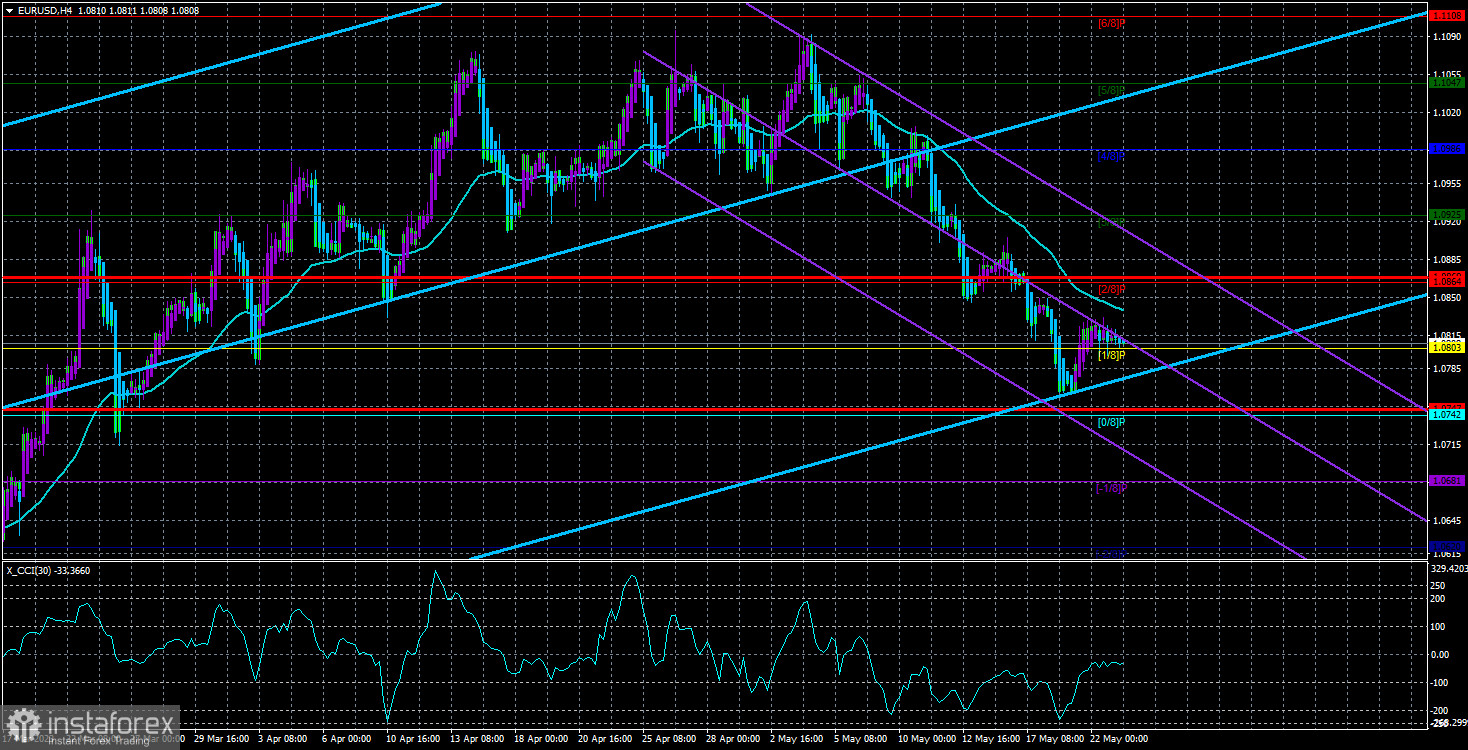

The technical picture has not changed, and the pair remains below the moving average line. Therefore, we expect the euro to continue its decline. However, the current fundamental and macroeconomic backdrop does not suggest strong movements. It should be noted that the market only sometimes trades actively, even with a strong backdrop. It takes a pause that can last for several months at certain times. We are currently experiencing one of those pauses.

