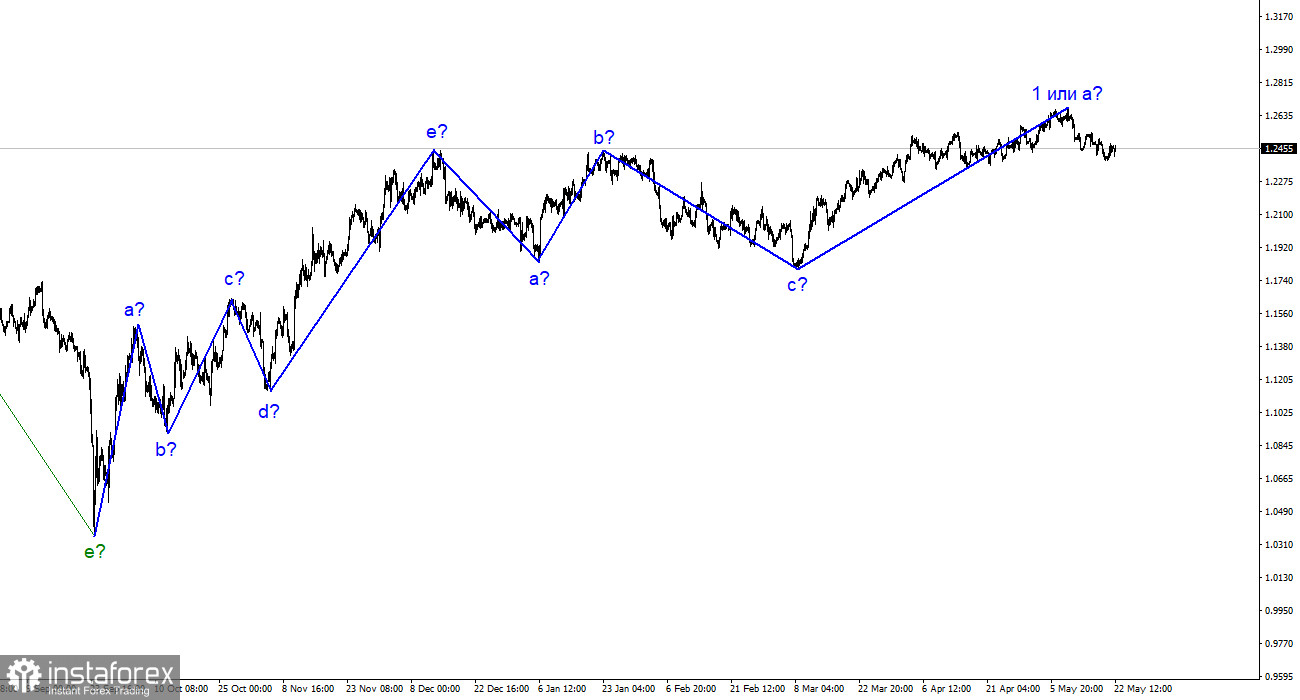

The wave labeling for the GBP/USD pair still appears complex and ambiguous. It does not resemble a classical corrective or impulsive phase of the trend. Since the peak of the current upward wave surpassed the peak of the last wave B, the entire downward phase of the trend, consisting of waves A-B-C, can be considered complete. Therefore, the formation of a new upward trend phase continues for the pound. Since March 8, I can identify only one wave of the current scale, indicating that forming a new trend phase may take a long time.

