather than take out loans for development or investment. The economy is responding with a slowdown.

Although Powell's statements can be characterized as "dovish," the dollar only slightly declined and is already rising again today. However, such behavior by traders should be clear to readers. Market activity is currently low, and movements of 50 pips are very weak. Based on Friday and today's movements, it can be said that bears will continue to try to push the pair downward.

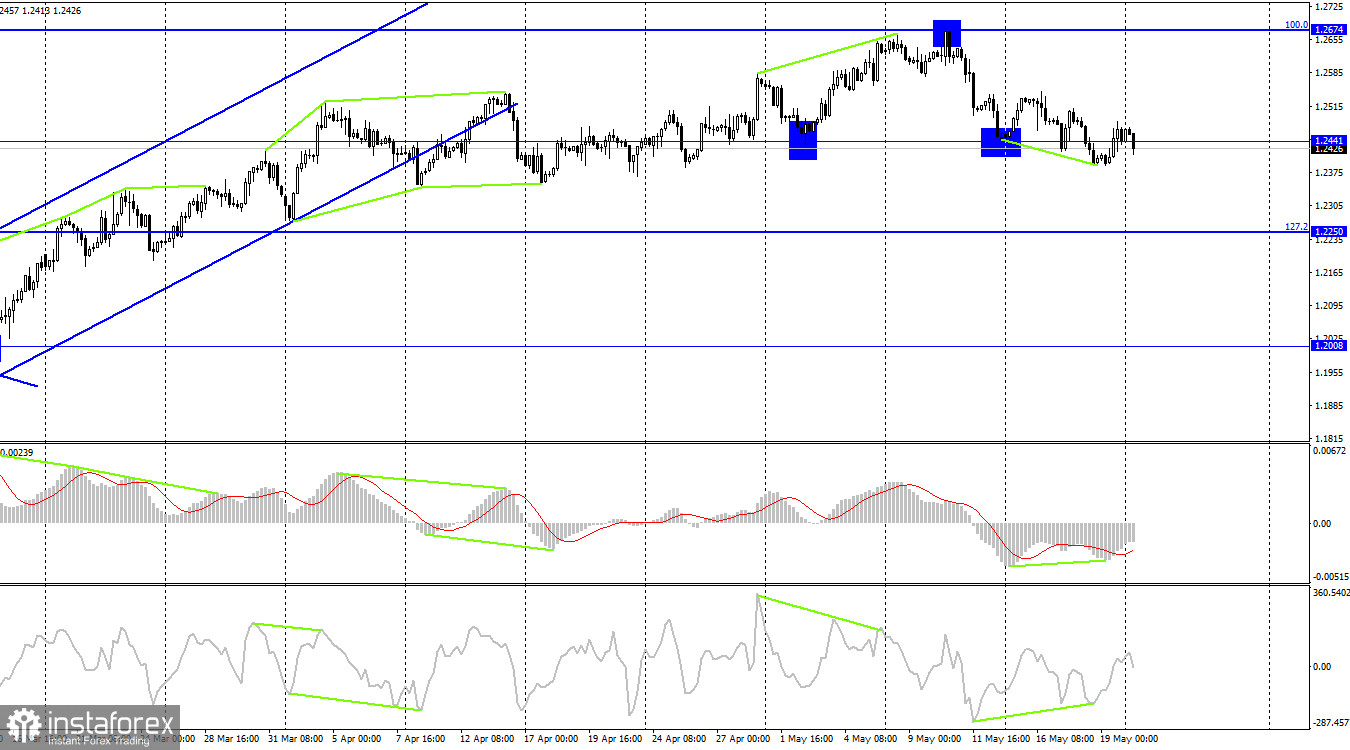

On the 4-hour chart, the pair has established support below the level of 1.2441, but after forming a "bullish" divergence, it retraced slightly upwards. A new close below the level of 1.2441 will favor the American currency and the resumption of the decline towards the next correction level of 127.2% at 1.2250. No emerging divergences were observed today for any indicator, and I am not currently counting on a strong rise in the British pound.

