As central banks in the European Union, the United Kingdom, and the United States approach their peak interest rates, market participants and analysts begin to question the timing of when rates will be at their peak levels. The answer to this question affects the health of every economy, since "tightening" and "cooling" are observed not only when rates are rising, but also when rates are at their peak. In other words, the longer central bank rates remain at restrictive levels, the higher the likelihood of a recession. Inflation, on the other hand, reacts somewhat differently. The impact of peak rates on inflation can be observed for up to one year, and then the correlation will be broken.

The first target for economists' scrutiny is the US Federal Reserve. The European Central Bank and the Bank of England may continue to raise interest rates for a few more months (and the Fed may as well), but the US central bank is much closer to the end of the tightening process. Therefore, everyone is interested in how long the US rates will stay at their peak levels. According to a study conducted by the National Association for Business Economics, rates are expected to start declining no earlier than the first quarter of next year. This means they will spend about a year at their peak values. Additionally, this implies that inflation may slow down significantly in its decline in the coming months and lose 0.1-0.2% per month in the future.

NABE respondents also favored higher inflation forecasts for 2023 and lowered GDP forecasts. However, labor market forecasts have sharply increased. Payrolls should average 142,000 per month by the end of 2023, according to the update. The unemployment rate forecast has been revised down from 3.9% to 3.7% for the current year. All this suggests that the U.S. economy is doing well with the Fed's hawkish policies. GDP will slow down but remain positive, and a recession, even a technical one, may not occur. Unemployment will hardly increase as the current rate of 3.4% is the lowest in 50 years. All signs indicate that the US economy is coping with challenges, and therefore, the dollar has no basis for a significant decline.

The situation in the EU and the UK is a bit worse. For example, unemployment in the EU is already twice as high as in the US. The UK also expects a sharp rise in unemployment. GDP growth rates in both Britain and the EU have been hovering around zero for several quarters. If central bank rates also remain at peak levels for about a year, a recession seems inevitable. And since inflation in the EU and the UK is higher and declining more slowly, these countries are at risk of facing an economic downturn. This could significantly reduce the demand for the euro and the pound.

