Analysis of Monday trades

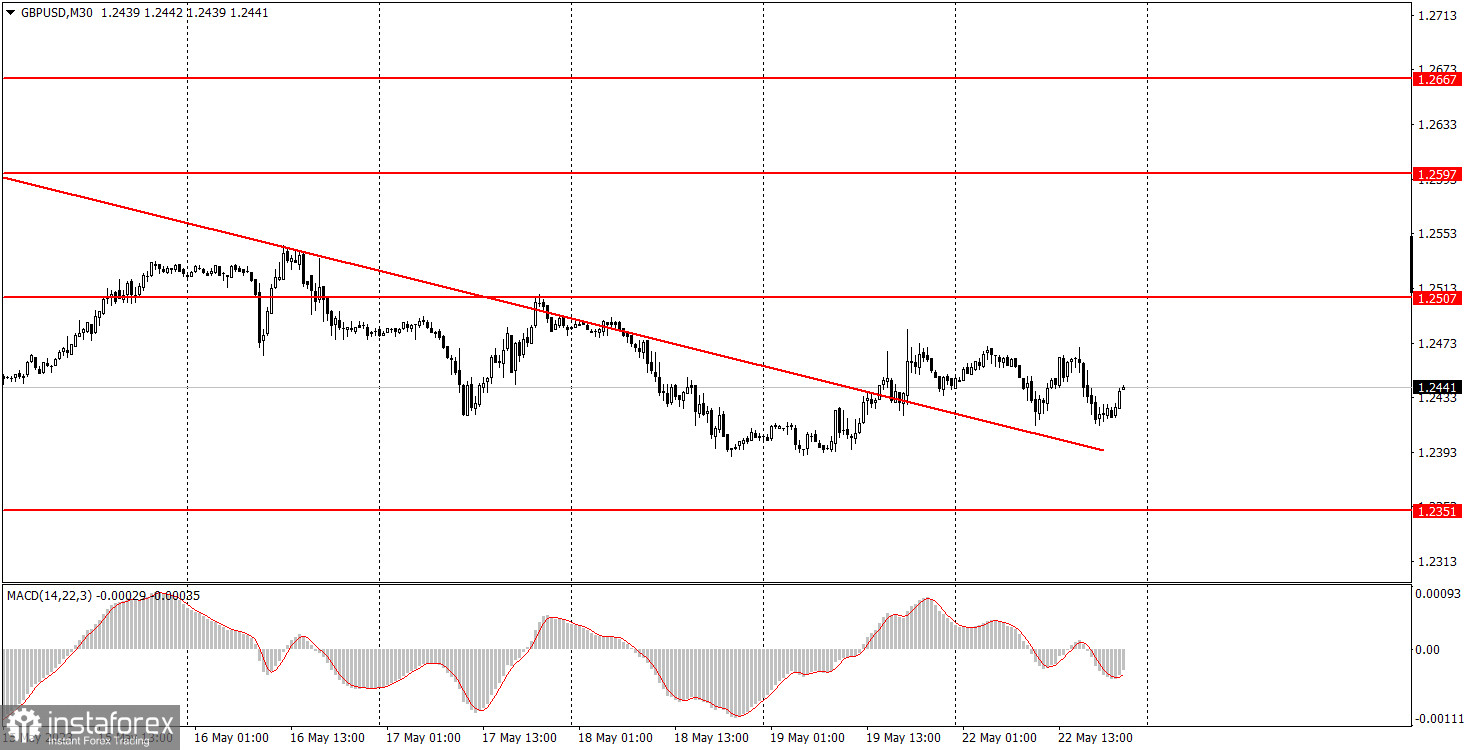

GBP/USD 30M chart

The GBP/USD pair also traded in a flat range on Monday, which can be seen on any timeframe. The pair broke below the descending trend line, but it did so within a flat range, so the overall downward trend remains intact. We believe that the pound has not fallen significantly enough and may continue its decline.

There were no important fundamental or macroeconomic events in the United States or the United Kingdom on Monday. Throughout the day, there were several speeches by representatives of the Federal Reserve and the Treasury in the US, but as we can see, they didn't generate any interest in the market. There was a feeble reaction that could provoke a movement of 10-20 pips only. The volatility of the pair was 60 pips, which is a low value for the British currency. Trading today simply didn't make any sense. The key was to recognize the flat range in a timely manner. But as we warned in the previous, a dull Monday could be expected.