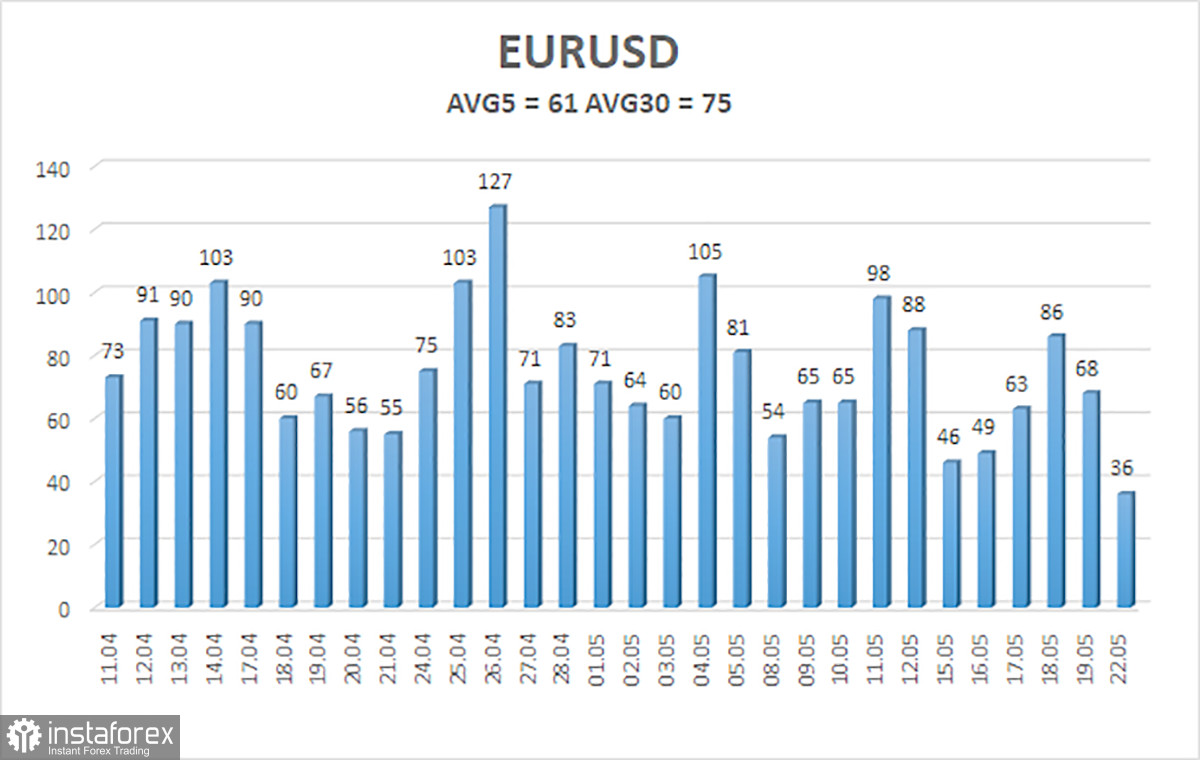

The volatility indicator rarely attracts attention when it is at high values. For the euro currency, any value above 90-100 points can be considered "high." If the pair moves only 50-60 points from the minimum to the maximum in a day, it becomes nearly impossible and unprofitable to trade in the short term, even on small time frames. If you prefer medium-term trading and can hold positions for several weeks or months, it's fine, as there is a trending movement. However, intraday trading is extremely difficult, both on the 4-hour time frame and the 5-minute chart.

On Monday, we can only highlight the speeches of the Federal Reserve's monetary committee representatives. However, judging by the market reaction, nothing important was said. We have been saying lately that all the speeches by ECB and Fed officials are of a background nature. The market wants them to understand how to trade in the medium term, but there has yet to be an immediate reaction. In the medium term, the decline of the European currency should continue, as it remains extremely overbought despite a 300-point pullback.

Europe takes the week off.

There will be practically no macroeconomic statistics or important events this week. Today, business activity indices in the manufacturing and services sectors will be published in the European Union and Germany. There are no problems with the services sector, as the indices are above the 50.0 level. The manufacturing sector, however, is more challenging as it is below 50.0. And it is unlikely that the situation will change to the opposite by the end of May, so we do not expect a strong reaction to this data.

On Thursday, Germany will release the final assessment of the GDP for the first quarter. It is expected to be 0.0%, unlikely to support the euro currency or trigger any significant reaction. Germany is just one country out of the 27 in the EU, and the absence of deviation from the forecast will not give traders any reason to act on this report.

And that's it. No more important publications are scheduled. Thus, the entire current week can be extremely dull and low-volatility. The moderate decline of the euro currency may continue, or a weak upward correction may begin. Still, we are more concerned that a blatant flat market may characterize the entire week. By the end of the week, the issue of the US debt ceiling will finally be resolved, which could slightly refresh the market. Still, as we have already mentioned, this issue currently does not affect the exchange rate and movement of the pair. Therefore, even its resolution is unlikely to make the market more active.

A pause can also allow the CCI indicator to discharge and continue the decline without entering the overbought zone. A consolidation period may begin in the medium term, as the fundamental global backdrop currently does not support the euro or the dollar. If the US currency rises another 300-400 points, then its debt will be repaid.

The average volatility of the euro/dollar currency pair for the last five trading days as of May 23rd is 61 points and is characterized as "average." Therefore, we expect the pair to move between the levels of 1.0747 and 1.0869 on Tuesday. A reversal of the Heiken Ashi indicator downwards will indicate a resumption of the downward movement.

Nearest support levels:

S1 - 1.0803

S2 - 1.0742

S3 - 1.0681

Nearest resistance levels:

R1 - 1.0863

R2 - 1.0925

R3 - 1.0986

Trading recommendations:

The EUR/USD pair has corrected slightly but has maintained a downward correction. It is advisable to consider new short positions with targets at 1.0747 and 1.0742 in case of a reversal of the Heiken Ashi indicator downwards or a price rebound from the moving average. Long positions will become relevant only after the price consolidates above the moving average with a target of 1.0925.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will move in the next 24 hours based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.