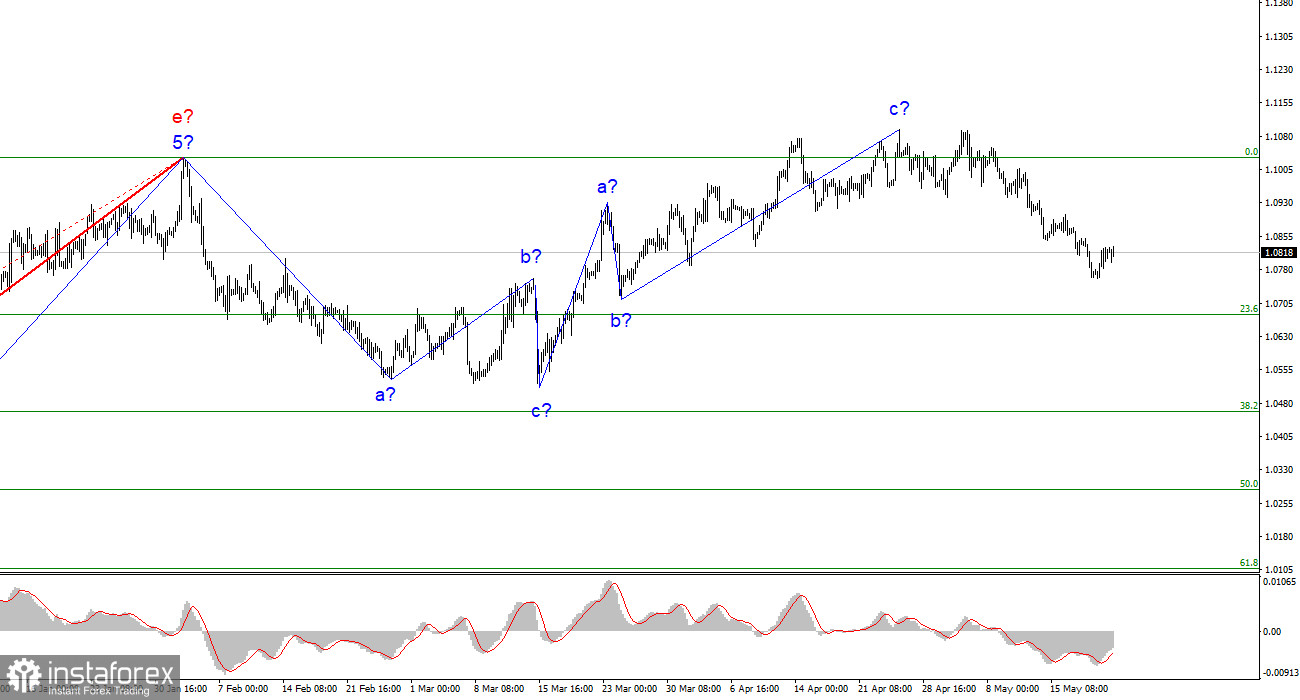

Based on the analysis, I conclude that the uptrend phase is complete. Therefore, I would recommend selling at this point, as the instrument has enough room for a decline. I believe that targets around 1.0500-1.0600 are quite realistic. With these targets in mind, I advise selling the instrument on downward reversals of the MACD indicator.

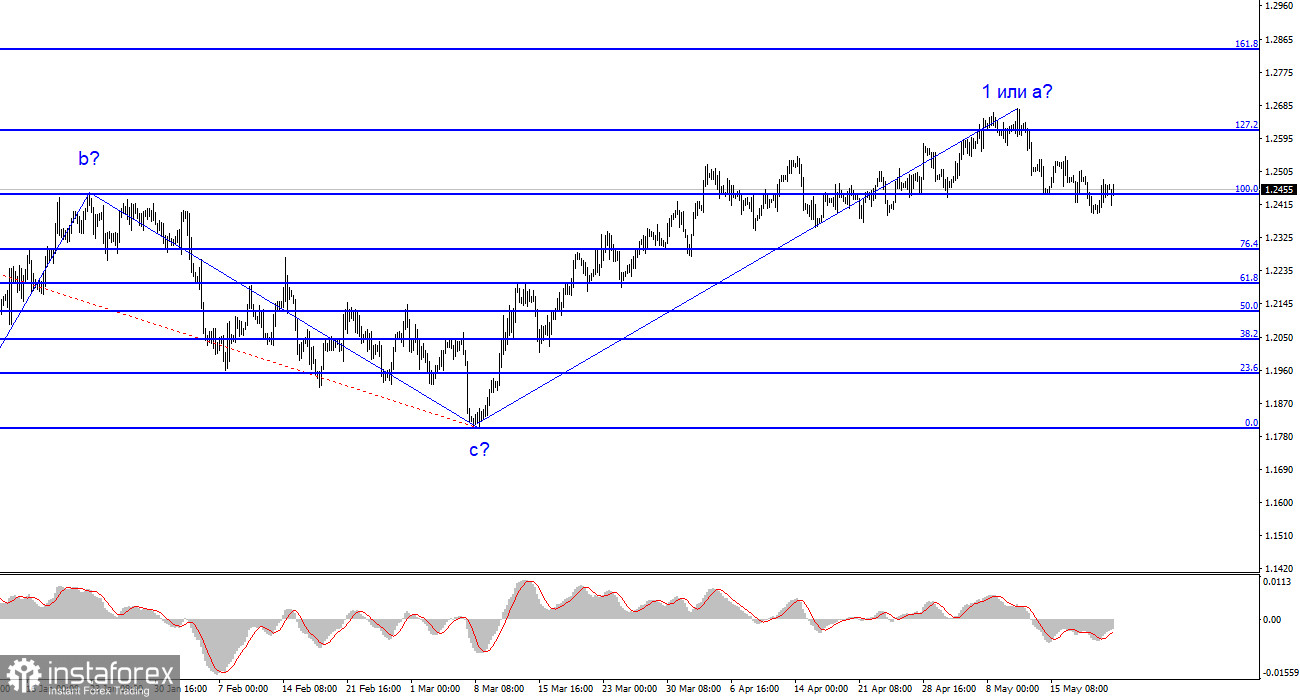

The wave pattern of the GBP/USD pair has long indicated the formation of a new downtrend wave. Wave b could be very deep, as all waves have recently been equal. The first wave of the upward phase may become even more complex. Failure to breach the 1.2615 level, which corresponds to 127.2% Fibonacci, indicates the market's readiness for selling, while a successful attempt to break through the 1.2445 level, equivalent to 100.0% Fibonacci, confirms this signal.