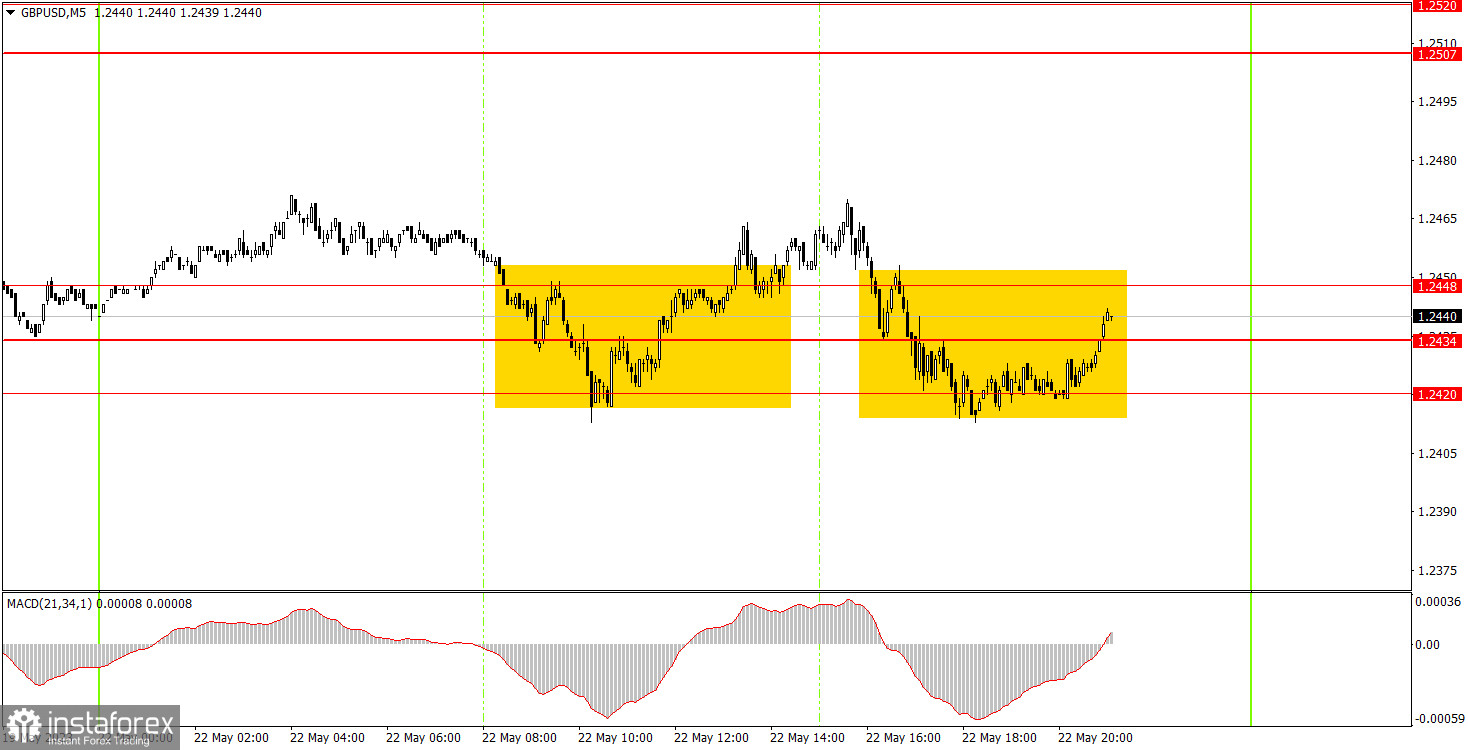

GBP/USD 5M chart

On the 5M timeframe, two trading signals were formed on Monday, but they appeared during a flat trend in the area of 1.2420-1.2448. It means they were in a very risky area where every trade had a very high potential loss and significantly lower potential profit given the current volatility. Therefore, it was not possible to trade within this range, and trading outside of it made any sense neither. In reality, only one signal was actually formed, as the second one did not fully develop. However, even that single signal should not have been executed. Several important levels have been shifted, so we recommend paying attention to them.

Trading plan on Tuesday:

On the 30M timeframe, the GBP/USD pair attempted to break the descending trend on Friday, following Jerome Powell's speech. However, this moment can be considered as a coincidence or incidental. We still believe that the decline of the British currency is likely to continue in any case. On the 5M timeframe, the key levels can be found at 1.2171-1.2179, 1.2245-1.2260, 1.2351-1.2367, 1.2420-1.2448, 1.2507-1.2520, 1.2597-1.2616, 1.2659, and 1.2697. When the price moves in the correct direction by 20 pips after entering a trade, a stop loss order can be placed to breakeven. On Tuesday, there are scheduled releases of business activity indexes in the services and manufacturing sectors for both the UK and the US. These are not the most important data, and the reaction to them is likely to be weak. Flat conditions may persist, and volatility could be low. Other events of the day are also of secondary importance.

The basic principles of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginning traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.