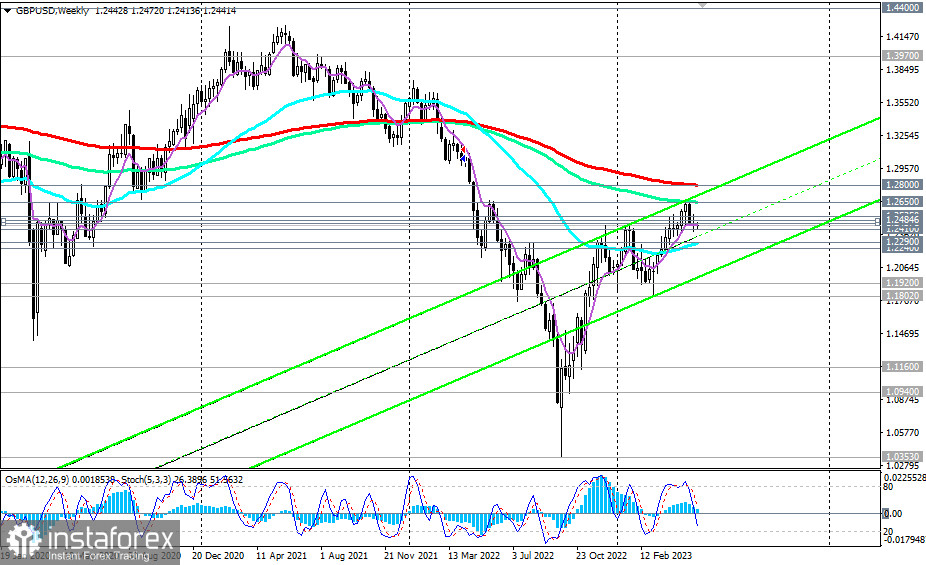

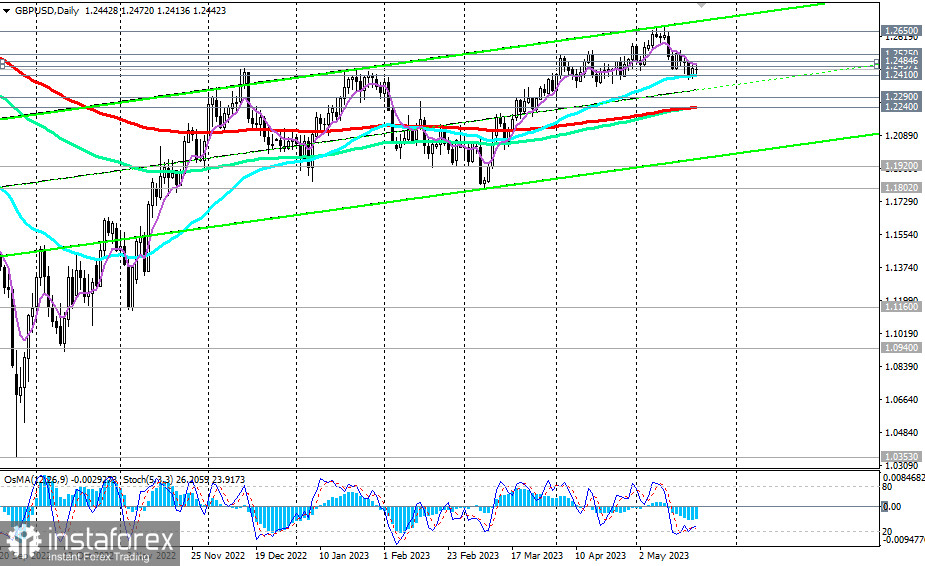

For the GBP/USD pair to break into the long-term bullish market zone, it needs to rise above the key resistance level 1.2800 (200 EMA on the weekly chart). Earlier this month, the price already attempted, but its growth was halted at the strong and long-term resistance level of 1.2650 (144 EMA on the weekly chart). GBP/USD declined to the important medium-term support level of 1.2410 (50 EMA on the daily chart), primarily due to the strengthening of the dollar.

In the main scenario, we expect a retest of the 1.2650 resistance level, its breakout, and a rise toward the 1.2800 resistance level, which separates the long-term bullish market from the bearish one. Further upward targets include key strategic resistance levels of 1.3930 (144 EMA on the monthly chart) and 1.4360 (200 EMA on the monthly chart). Below these levels, GBP/USD remains in the global bearish market zone.

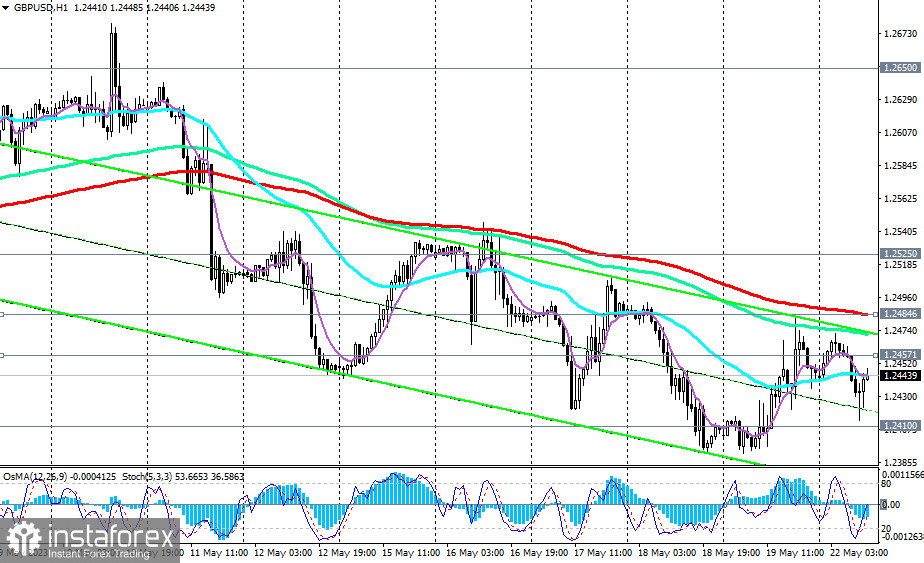

The first signal to implement this scenario would be a breakout of the important short-term resistance level 1.2485 (200 EMA on the 1H chart).

It is worth noting that the test of this level already occurred last Friday.

In the alternative scenario, a breakout of the 1.2410 support level (50 EMA on the daily chart), followed by the local support level of 1.2400, would signal a resumption of short positions.

A breakout of the key support level 1.2240 (200 EMA on the daily chart) would once again return GBP/USD to the long-term bearish market zone.

Support levels: 1.2410, 1.2400, 1.2300, 1.2290, 1.2240

Resistance levels: 1.2457, 1.2485, 1.2500, 1.2525, 1.2600, 1.2650, 1.2700, 1.2800