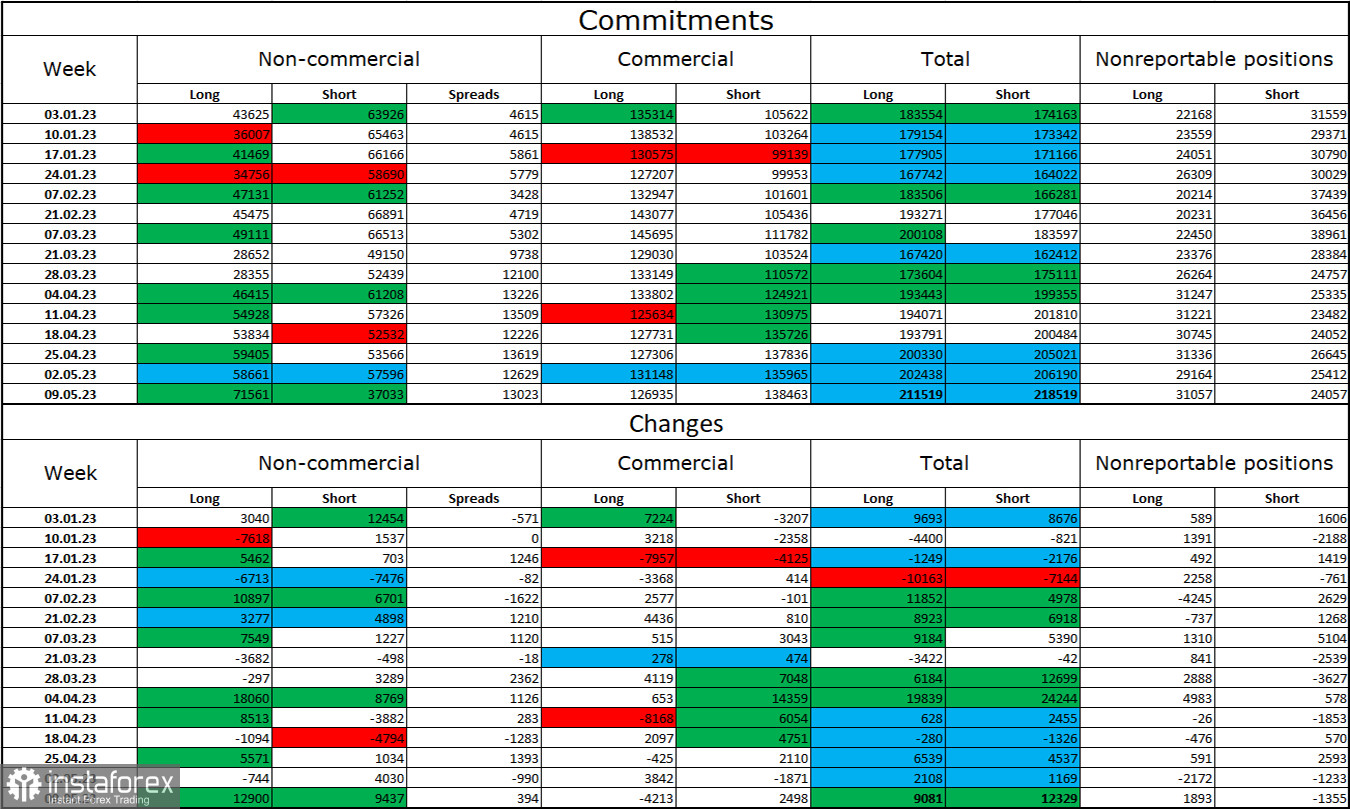

Commitments of Traders (COT) report:

The sentiment of the "non-commercial" trader category has become more bullish over the past reporting week. The number of long contracts held by speculators increased by 12,900 units, while the number of short contracts increased by 9,437. The overall sentiment of large players remains predominantly bullish (it had been bearish for a long time). Still, the number of long and short contracts is now almost equal at 71.5 thousand and 67 thousand, respectively. The British pound continues to rise, although very few factors support buyers. Since the ratio of long to short is nearly equal, the pound cannot be considered overbought. The prospects for the pound remain decent, but a decline can be expected soon, as it has been rising for a prolonged period.

News calendar for the US and the UK:

Monday's economic events calendar does not include any important entries. Bullard's speech may influence traders' sentiment but is not considered a significant event. The impact of the background information on traders' sentiment for the remainder of the day may be absent.

GBP/USD forecast and trader advice:

I recommend selling the pound upon a new close below 1.2441 on the 4-hour chart, with a target of 1.2342. As for buying the pound, I previously advised doing so upon a close above the corridor on the hourly chart, with a target of 1.2546. However, I am ready to adjust this recommendation: stronger buying signals are needed.