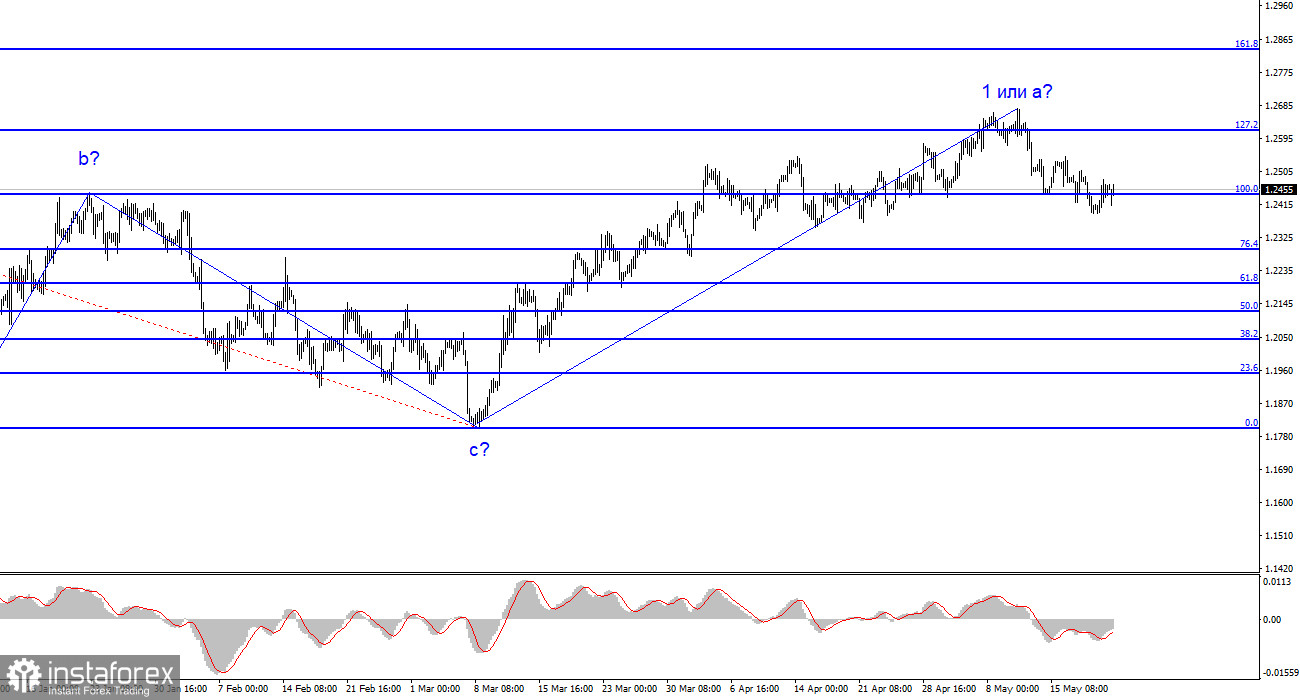

Both pairs should form similar wave formations. If this is true, wave 2 or B for the pound may be extensive, while a downward three-wave structure may form for the euro. Consequently, I expect a deep wave B, similar to the formation of the previous three-wave structure. Therefore, we expect the pair to decline towards the 1.1850 level or slightly higher. At the moment, wave 1 or A has a chance of being considered complete, but some things could still be improved.

The only danger lies in default.

The GBP/USD exchange rate increased by 15 basis points on Monday. Today, the amplitude of movements is weak, and the pair is not moving significantly up or down. Negotiations between Republicans and Democrats on the U.S. national debt are set to resume this evening, and President Joe Biden has already reported some progress in resolving this issue. At the same time, analysts from several major banks have stated that debt ceiling problems do not affect and will not affect the U.S. currency. I want to remind you that I expressed the same thoughts over the weekend.

The danger for the dollar lies solely in the event of a default. The probability of a default is extremely low, despite the approaching June 1, when, according to U.S. Treasury Secretary Janet Yellen, the Treasury will run out of funds. The market is slightly nervous about this, but there are no signs of panic yet. If a default occurs, the dollar could suffer significant losses in the long term. It could initiate a process of de-dollarization, which has been rumored for several years. In this case, the U.S. currency may cease to be the global reserve currency. This process could take several years to several decades, but if it is launched, the U.S. currency will enter a downward supercycle.

However, I do not expect anything like that to happen, as it is incredibly unlikely to imagine that Republicans and Democrats would allow it. Everyone in the U.S. Congress understands the potential consequences of a default if politicians cannot reach an agreement and do their job. I expect this issue to be resolved this week, and demand for the U.S. currency may increase afterward, aligning with the current wave labeling.

General conclusions.

The wave pattern of the GBP/USD pair has long suggested the formation of a new downward wave. Wave B could be very deep, as all recent waves are approximately equal. The first wave of the upward phase may become even more complex. An unsuccessful attempt to break through the 1.2615 level, which corresponds to 127.2% Fibonacci, indicates market readiness for selling. A successful attempt to break through the 1.2445 level, which is equivalent to 100.0% Fibonacci, confirms this signal.

The pattern resembles the EUR/USD pair on the larger wave scale, but there are still some differences. The downward corrective phase of the trend is completed, but a new downward wave may begin at this time. This wave could be deep and extensive, and the entire trend phase could be horizontal, similar to the previous one.