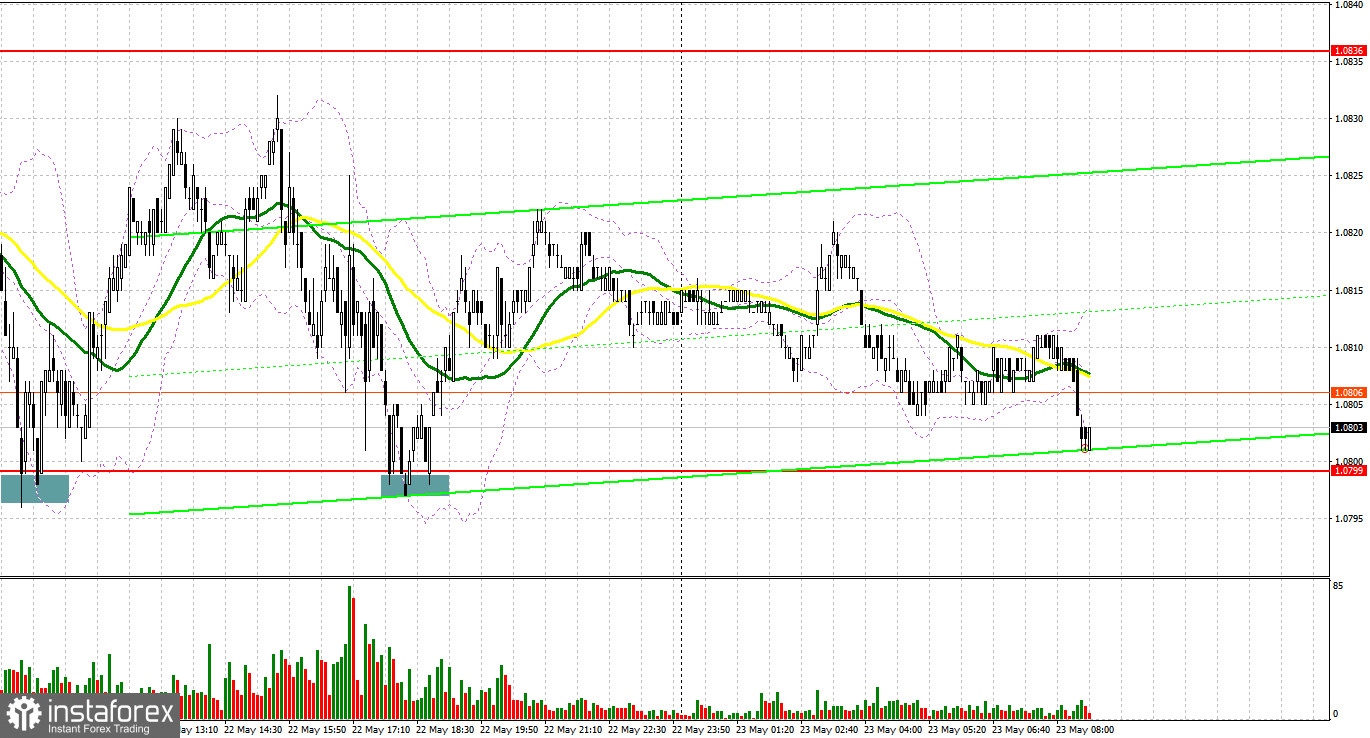

Several entry signals were formed yesterday. Let us take a look at the 5-minute chart and figure out what happened. A decline and a false breakout at 1.0799 created a buy signal, resulting in an upward movement of nearly 30 pips. A similar movement occurred in the second half of the day, but the upsurge was not as strong as the one in the morning.

When to open long positions on EUR/USD:

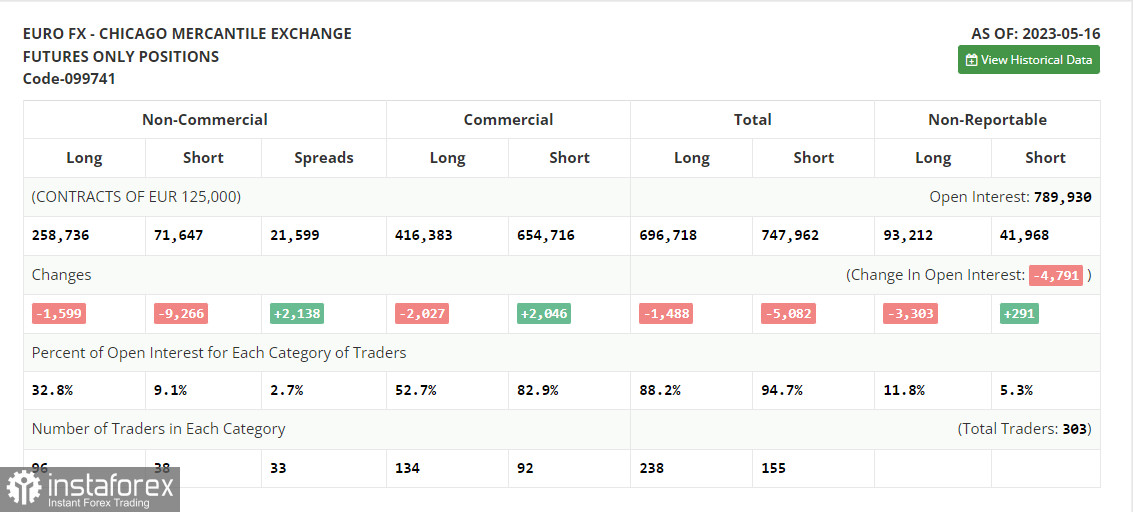

Before discussing prospective EUR/USD movements, let's review what happened in the futures market and how trader positions in the Commitment of Traders (COT) report have changed. The COT report for May 16 showed that both long and short positions declined, although the latter dropped more strongly. The downward correction of the euro that we observed last week remains a good opportunity to increase long positions. However, until the US debt ceiling issue is resolved, it is unlikely that we will see significant demand for risk assets. Traders are even ignoring statements from Federal Reserve officials, who unanimously emphasize that the committee will pause the rate hike cycle at the upcoming meeting, which is a bullish signal for the euro. So, we need to wait a bit for bulls to return to the market once the debt ceiling issue is raised. According to the COT report, non-commercial long positions decreased by only 1,599 to 258,736, while non-commercial short positions decreased by 9,266 to 71,647. The overall non-commercial net position increased to 187,089 from 179,422 at the end of the week. The weekly closing price decreased to 1.0889 from 1.0992.

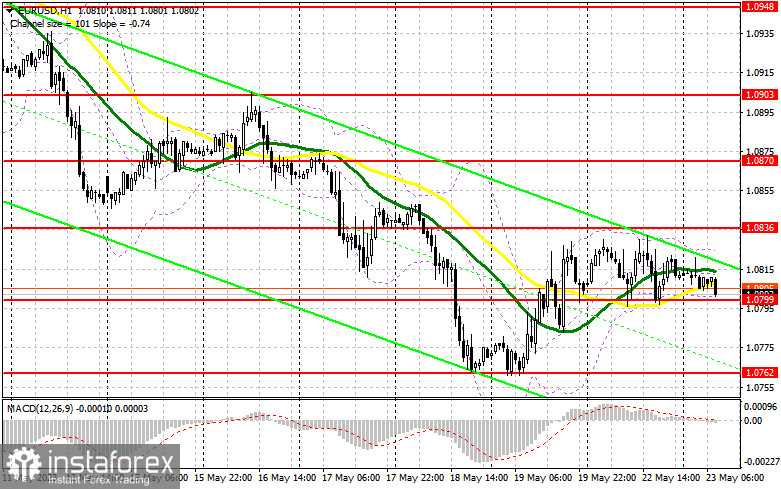

In the first half of the day, traders will focus on the eurozone manufacturing and services PMI data. The composite PMI for the eurozone will also be important. Undoubtedly, the decline in manufacturing activity will be offset by strong activity in the services sector, so the euro may receive some minimal support in the first half of the day. However, considering that the technical picture has not changed, I will act based on yesterday's strategy.

I will consider opening long positions only after a decline and a false breakout of the 1.0799 support level. Positive eurozone PMI data will boost EUR/USD, sending it back to the resistance zone at 1.0836. A breakout and a downward retest of this range will strengthen demand, providing an additional entry point for increasing long positions with a target around 1.0870. The most distant target remains in the 1.0903 area, where I will take profit. If bears attempt to take action and buyers are idle at 1.0799, we can expect the bearish trend to continue. Therefore, a false breakout of the next support level of 1.0762 and the last week's low will be a buy signal for the euro. I will open long positions immediately if the euro bounces off the 1.0716 low, targeting an intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Bears persistently try to keep the market under their control, and so far, they have been fairly successful. In the event of another upward correction following speeches by ECB policymakers, protecting the nearest resistance level at 1.0836 will be a top priority for bearish traders. A false breakout of this level will create a sell signal capable of pushing the pair back towards 1.0799. A sustained move below this range, along with an upward retest, could pave the way towards the low near 1.0762. The most distant target would be the 1.0716 low, where profits will be taken.

If EUR/USD moves higher during the European session and the bears remain idle at 1.0836, which seems to be the case, bulls will attempt to return to the market. In such a scenario, I will open short positions only around 1.0870. Going short on the euro there can be considered after a failed consolidation in the area. I will open short positions immediately if EUR/USD bounces off the high at 1.0903, targeting a downward correction of 30-35 pips.

Indicator signals:

Moving averages

Trading is occurring around the 30-day and 50-day moving averages, indicating a sideways market.

Note: The author considers the period and prices of the moving averages on the hourly chart (H1), which differ from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands

If EUR/USD declines, support will be provided by the lower band of the indicator around 1.0799. In the case of an upward movement, the upper band of the indicator around 1.0830 will act as resistance.

Description of indicators

Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart. Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart. MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9 Bollinger Bands (Bollinger Bands). Period 20 Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements. Long non-commercial positions represent the total long open position of non-commercial traders. Short non-commercial positions represent the total short open position of non-commercial traders. Total non-commercial net position is the difference between the short and long positions of non-commercial traders.